The month of January is traditionally a quiet time for the property market with less competition amongst buyers and fewer listings as most Australians take a large portion off the month to enjoy the holiday period and the Australian summer with their family & friends. For aspiring first home buyers who are looking to stay local over the holiday period, it could present an opportunity for you to pick up a bargain (due to few buyers) or a property on sale by a depressed seller.

As most of you already know, the first and most important step of your first home buying journey is the ‘First Home Loan pre-approval‘. At FHBA, our team of expert FHBA Coaches, who are also fully qualified Lending Advisers (Mortgage Brokers), always suggest our clients get a home loan pre-approval before taking on the more exciting step of searching and inspecting your first home.

In 2017, Christmas has come early for aspiring first home buyers looking to buy now or in the quieter period of January 2018 – most lenders are open for business till Christmas and then straight after Christmas. We have handpicked some of the Xmas home loan offers that are currently available through our exclusive first home buyer mortgage broking service – FHBA Mortgages. Regardless of what your financial position, FHBA is well equipped to provide qualified credit advice to all first home buyers. And if you aren’t quite ready yet, we will advise you on what you need to do in order to be ready!

1. A big 4 bank rate never seen by FHBA Mortgages

FHBA Mortgages has been helping first home buyers for over 2 years now! In a first for us, a big 4 bank has taken the step of offering a very special introductory variable rate which allows first home buyers to lower their repayments in the initial stages of your home loan life. Some of the features include:

- 3.59% p.a. 2 year Introductory Variable Rate (Comparison rate: 4.24% p.a.)

- No establishment fee: Save $600

- Customers receive a 1.00% discount for the first 2 years of the first home loan

- Available for a limited time only

If you are interested in a home loan product without all the bells and whistles, then this may well be worth exploring. Click below to book your complimentary session with an FHBA Coach.

2. Package Fee waived for the life of the loan + Special 5 year fixed rate + Low variable rate

One mid-tier lender is offering a special product enabling borrowers to avoid fees associated with the loan, the features include:

- First home buyers only!

- Low variable rate of 3.79% (comparison rate 3.80%)

- Ability to fix all or a portion of your loan at a 5 year fixed rate of 3.99%

- Annual package fee ($375) waived for the life of the loan, resulting in savings of $11,250

- Minimum borrowing amount is $150,000

- Maximum borrowing is 95% of property purchase price

- Clean credit history

- 100% offset account is included in the package (ask your FHBA Coach for more info)

Click below to see if you qualify for this special product.

First home buyers are getting more special offers during the 2017 festive season!

3. Low deposit construction loans with no genuine savings³ requirement

Another lender (who also offers non-conforming loan products) is now offering construction loans for a large range of borrowers and without the requirement to hold 5% in genuine savings. Some features of this exciting new product include:

- Interest rates start from 3.94% p.a. (comparison rate 4.16% p.a.)

- Available to rentvestors and owner occupiers looking to use the First Home Owners Grant (FHOG) as a deposit

- Credit impaired borrowers may be eligible for this product

- An 8% deposit (inclusive of the FHOG) will be sufficient as the LMI can be capitalised¹ up to 95% of the property value

- No credit scoring and no external LMI approval required

Click below to see if you qualify for this special product

4. Low 2 year fixed rate² offer for University Graduates, Education professionals & Emergency services personnel

One of our most popular lenders amongst first home buyers with three brands is offering first home buyers a certainty in repayments. These products are particularly good for first home buyers with low deposits. The fixed rate offers include:

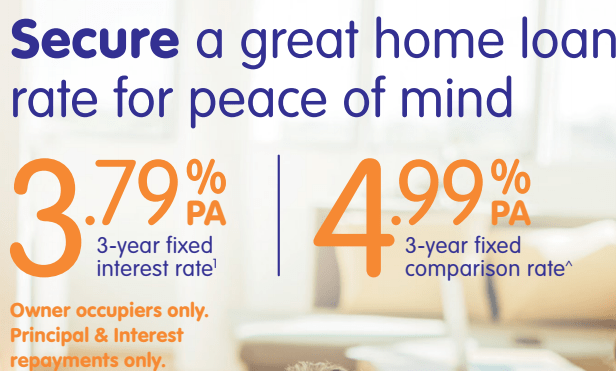

- 3 year fixed rate of 3.79% (comparison rate 4.99%)

- 2 year fixed rate of 3.69% (comparison rate 5.10%)

- 1 year fixed rate of 3.69% (comparison rate 5.10%)

Key features include:

- Minimum deposit required is 5%

- Non-genuine savings are acceptable

- Satisfactory rental ledger for the last 6 months can be used in lieu of genuine savings³

- 100% offset account available on fixed rate loan splits

- LMI capitalisation¹ available above 95% of the property value

- Family members of University students/graduates or teachers are eligible for this product too!

Are you looking to fix your interest rate for a period of 1, 2 or 3 years? Then click below to book your complimentary consultation with an FHBA Coach.

5. Aspiring first home buyers on maternity leave

Are you a first home buyer who is on maternity leave and looking to get your first home loan whilst on maternity leave? This may still be an option even though you don’t have any income. To qualify for this the lenders will usually require:

- A return-to-work letter from your employer confirming the date you will be resuming your job

- Enough savings to cover repayments during the time you are on maternity leave

- Deposit to cover your contribution to the loan (a minimum of 5%)

Alternatively, if you are still receiving maternity leave pay, either through your employer or from the government, some lenders will even consider this income when determining your borrowing capacity. Click below to find out more about this product:

Glossary of Terms:

¹LMI Capitalisation – Whereby the Lenders Mortgage Insurance premium is not paid upfront by the borrower but instead added onto the total loan balance and therefore paid over the term of the loan by the borrower

² Fixed Rate – A fixed interest rate loan is a loan where the interest rate doesn’t change during the fixed rate period of the loan giving you certainty in your repayments

³ Genuine Savings – Funds to be used as a deposit by a proposed borrower (for a property purchase) have been genuinely saved over time – usually between 3 and 6 months

Every aspiring first home buyer’s situation is different, therefore it is important to get some expert advice on which product is suited to your needs. Are you looking to compare these different home loan products? Perhaps you just want to know your borrowing capacity or get a better understanding of how your first home loan works? Click here to speak with an FHBA Mortgage Broker.

Disclaimer: The information on our website including this page is general in nature and should be solely relied upon. The advertised rates above were true and correct at the time of the publication. The rates do not take into account other fees and charges which you should also consider. The credit license responsible for the mortgage service offered to clients is Mortgage Australia Group Pty Ltd, Australian Credit License (ACL) number 377294, Australian Business Number (ABN) 99 091 941 749. Mortgage Australia Group Pty Ltd is a member of the Mortgage & Finance Association of Australia (MFAA). FHBA Pty Ltd is an authorised credit representative of Mortgage Australia Group Pty Ltd. You should seek professional advice when obtaining finance and purchasing your first property. Written By, First Home Buyers Australia

Get a great finance deal to assist you with your first home purchase