FHBA Property Market Update – Top story

Once, the idea that buyers could go to one place (an online property portal) to see every property on the market was revolutionary. But that was more than 15 years ago. Is it possible the portals, such as Domain and realestate.com.au, are about to be disrupted themselves? Given our love for mobile technology and our high social media usage (with the two intertwined with each other), we take a look at if this disruption could come from the biggest social media provider of them all……Facebook.

Facebook ads. We all hate them. But, they are a reality on a platform that we almost all use. It is basically the only revenue provider for Facebook. And Facebook has some 20,000 + staff to pay (that is a pretty big wages bill!).

Recently, Facebook admitted they cannot make too much more space available for advertisements. Phew!

Facebook is loved by businesses of all sizes because of the ease in which one can use Facebook to do strategic, targeted and effective advertising. With all the data Facebook has and analytics improving by the day, Facebook will only get better at displaying ads that are relevant to us.

Facebook will also very likely get better & better at being able to present to us properties that might be suitable to our budgets and what we are looking for – even better than property portals themselves according to many tech experts.

Will you be using Facebook to do your property search in the future?

So if you are a first home buyer, where is the best place to search for your dream first home? If everyone else (other first home buyers, second home buyers, investors etc) are all looking at the same places, how can you develop a search strategy that puts you ahead of the pack?

Well, you might want to check out this first home buyer search formula. It shows you ways to get ahead of flaws in Facebook, Domain and realestate.com.au.

Want more insights into how Facebook could affect Domain and realestate.com.au? Check out this blog prepared by CoreLogic Australia titled – Why the portals are worried about Facebook.

Want expert help with planning your first home purchase? Get in touch with an FHBA Coach today to begin your journey.

What is your property search strategy?

Enjoy the rest of your weekly FHBA Property Market Update.

More First Home Buyer News

- First Home Super Saver Scheme (FHSSS) hits another roadblock – Last month we reported that the FHSSS finally passed the lower house in Canberra, however, on the back of the politician citizenship crisis, the Government is set to have difficulties in getting the FHSSS over the line in the Senate – see the challenge on smh.com.au

- HomesVic program set to begin – The Victorian Government has released further details on the HomesVic first home buyer shared equity program, with the pilot version to begin in early 2018 – learn more and register your interest in FHBA News

- Buying off-the plan is right on (if you do your homework) – Some people are too scared to buy off-the-plan, but according to Urban Development Institute of Australia, it can be a good investment – see research suggestions on realestate.com.au

New Homes of the Week (edition 80)

Introducing our top five picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week – our 80th edition! If you are interested in any of these properties or want assistance in searching for other new property opportunities, then you know the drill – get in touch with our team for a complimentary consultation.

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | ‘on enquiry’ | See property |

| Queensland | $20,000 | $8,000 | See property |

| South Australia | $15,000 | $5,250 | See property |

| Victoria | $10,000 | ‘on enquiry’ | See property |

| Western Australia | $10,000 | from $6,450 | See property |

Could you picture yourself living here?

Did you know??

Our FHBA New Homes service can help you compare hundreds of new home options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Not to mention, we are the only ones to offer the FHBA 50 Rebate on top of the First Home Owners Grant*. Say g’day to us so we can help you with your search to find your unique slice of the great Australian dream today! G’day!

*FHOG & FHBA 50 Rebate amounts are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details.

Interest Rates Update: 13/November/2017

Last Tuesday, while the country paused to watch the race that stops the nation, the Reserve Bank of Australia opted to leave the official cash rate on hold once more, at 1.50%. The RBA Board will meet to review the cash rate one more time before the year is over.

https://www.facebook.com/fhbah/posts/1352948348161032

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

- Why the RBA left the cash rate on hold

New hotspot in focus: Ellenbrook (WA)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Introducing our new ‘hotspot in focus’ – Ellenbrook of Western Australia:

- Ellenbrook is an affordable area located approximately 20km’s North East of Perth CBD

- Offering a great lifestyle, proximity to Perth CBD, pending train line and affordable housing, Ellenbrook has been growing in popularity with first home buyers of late

- Properties are currently priced around levels where first-timers can take advantage of government incentives such as the Grant and Stamp Duty concessions

- Learn more about Ellenbrook and why it’s population is growing in out ‘hotspot in focus’ article

Can you picture yourself living in beautiful Ellenbrook?

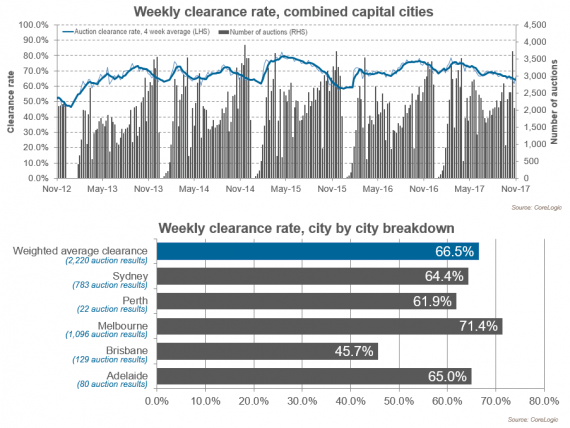

Preliminary Weekend Auction Clearance Rates (11th – 12th of November)

(Auction clearance rates continue to track below 70%. Source: CoreLogic)

Capital City Property Price Movements: 13/November/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Over the last 3 months, Sydney property prices have fallen nearly 1%. Adelaide and Perth have also seen softer dwelling values.

| Capital City Index Score | 3 months % Change | Yearly % Change |

|---|---|---|

| Adelaide: 113.13 | – 0.1% | + 4.1% |

| Brisbane: 109.34 | + 0.5% | + 3.0% |

| Melbourne: 156.63 | + 1.8% | + 10.5% |

| Perth: 95.12 | – 0.4% | – 2.8% |

| Sydney: 175.31 | – 0.9% | + 6.6% |

(Source: CoreLogic)

FHBA Social

A quick snap of what’s trending on our social media accounts – are you taking part in the conversations?

https://www.facebook.com/fhbah/posts/1357277301061470

"Made possible what others deemed possible" – we love making dreams come true at #FHBA. Talk to us > https://t.co/HVHu6JvFr9 @TajSingh90 #ausproperty 🏠 pic.twitter.com/GgdmuxZs0B

— FHBA (@fhba_com_au) November 9, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

https://www.facebook.com/fhbah/posts/1357385737717293

Are you thinking of buying your first home soon?

Regardless of who you are or what you are looking for, before you commence house hunting you should get a no obligation home loan pre-approval!

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you, so you can determine your approximate borrowing capacity. A loan pre-approval comes with no obligations to proceed with a home loan application, leaving you in control and importantly, attending open homes knowing what your budget is.