In this blog we take a look at what the property market might have in-store for first home buyers in 2018 and what first home buyers should be considering.

2018: the year of the first home buyer?

Around a year ago we were reporting that first home buyer activity was at around an all-time high as housing affordability worsened and investor activity soared. A year on and things are looking just that little bit better for first home buyers. Many governments, although not all, have increased assistance for first home buyers, while incentives for property investors have reduced and lending to investors has also tightened over the same period. Combined with other factors, this has led to Australia seeing first home buyer activity beginning to increase over the last several months and investor activity has pulled back slightly.

Housing finance data obtained from the Australian Bureau of Statistics (ABS) reveals first time buyers accounted for 17.6% of all owner occupier housing loans in October, the highest share of borrowing since November 2012 (5 years ago). The 10,061 home loans given to first home buyers nationally in October 2017 was a significant 37.8% higher than October 2016.

Heading into 2018, a lot of the factors that have influenced the ‘rise of the first home buyer’ are still in place. While government policy stance can change at any time, what we do know at the time of writing is that first home buyer incentives in 2018 are only increasing on the 2017 increases. Meanwhile, there is nothing to suggest things will be designed to increase investor activity.

But we understand life for first home buyers is still difficult. In many parts of Australia property prices remain very high and much of the country is considered ‘un-affordable’ for first home buyers. In 2018, FHBA will continue to lobby our federal and state governments for a more level playing field between investors and first home buyers. We will be letting them know that their 2017 work is a step in the right direction, but more still needs to be done.

2018: Housing Prices Outlook

| Capital City | 2017 Change* | 2018 Prediction* |

|---|---|---|

| Adelaide | + 3.4% | + 1.0% |

| Brisbane | + 2.5% | +4.0% |

| Canberra | + 5.8% | + 7.0% |

| Darwin | – 5.5% | + 2.5% |

| Hobart | + 11.5% | + 10.5% |

| Melbourne | + 10.1% | + 7.0% |

| Perth | – 2.6% | + 2.5% |

| Sydney | + 5.0% | + 4.5% |

*2017 changes based on the CoreLogic Daily Home Value Index 12 month dwelling value change between 1 December 2016 and 30 November 2017. 2018 predictions are the centre prediction of SQM Research and are based on one 0.25% interest rate increase in quarter 3 and no further action by APRA. SQM Research and FHBA take no responsibility for individuals making decisions based on these predictions or any other content in this blog.

Recently Australia’s leading property forecaster, SQM Research, produced a series of housing price predictions (forecasts) for 2018. These predictions are based on a range of factors and SQM Research published a variety of different forecasts based on different factors playing out in 2018.

Overall, SQM Research expects property prices to rise further in 2018, in all capital cities, underpinned by a low interest rate environment and Australia’s rising population on the back of record immigration.

You should understand that many things influence property prices and future property prices are very difficult to predict. Further, within each capital city are different suburbs and areas that could perform differently to other areas of the same metropolitan.

Our best tip? When buying your first home consider your goals. How long do you think you will own the property for? These predictions here are 1-year predictions. First home buyers typically hold onto their first home for much longer than 1 year!

If you are interested, you can find BIS Oxford Economics recent 3 year forecasts for Australia’s capital cities, here.

2018: Areas to watch

One of Australia’s leading property guru’s, John McGrath (founder of McGrath Agents), each year releases a glossy report on predictions of 2018. When the report comes out, everyone in the industry rushes to look up which areas McGrath has picked to be a hotspot in the period ahead. Hot locations picked in the McGrath Report 2018 include:

- Geelong in Victoria

- Newcastle in NSW

- North Lakes in Queensland

To see other areas picked out + obtain a free copy of the McGrath Report 2018 please click here

Please note, before selecting an area to buy your first home in you should consider your circumstances and conduct your own research (or purchase tailored research for your circumstances).

Geelong is tipped to be a first home buyer hotspot in 2018

2018: Interest Rates Outlook

In 2017 the Reserve Bank of Australia (RBA) did not change the official cash rate once, leaving it at a record low of just 1.50%.

So what will be happening to interest rates in 2018? Recently we compiled these outlooks on interest rates by Australia’s big 4 banks:

- ANZ – ANZ were anticipating rates to stay on hold until 2019 but are now predicting two 0.25% increases in 2018, with the first 0.25% most likely to occur in May.

- CBA – CBA have been expecting rates to stay on hold until 2019 but one of their senior economists, Michael Workman says CBA now expects a single RBA rate increase in late 2018 with “the risk of an earlier move building”.

- NAB – NAB have also been predicting that interest rates would stay on hold until 2019 but have just updated their forecasts to two 0.25% increases in 2018, one in August followed by a second one in November.

- Westpac – At this stage Westpac is keeping to its forecasts of rates staying on hold until at least 2019.

Predicting how much interest rates will change is almost as difficult as predicting future property prices. What we will say as a tip to first home buyers is that interest rates can (and do) move up and down. The current run of stable interest rates is the longest ever since the RBA was made to be independent of the Australian Government. When buying your first home, you should calculate potential interest rate rises into your budget. An FHBA Lending Adviser can help you with everything you need to finance your first home purchase, and this includes showing you the impact of potential interest rate rises on your repayments.

Do you think rates will rise in 2018? 3 out of these big 4 banks do

2018: Government Incentives Outlook

In 2017 there were some increases to first home buyer incentives, such as stamp duty exemptions for some eligible first home buyers in NSW and Victoria.

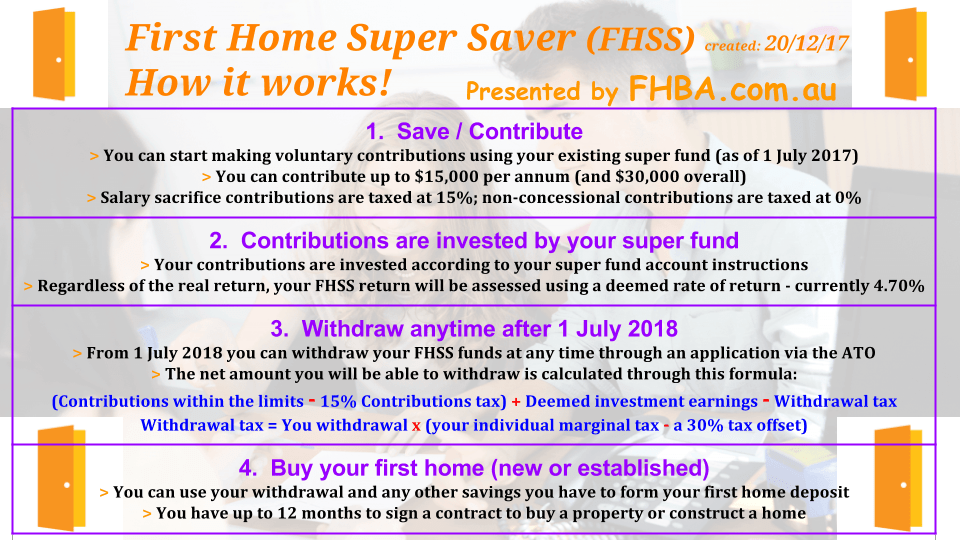

In December 2017 the Australian Federal Government saw their controversial First Home Super Saver Scheme (FHSSS) become law. The FHSSS is designed to help Australians boost their savings tax effectively for the purpose of buying a first home. Essentially, the Scheme (which has strict rules) allows eligible individuals to build a home deposit inside super at concessional (discounted) tax rates. These concessional tax rates, together with potentially stronger investment returns achieved inside super (rather than saving for a deposit in a typical bank account earning low interest) work together to help individuals save a home deposit sooner (in most cases).

The graphic below outlines the journey of an individual using the FHSSS to save a deposit.

For more information on the FHSSS please click here.

Another change in December 2017 was the formal announcement by the Queensland Government that the Queensland First Home Owners’ Grant (FHOG) for eligible first home buyers would remain at $20,000 until 30 June 2018. It has been due to fall to $15,000 on the 1st of January 2018. The Queensland Government has reported high popularity and use of the FHOG since being set at $20,000. Read up on the Queensland FHOG, $20,000 extension, here.

In January 2018, the Victorian Government will officially launch HomesVic, a property shared equity scheme. Under the program, the Victorian Government will help eligible first home buyers by taking a stake (up to 25%) in their first home purchase, enabling program users to enter the property market earlier. You can learn more about the HomesVic program here (plus register your interest!).

HomesVic will be officially launching in Victoria in January 2018

To see what government incentives are available in your state please see our latest summary blog.

2018: First Home Buyers Australia ready to turn dreams into reality

FHBA Co-Founders Daniel Cohen and Taj Singh, along with the rest of the team, cannot wait to help first home buyers achieve the great Australian dream of home ownership in 2018.

2018 will be FHBA’s third year in business and we are looking forward to helping more first home buyers than over our last two years combined, all through our leading first home buyer services such as FHBA Mortgages and FHBA New Homes.

Our @fhba_com_au Co-Founders @DanielPCohen1 (left) and @TajSingh90 (right) can't wait to help first home buyers in 2018! 🏠😀#fhba #thegreatAustraliandream #ausproperty #realestate pic.twitter.com/1apFsujhrt

— FHBA (@fhba_com_au) December 27, 2017

If you are planning on buying your first home in 2018 do yourself a favour and book in a FREE Discovery Session with an FHBA Coach. Regardless of what your dream first home looks like, our leading first home buyer experts can help you every step of the way. But don’t just take our word for it, check out our client testimonials that we are proud to display on our homepage!

We wish all aspiring first home buyers every success in 2018. Stay tuned to FHBA News as we keep you informed in 2018 with all matters affecting first home buyers, plus catch the hottest first home buyer tips!

Get a FREE consultation with an FHBA Coach

Written By,