FHBA Weekend Preview: 9 – 10 September 2017

In today’s edition of FHBA Weekend Preview we take a look at strategies to help you find your slice of the great Australian dream; why Wanneroo is popular with first home buyers; a review of the top first home buyer stories this week; a preview of this weekends auction activity and our five favourite ‘new’ properties for first home buyers this weekend.

Last week we covered the start of the Spring property market, explaining that Spring is typically the busiest time of the year for Australia’s real estate sector. If you missed it, you can see our Spring 2017 preview here.

In this Weekend Preview we thought we would go through a simple ‘3 point plan’ to help you get started on finding your first home. Today, first home buyers compete with so many other people in the property market, so it is important to form your strategies early and get professional help where you need it. Please note, these strategies are general in nature, we recommend that you do not follow them without considering your circumstances or seeking expert advice.

The 3 point plan involves these 3 steps:

- Work out your budget

- Decide what are looking for

- Search for your ideal first home

Lets take a look at what is involved in each step.

Step 1: Work out your budget

Before you get started with your searching and dreaming, you need to work out what your budget is. That is, how much will you spend on your first home? E.g. You may say, I have a deposit of $50,000 and I am going to get a loan of $350,000 + get my transaction costs covered. Therefore, your first home will need to be purchased at under $400,000. That is, your first home budget is $400,000.

To help you work out your property budget we recommend you speak to a Mortgage Broker (also known as a Lending Adviser). A Mortgage Broker can assist by working your borrowing capacity (and therefore determine how you can afford for that dream first home), along with assistance in obtaining a home loan (starting with a loan pre-approval). A Mortgage Broker may determine you can afford to spend a certain amount (such as $500,000), but you may choose to have a lower budget because you don’t want to borrow to the max. Again, a Mortgage Broker can help you work out your options.

Hint: see step 3 for info on how to access ‘off-market properties’

Step 2: Decide what you are looking for

Once you have determined your budget you can now begin to consider what you want in your first home. Things you may want to consider include:

- property type;

- property size;

- property features;

- property condition;

- property location.

Once you have worked this out, head to a real estate website (e.g. realestate.com.au) and look at properties recently sold that meet your desired criteria. Are they selling for a price below your budget? If yes, proceed to step 3. If no, then you need to consider either making compromises or saving more so that you have a bigger budget down the track.

So what compromises can you make? Well that is up to you. You could consider a smaller property, or a cheaper location, amongst other potential compromises. A good place to start is to consider your ‘needs’ versus your ‘wants’.

Step 3: Search for your ideal first home

Once you have worked out your budget, features and location of your first home you can begin searching for properties that are actually listed on the market for sale at the moment. These days, most properties are listed on at least of one of two websites: realestate.com.au or domain.com.au. Our biggest two tips for using these websites are:

- Use both sites – sometimes a property listing may only appear on one website (not both of them)

- Setup alerts – create a free account and setup an alert so that you get notified when new listings are posted that suit your search criteria.

But here is one of our biggest tips for first home buyers. Are you ready for it? Not all properties sold in Australia appear on realestate.com.au or Domain. Some properties exchange hands between a seller and a buyer without ever appearing on either one of these websites!

You may be surprised to hear this so let us explain the key reason why. These websites are expensive to list a property for sale on due to their popularity, so some people try to avoid these costs. Properties for sale that are not advertised are often referred to as “off-market opportunities“.

So how do people access off-market opportunities?

There are a couple of ways, but the easiest, cheapest and most cost-effective way of accessing these opportunities is to look up who the real estate agents are in the areas you are looking at buying in and connect with them. Call them, email them, meet with them, whatever suits you. Let them know you are an active buyer and what it is that you are looking for. When real estate agents are hired to sell a property, sometimes they consider who they know that might be interested in buying a property prior to launching any advertising campaign. This gives you an opportunity to inspect the property first and potentially (if it meets your criteria and you like it), allows you to put an offer in before the property is advertised online.

Another way to access these opportunities is to speak to a Buyer’s Agent (also known as Buyers Advocates). Buyers Agents are real estate experts that specialise in helping buyers search and settle on a property that meets your criteria. Buyers Agents charge a fee for their service.

So what happens when you find a property that is your ‘dream first home’? That is beyond the scope of this blog, but we recommend you check out our other Hot Tips for first home buyers here, or speak to an FHBA Coach about the process in a FREE Discovery Session.

Out and about this weekend? Here are the auctions scheduled for this weekend around the country:

| Adelaide | 63 |

|---|---|

| Brisbane | 119 |

| Canberra | 70 |

| Melbourne | 998 |

| Perth | 27 |

| Sydney | 763 |

Want to know more about this weekend’s auction activity? See the CoreLogic blog.

Good luck to all first home buyers in action this weekend!

First home buyer homes of the week: edition 70

These are our favourite 5 new properties for first home buyers looking for First Home Owner Grant eligible homes, this weekend. These properties are also eligible for the exclusive FHBA 50 Rebate! Which one is your favourite?

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

What a great start for first home buyers!

Open homes and auction weather

COMING SOON

New hotspot in focus: Wanneroo (WA)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus is Wanneroo in Western Australia.

- Wanneroo is located 30 km north of Perth CBD (and very close to the beaches on the north Perth coast)

- Wanneroo is part of a fast-growing area that is receiving plenty of government investment

- Beautiful parks, shops, restaurants, bicycle paths, the glorious Indian Ocean at the doorsteps, Wanneroo (and surrounding suburbs) have plenty of lifestyle pluses that first timers love

- And despite the great lifestyle and proximity to Perth CBD, the median property price is….click here to reveal more

Wanneroo – location, lifestyle, affordable – great for first timers

House hunt with confidence

Planning on going house hunting soon but don’t know whether a bank will lend you enough funds to buy your first home yet?

You should get a no obligation home loan pre-approval! A loan pre-approval provides you written guidance of how much a particular bank is willing to lend to you. A loan pre-approval comes with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak with an FHBA Broker from FHBA Mortgages today

Search FHOG eligible homes from your couch

Are you in the market for a newly built property? This could be a house & land package, a townhouse or a newly constructed apartment. Search our new look ‘new homes’ portal this weekend to see hundreds of Grant eligible properties suitable for first home buyers!

Search first home buyer homes here

Friday News Review

https://www.facebook.com/fhbah

Home loan deal of the week

For hot home loan deals for your first home get in touch with us today!

Never miss an FHBA Market Update or FHBA Weekend Preview!

Enjoy reading our free Market Updates and Weekend Previews? You are not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!

Written By,

First Home Buyers Australia

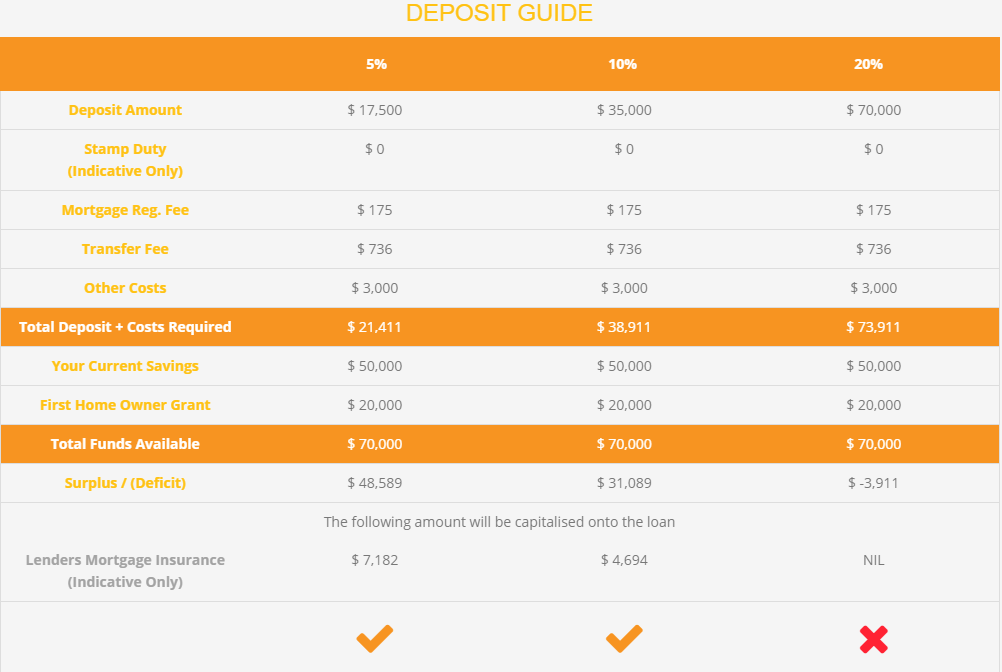

Wondering whether you have saved enough to form a deposit? Try the revamped FHBA Eligibility Estimator for free!

self-estimate if you have saved a deposit using our Eligibility Estimator now