FHBA Property Market Update – Top story

Over the last several years property prices in Sydney and Melbourne have surged, while most other capital cities have had more modest growth (except Perth and Darwin, 0which have seen property prices decline). Will these trends continue over the next few years, or will new trends start to take place in the years ahead? We take a look at some new three-year forecasts for every capital city as well as some major regional areas.

Every year, QBE Lenders Mortgage Insurance employs BIS Oxford Economics to help them analyse the Australian housing market. QBE need their critical insights because it helps them set their Lenders Mortgage Insurance policy parameters (What is Lenders Mortgage Insurance?). Employing BIS Oxford Economics to create an annual Australian Housing Outlook report is not cheap, but fortunately for the rest of us, QBE publicly publish this annual report for everyone to read. Today we look at the recently released 2017 – 2020 outlook report.

This report looks at a range of factors likely to influence the property market. It includes a range of forecasts / predictions, including 3-year property price forecasts for houses and units of each capital city.

This year’s report is very interesting. It suggests some change is on the way. Over 2017 – 2020, BIS Oxford Economics predicts Sydney to finally take a breather (phew!); Melbourne & Brisbane units to decline; and Canberra to surge ahead (sorry Canberrians who are already priced out of the market). We have conveniently summarised these 3 year forecasts for you in the table below:

| Capital City (highest to lowest) |

3 year house growth |

3 year unit growth |

|---|---|---|

| Canberra | + 16.3% | + 2.4% |

| Hobart | + 10.8% | + 8.7% |

| Melbourne | + 10.2% | – 4.8% |

| Adelaide | + 6.9% | + 3.2% |

| Perth | + 2.8% | – 0.6% |

| Brisbane | + 7.1% | – 7.2% |

| Sydney | – 0.2% | – 3.8% |

| Darwin | – 0.9% | – 3.2% |

(Source: QBE)

What about regional areas?

The report looks at many regional areas as well, including Gelong, Gold Coast, Launceston & Newcastle. To see regional conditions and forecasts see the full QBE Australian Housing Outlook report available on QBE’s website.

What else did the report look at?

Unfortunately, the report suggests that housing affordability will continue to deteriorate across Australia despite low interest rates and government incentives for first home buyers.

The housing affordability challenge summarised. Source: QBE

As for interest rates, which plays such a vital role in our ability to meet repayments in today’s world, QBE predicts the Reserve Bank’s cash rate will barely change over the next three years. The report forecasts a cash rate of 1.75% in 2020 – a 0.25% increase from today.

Interest rate outlook summarised. Source: QBE

The report also looks at other important economic factors such as property construction, rental conditions, population forecasts, economic growth, employment numbers and various other intriguing factors. You can download the full 2017-2020 QBE Australian Housing Outlook report for free on QBE’s website.

Can I trust the forecasts and predictions of this report?

BIS Oxford Economics is a reputable forecaster in the Australian property sector. While plenty of expertise and resources are dedicated to this annual report, no one has a crystal ball on what will occur in the future. Also, predictions for various capital cities and regions are also fairly broad. Different suburbs within capital cities and regions can perform differently to other suburbs within the same suburban or regional area. While it is always good to read up on expert insights to help improve your knowledge, you should always seek professional advice before making any financial or investment decisions.

Not sure where to start? At FHBA we are here to help you every step of the way. Organise a free Discovery Session with an FHBA Coach today to find out more.

Enjoy the rest of your weekly FHBA Property Market Update.

QBE’s 2017-2020 Australian Housing Outlook forecasts Canberra property prices to rise faster than anywhere else in Australia – QBE

More First Home Buyer News

- Can you get a home loan when you are pregnant (or on maternity leave)? – If you are having a baby and are due to take maternity leave from work, it can cause complications in obtaining a home loan, but it is still possible – FHBA Co-Founder Taj Singh explores in this investigation

- Scott Morrison say’s first home buyers have ‘hope’ – Australian Treasurer Scott Morrison has told Fairfax Media that the chances of first home buyers getting into the property market have improved – read Mr Morrison’s housing affordability thoughts on SMH online

- Are ‘tiny homes’ under 35sqm the future of Australian housing? – As housing affordability continues to deteriorate, there is growing popularity for this small (very small) affordable housing solution – see the pics of popular tiny homes on Domain

New Homes of the Week (edition 79)

Introducing our top five picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! This week, the properties are all great value house & land packages waiting for you to build and call home. If you are interested in any of these properties or want assistance in searching for other new property opportunities get in touch with our team for a complimentary consultation.

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | $9,650 | See property |

| Queensland | $20,000 | $9,650 | See property |

| South Australia | $15,000 | $5,150 | See property |

| Victoria | $10,000 | ‘on enquiry’ | See property |

| Western Australia | $10,000 | $6,500 | See property |

Affordable? Yep! And packed with first home buyer incentives!

Did you know??

Our FHBA New Homes service can help you compare hundreds of new property options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Plus, we are the only ones to offer the FHBA 50 Rebate on top of the First Home Owners Grant*. Get in contact with us so we can help you with your search to find your unique slice of the great Australian dream today! OK!

*FHOG & FHBA 50 Rebate amounts are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details.

Interest Rates Update: 6/November/2017

Tomorrow (Tuesday the 7th of November 2017), the Reserve Bank of Australia will meet to review the official cash rate for the second last time of 2017. Stay tuned to FHBA for the decision, including insights into what it means for aspiring first home buyers.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

https://www.facebook.com/fhbah/posts/1347381548717712

Current hotspot in focus: Central Coast (NSW)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current ‘hotspot in focus’ is Wyong (and the broader Central Coast region) of NSW:

- Wyong is an affordable housing area located approximately 90km’s drive North of Sydney CBD and 70km’s drive from Newcastle

- Wyong is one of only a few areas that is within a reasonable commute to Sydney CBD (via the motorway or train) that is still considered affordable, with a median dwelling price of around $536,000 according to APM data

- Much of the Central Coast property is still priced under thresholds to receive the NSW Governments’ first home buyer incentives such as the First Home Owners Grant and Stamp Duty exemption (or concession)

- Learn more about Wyong and surrounding areas in our ‘hotspot in focus’ article

There is much to love about the family friendly area of Wyong, north of Sydney

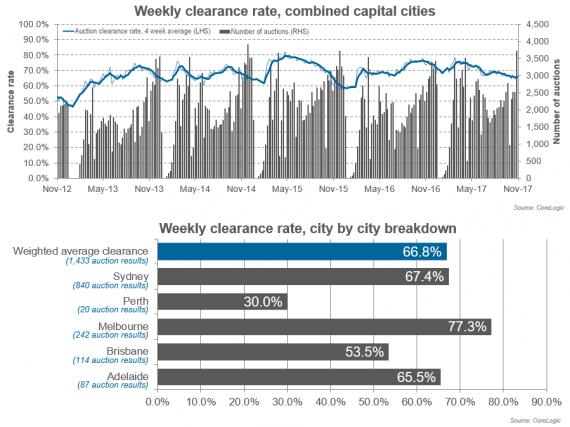

Preliminary Weekend Auction Clearance Rates (4th – 5th of November)

(Source: CoreLogic)

Capital City Property Price Movements: 6/November/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Did you know that over the last 3 months, Sydney & Perth property values have declined by the same amount of – 0.7%?

| Capital City Index Score | 3 months % Change | Yearly % Change |

|---|---|---|

| Adelaide: 113.28 | + 0.1% | + 4.5% |

| Brisbane: 109.30 | + 0.5% | + 3.0% |

| Melbourne: 156.47 | + 1.8% | + 10.9% |

| Perth: 95.15 | – 0.7% | – 2.7% |

| Sydney: 175.68 | – 0.7% | + 7.3% |

(Source: CoreLogic)

FHBA Social

A quick snap of what’s trending on our social media accounts – are you taking part in the conversations?

https://www.facebook.com/fhbah/posts/1349061535216380

Lenders are loving first home buyers right now ✍️ #FHBA #ausproperty #realestate #Banking #aushousing 🏠 https://t.co/JhySJMfuUh pic.twitter.com/GdNqyt4heV

— FHBA (@fhba_com_au) November 2, 2017

https://www.instagram.com/p/BbGeY4cnbKT/?hl

https://www.linkedin.com/feed/update/urn:li:activity:6333158371952291840

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

Are you planning on entering the property market soon?

Regardless of who you are or what you are looking for, before you commence house hunting you should get a no obligation home loan pre-approval!

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you, so you can determine your approximate borrowing capacity. A loan pre-approval comes with no obligations to proceed with a home loan application, leaving you in control and importantly, attending open homes knowing what your budget is.

Get a no cost loan pre-approval by speaking with an FHBA Lending Adviser today