FHBA Property Market Update 4/December/2017

Every year John McGrath, founder of McGrath Estate Agents, releases the McGrath Report which includes analysis on the property market and John McGrath’s predictions for the period ahead. Today we take a look at McGrath’s 2018 predictions.

Important: Please note, we are aware that these areas are not all priced suitably for typical first home budgets. Further, we (FHBA) and McGrath do not take any responsibility for you choosing to act on McGrath’s ‘opinions’. We recommend you seek your own advice before making any purchasing decisions. Speak to an FHBA Coach for details.

McGrath’s Top 5 Greater Brisbane Picks

- Wynnum

- North Lakes

- Coomera

- Peregian Springs

- Caloundra

McGrath’s Top 5 Melbourne Picks

- Pascoe Vale

- West Footscray

- Mentone

- Doncaster East

- Chelsea

McGrath’s Top 5 Sydney Picks

- Haberfield

- Cammeray

- Breakfast Point

- Cronulla Beach

- Forestville

McGrath’s Top Regional Picks

- Ballarat, Victoria

- Geelong, Victoria

- Newcastle, NSW

- Toowoomba, Queensland (which is also our current ‘hotspot in focus‘ location!)

- Wollongong, NSW

McGrath predicts Geelong (pictured above) will grow

Other predictions by McGrath

Do you want to see other predictions by McGrath, or perhaps you want to read the insights into how these predictions were formed? The full 44 page McGrath Report 2018 is available to download now for free at www.mcgrath.com.au/mcgrath-report.

Enjoy the rest of your weekly FHBA Property Market Update.

New Homes of the Week (edition 83)

Introducing our top five picks for First Home Owner Grant* (FHOG) (& FHBA 50 Rebate) eligible properties for this week. There are some stunning first home buyer properties in this weeks pics (and when we mean stunning, we mean the look of the home and the value!).

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | $8,000 | See property |

| Queensland | $20,000 | $8,000 | See property |

| South Australia | $15,000 | $5,250 | See property |

| Victoria | $10,000 | $8,000 | See property |

| Western Australia | $10,000 | $5,700 | See property |

Did you know??

Our FHBA New Homes service can help you compare thousands of new home options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Not to mention, we are the only service to offer the FHBA 50 Rebate on top of the First Home Owners Grant*! Don’t be shy, say g’day to us so we can help you with your search to find your unique slice of the great Australian dream today! G’day!

*FHOG & FHBA 50 Rebate amounts are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details.

Interest Rates Update: 4/December/2017

Last week the Coalition Government announced that there will be a Royal Commission into the banks (as well as some other financial institutions). The Australian Financial Review has prepared a story on whether the Royal Commission will put upward pressure on interest rates – see the article here.

Tomorrow the Reserve Bank of Australia (RBA) board will meet for the last time in 2017 to review the cash rate. The Australian Stock Exchange (ASX) Rate Indicator showed on the 30th of November that no change is expected to the RBA official cash rate on the 5th of December. Stay tuned to FHBA News for the RBA’s decision, including insights around their decision and what could be in-store for interest rates in 2018.

https://www.facebook.com/fhbah/posts/1374353326020534

Current hotspot in focus: ‘The Garden City’

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our new ‘hotspot in focus’, the beautiful Toowoomba (nicknamed the ‘Garden City’) of Australia’s sunshine state , Queensland:

- Where is Toowoomba? Toowoomba is located approximately 125km west from Brisbane CBD and is 90km from Ipswich

- What is the median property price of Toowoomba? Houses – $350,000. Apartments – $308,000 (APM Data)

- What is the current population of Toowoomba? Approximately 161,000

- Why is Toowoomba considered a hotspot for first home buyers? Click here to learn more about Toowoomba and it’s popularity

Do you want a house & yard in the ‘Garden City’?

Not interested in Toowoomba? See previous ‘hotspots in focus’ here

Capital City Property Price Movements: 4/December/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Over the last 3 months, Sydney property values have fallen 1.5%. This is most welcoming following such a long period of high growth Elsewhere, Perth is starting to show signs of growth after a lengthy sluggish period where property values have been declining.

| Capital City Index Score | 3 months % Change | Yearly % Change |

|---|---|---|

| Adelaide: 113.29 | + 0.1% | + 3.4% |

| Brisbane: 109.37 | + 0.4% | + 2.7% |

| Melbourne: 157.35 | + 1.9% | + 10.0% |

| Perth: 95.45 | + 0.4% | – 2.5% |

| Sydney: 174.40 | – 1.5% | + 4.7% |

(Source: CoreLogic)

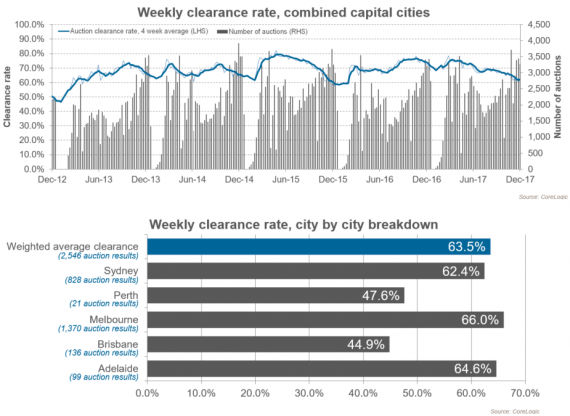

Preliminary Weekend Auction Clearance Rates (2 – 3 December 2017)

(Melbourne appears to be following Sydney’s falling auction clearance rate direction. Source: CoreLogic)

More First Home Buyer News

- Sydney investors down, first home buyers up – On the weekend FHBA Co-Founder Daniel Cohen told The New Daily that while changes in the Sydney market have been ‘encouraging’, more needs to be done to level the playing field between investors and first home buyers – read Daniel’s thoughts, as well as other experts, on The New Daily website

- Would abolishing negative gearing help first home buyers – Have you ever wondered what would happen to property prices if Labor won government and introduced a policy to end negative gearing on established properties? SQM Research recently tackled this thought – see SQM’s analysis in FHBA News

- Even property owners are happy to see property prices take a breather! – An amazing 37% of Australians want to see lower house prices, according to a survey of 1500 Australians by ME Bank, including 24% who own a home and 20% with an investment property! – see why on Domain

FHBA Social

Written By,

First Home Buyers Australia

Wan to buy your first home soon? Organise a FREE FHBA Discovery Session with an FHBA Coach today