FHBA Market Update: 11/September/2017

In today’s FHBA Market Update we take a look at how the Spring market is going; an update on the First Home Super Saver Scheme; the outer city suburbs first timers are buying in; how many people are getting financial help from their parents; our latest favourite properties for first home buyers; the latest property prices around the country; why first home buyers love Wanneroo and what penalties apply if you wrongly claim government incentives such as the First Home Owners Grant.

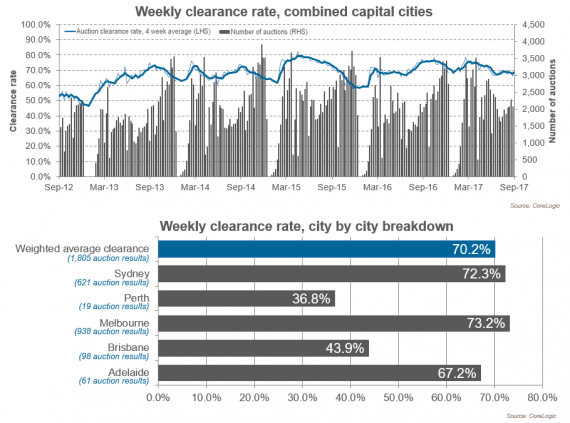

This week saw the Spring property market in full swing with CoreLogic reporting over 2,200 auctions held around the country, with a preliminary clearance rate (proportion of properties sold on auction day) being just over 70%. There was also an increase in the amount of homes open for inspection.

According to the Australian Bureau of Statistics (ABS) there have been a small increase in first home buyer activity over the last few months right across the country. While in some states new stamp duty exemptions and concessions are helping (e.g. NSW and Victoria), the ‘deposit gap’ remains one of the biggest hurdles an aspiring first home buyer must overcome.

Earlier this year in the May federal budget, the government announced a new scheme designed to assist Australian first home buyers save a deposit tax effectively – the First home Super Saver Scheme (FHSSS). The FHSSS involves allowing eligible Australians to salary sacrifice up to $15,000 per annum (and $30,000 grand total) of their pre-tax wages into their super fund and withdraw this later (along with deemed investment earnings, less some tax) for a deposit, regardless of whether you are buying a new or established property.

There are many pros and cons of the FHSSS which we have discussed previously in FHBA News. Thus far, the government has failed to make any meaningful improvements to the FHSSS. Despite the controversy around this plan to address housing affordability, last Thursday the government introduced a Bill to Parliament (a step in the process of making it law).

Assistant Treasurer Michael Sukkar said in the lower house in Canberra on Thursday “with house prices high, difficulty saving a deposit is a key barrier to getting into the market. The changes in this Bill are essential, we need to act now”.

For ongoing updates on the FHSSS, including whether it gets through Parliament and becomes law, stay tuned to FHBA News and our social media pages.

Want to know more about the FHSSS? Check out our summary here.

Enjoy the rest of our your weekly FHBA Property Market Update.

Will you save for your house deposit in your existing super fund?

More First Home Buyer News

- Thank you Mum & Dad – According to a new survey nearly 1 in 3 first timers are getting some form of accommodation / finance assistance from their parents – see the survey results and our co-founder Taj Singh’s thoughts in Domain

- First home buyers ‘buying’ in the outer suburbs – First home buyers are using government incentives to assist them enter the property market via outer suburbs of our biggest cities – see where in Domain

- Penalties for those who wrongly claim the First Home Owners Grant – Following Daniel Cohen & Taj Singh’s interview last week with Domain about certain loopholes for claiming government incentives such as the First Home Owners Grant, the NSW Office of State Revenue has reminded people that heavy penalties apply for wrongly claiming taxpayer funded help – see the penalties being applied in the Newcastle Herald

Current hotspot in focus: Wanneroo (WA)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus is the popular Wanneroo region in Western Australia:

- Wanneroo is located 30 km north of Perth CBD (and is very close to the beaches on the north Perth coast)

- Wanneroo is part of a fast growing area that is receiving plenty of government investment

- Shops, restaurants, bicycle paths, pretty parks, the glorious Indian Ocean at the doorsteps, Wanneroo (and the surrounding areas) have plenty of lifestyle pluses that first timers love

- And despite the great lifestyle and proximity to Perth CBD, the median property price is….click here to reveal more

Capital City Property Price Movements: 11/September/2017

Updated daily, the CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months. Last week CoreLogic gave the Index an overhaul “using update methodologies and processes to provide insights into housing market conditions across the regions of Australia”. The enhanced Index is “designed to measure pure returns and exclude value add from capital works (such as renovations)” according to the CoreLogic website. As of last week we are reporting the new index figures and will continue to do so every week.

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 113.20 | + 0.1% | + 5.3% |

| Brisbane: 108.98 | +0.1% | + 3.6% |

| Melbourne: 154.74 | + 1.9% | + 12.4% |

| Perth: 94.97 | – 1.8% | – 2.9% |

| Sydney: 177.10 | + 0.4% | + 12.3% |

(Source: CoreLogic)

Interest Rates Update: 11/September/2017

Last week the Reserve Bank of Australia (RBA) opted to leave the cash rate on hold at a record low of 1.50%. Lenders continue to favour first home buyers.

- Read why the RBA left the cash rate on hold

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

New Homes of the Week (edition 71)

These are our top picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! All the homes are affordably priced for aspiring first home buyers:

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

Location, lifestyle, beautiful surroundings, price, Grant + rebate, construction complete……home

Preliminary Weekend Auction Clearance Rates (9 – 10 September 2017)

(Source: CoreLogic)

Tweet of the Week

According to @ABSStats more people (in particular in #NSW) are fixing their #homeloan. @DocNicolaPowell reports: https://t.co/LvkvHnZs2R

— FHBA (@fhba_com_au) September 10, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia