Yesterday, while the nation was preparing to watch the race that stops the nation, the Reserve Bank of Australia (RBA) board opted once again to leave the cash rate on hold (at a record low of just 1.50%). Today we explore RBA’s reasoning for the decision by exploring into RBA Governor Philip Lowe’s official media statement, plus we take a look at first home buyer options for those looking to enter the property market before the year is out and what the banks predict will happen to interest rates in 2018.

RBA on the Economy

- “The central forecast is for GDP growth to pick up and to average around 3 per cent over the next few years”.

- “Business conditions are positive and capacity utilisation has increased”.

- “The outlook for non-mining business investment has improved, with the forward-looking indicators being more positive than they have been for some time”.

- “Increased public infrastructure investment is also supporting the economy”.

- However, “one continuing source of uncertainty is the outlook for household consumption. Household incomes are growing slowly, and debt levels are high”.

RBA on Employment

- “The labour market has continued to strengthen. Employment has been rising in all states and has been accompanied by a rise in labour force participation”.

- “The various forward-looking indicators point to solid growth in employment over the period ahead. The unemployment rate is expected to decline gradually from its current level of 5.5%”.

- “Wage growth remains low. This is likely to continue for a while yet, although the stronger conditions in the labour market should see some lift in wage growth over time”.

RBA on Inflation

- “Inflation also remains low”.

- “In underlying terms, inflation is likely to remain low for some time, reflecting the slow growth in labour costs and increased competitive pressures, especially in retailing”.

- “The Bank’s central forecast remains for inflation to pick up gradually as the economy strengthens”.

RBA on the Property Market

- “In most cities, housing prices have shown little change over recent months, although they are still increasing in Melbourne”.

- “Housing market conditions have eased further in Sydney”.

- “In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years”.

- “Credit standards have been tightened in a way that has reduced the risk profile of borrowers”.

- “Rent increases remain low in most cities”.

Compare current home loan rates here

Compare current home loan rates here

I’m about to be in the market for a home loan

- If you are getting close to buying your first home why not check out this easy to use home loan comparison table to see a range of rates currently on offer.

- Got questions and wondering what the next steps are? We recommend you arrange an appointment with an FHBA Lending Adviser who can discuss your circumstances, help you determine your borrowing capacity, showcase home loan options you may be eligible for and go through the home loan process with you – learn more about FHBA Mortgages here.

Speak with a FHBA Lending Adviser to work out how you can finance your first home

I’m still saving for a home deposit

Unfortunately, the rate of interest on savings accounts are relatively low at the moment. But when saving for a home deposit, as cliche as it may sound, every bit really does counts. See if you can give your savings a boost by checking out these free & easy to use saving accounts comparison tables!

Compare deposit savings accounts

I want to know more about the RBA decision

Interested in reading full RBA statement from the November board meeting? You can access the RBA press release here.

Did you know?

Did you know that you can protect yourself from a rate rise as a mortgage borrower? A fixed rate home loan allows you to lock in an interest rate for a period of time, such as 1 year – 5 years. This gives borrowers certainty around home loan repayments. But how do you choose whether to get a fixed rate home loan or the more common variable rate home loan? Click here to learn more about your home loan options.

When is the next RBA board meeting?

The final RBA board meeting for 2017 will be held on Tuesday the 5th of December 2017.

What will the RBA likely do with the cash rate in the future?

Check out these recent predictions made by Australia’s big 4 banks – big banks update interest rate forecasts

Do you agree with these interest rate predictions?

Written By,

First Home Buyers Australia

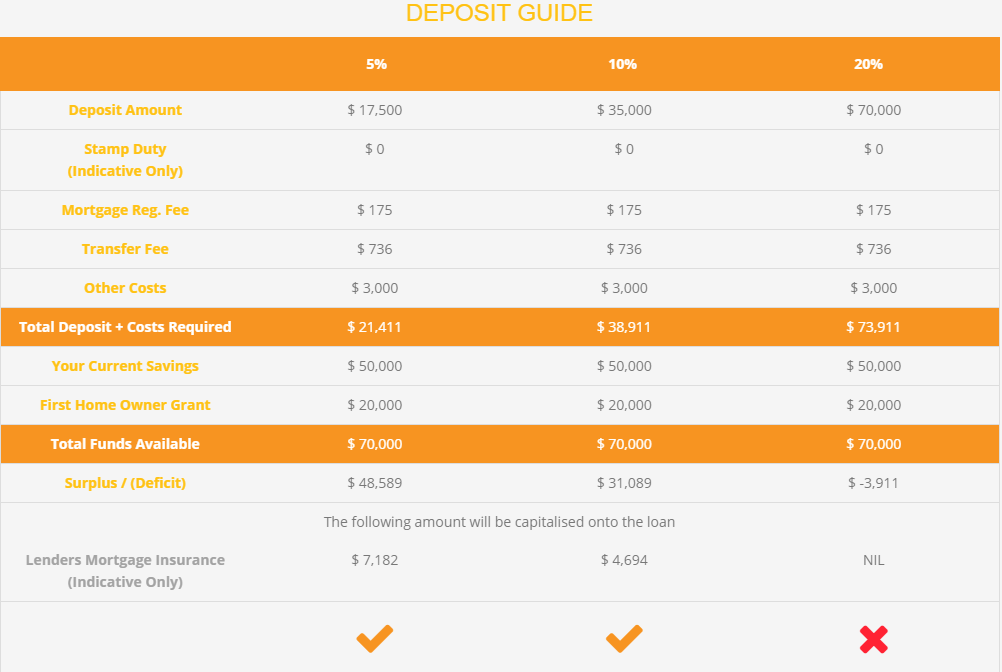

Not sure whether you have saved enough to enter the property market? Try our FHBA Deposit Estimator for free!