FHBA Property Market Update 11/December/2017

With 2017 coming to a close we take a look at where first home buyers have been buying. This and much much more in your weekly FHBA Property Market Update.

Around this time last year, we were regularly posting things like “first home buyer activity has reached a new all-time low” and “first home buyer activity has declined further”. But how things have changed over the last year. Over the last 12 months, Australia has seen small decreases of local and foreign investment activity in the residential property market (coming off all time highs). With property prices slowing down in key markets and new or increased first home buyer incentives available in some states (e.g. NSW and Victoria), first home buyer activity in October surged to a 5 year high, displaying what many are describing as the ‘first home buyer fightback’.

According to the Australian Bureau of Statics (ABS) Housing Finance data, around 10,000 first home buyers took out a home loan in the month of October 2017, That is a staggering 38% more than the number of first home buyer loans that were issued the year before in October 2016. And many property experts are tipping this trend to continue for the time being.

First home buyer activity as a proportion of total owner occupier activity was the highest in the Northern Territory. The remaining state and territories ranked behind:

- Nothern Territory – 25%

- Western Australia – 24%

- Australian Capital Territory – 20%

- Queensland – 19.5%

- Victoria – 19%

- New South Wales – 13.5%

- Tasmania – 13.5%

- South Australia – 13%

Source: ABS Housing Finance, October 2017

If you are an aspiring first home buyer, you could be forgiven for reading this and having the fear of ‘fomo’ (fear of missing out). Don’t have this fear.

Data and activity is always changing. Indeed, property markets are always changing. While it is good to know what is going on in the market, you also need to consider your circumstances (both your financial circumstances and your personal circumstances). You will buy when you are ready based on your situation.

Do you feel ready to buy your first home, but you are not sure if your finances are strong enough? A great place to start is our free FHBA Eligibility Estimator, followed by a complimentary chat with one of our FHBA Lending Advisers.

Are you dreaming of buying your first home in 2018?

Enjoy the rest of your weekly FHBA Property Market Update.

New Homes of the Week (edition 84)

Introducing our top five picks for First Home Owner Grant* (FHOG) (& FHBA 50 Rebate) eligible properties for this week. There are some stunning first home buyer properties in this weeks pics (and when we mean stunning, we mean the look of the home and the value!).

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | ‘on enquiry’ | See property |

| Queensland | $20,000 | $8,000 | See property |

| South Australia | $15,000 | $5,950 | See property |

| Victoria | $10,000 | $8,000 | See property |

| Western Australia | $10,000 | $1,200 | See property |

Did you know??

Our FHBA New Homes service can help you compare thousands of new home options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Not to mention, we are the only service to offer the FHBA 50 Rebate on top of the First Home Owners Grant*! Don’t be shy, say hello to us so we can help you with your search to find your unique slice of the great Australian dream today! Hello

*FHOG & FHBA 50 Rebate amounts are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details.

Interest Rates Update: 11/December/2017

Last week the Reserve Bank of Australia (RBA) board meet for the last time in 2017. Once again, the RBA opted to leave the official cash rate on hold at 1.50%.

- Why the RBA left the cash rate on hold

- What will the RBA do in 2018?

- Christmas home loan specials for first home buyers

New hotspot in focus: Salisbury

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Introducing our new ‘hotspot in focus’, the amazing Salisbury of South Australia.

- Where is Salisbury? Salisbury is located approximately 25km North from Adelaide CBD

- What is the median property price of Salisbury? Houses – $320,000. Apartments – $326,000 (APM Data)

- What is the current population of Salisbury? Approximately 141,000

- Why is Salisbury considered a hotspot for first home buyers? Click here to learn more about Salisbury

An example of a first home buyer home in Salisbury

Not interested in Salisbury? See previous ‘hotspots in focus’ here

Capital City Property Price Movements: 11/December/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. As you may have noticed, Sydney property values have been dropping every single week for the last 9 weeks and counting.

| Capital City Index Score | 3 months % Change | Yearly % Change |

|---|---|---|

| Adelaide: 113.30 | + 0.1% | + 3.0% |

| Brisbane: 109.54 | + 0.6% | + 2.8% |

| Melbourne: 157.25 | + 1.6% | + 9.6% |

| Perth: 95.55 | + 0.6% | – 2.3% |

| Sydney: 173.94 | – 1.8% | + 4.1% |

(Source: CoreLogic)

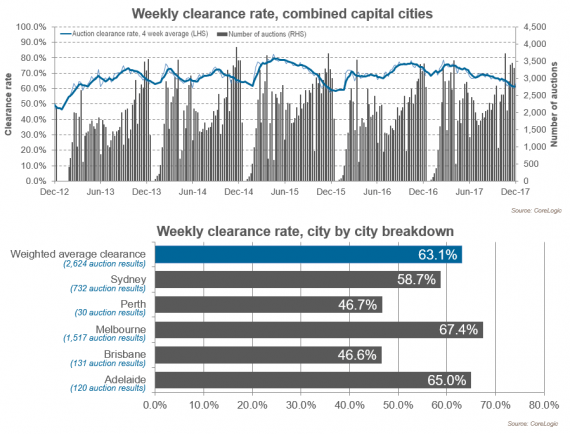

Preliminary Weekend Auction Clearance Rates (9 – 10 December 2017)

(Nearly 1 in 2 Sydney properties are passing in at auction. Source: CoreLogic)

More First Home Buyer News

- How can I maximise my borrowing capacity? – There are so many things that banks take into consideration when assessing how much they are willing to lend to you – here is how you can work on increasing your borrowing capacity

- McGrath 2018 property predictions – Want to know what one of Australia’s sharpest property minds is thinking about the 2018 property market? – see John McGrath’s 2018 tips in FHBA News

Written By,

First Home Buyers Australia

Wan to buy your first home soon? Organise a FREE FHBA Discovery Session with an FHBA Coach today