FHBA Market Update: 7/August/2017

In today’s FHBA Market Update we take a look at where renting is most common, where Australia’s younger generations are living, why waiting for a 20% deposit isn’t always the best financial decision you can make, why getting your first home loan through a mortgage broker is better than going straight to the bank, our latest favourite properties for first home buyers, the latest property prices, weekend auction clearance rates around the country and a whole lot more.

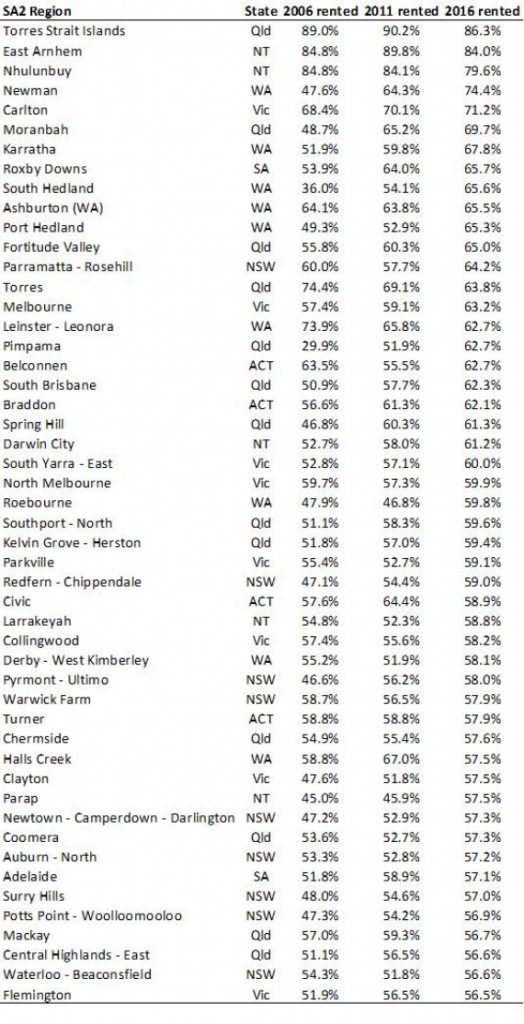

Usually we use our weekly FHBA Market Update as an opportunity to update you on the latest matters concerning (and impacting) first home buyers. However, given many people rent before they buy we thought we’d take a quick look at where renting is most common in Australia in this Market Update.

The recently published 2016 Australian Census results showed that 30.9% of residential properties nationally were rented, an increase on previous Census results (2011 – 29.6% and 27.2% in 2006). Out of the top 50 most common rental suburbs, 41 suburbs saw an increase of renters on the 2011 Census result.

(Table and analysis produced by CoreLogic)

With renting on the rise and home ownership levels on the decrease (in particular among the younger generations) more pressure will continue to mount on our federal and state governments to act.

Australia’s parliament returns this week following the winter break and with a new Sydney Morning Herald article published on the weekend stating that unaffordable housing has surged to the top of the list of ‘undecided voters concerns’ in western Sydney (even trumping long-standing priorities of health, education and jobs, according to a new Fairfox-Ippsos focus group research) – housing affordability could be debated again sooner rather than later.

Clearly housing affordability is not yet solved and therefore we hope (and anticipate) that housing affordability will continue to be debated amongst our politicians in the coming weeks and months.

More First Home Buyer News

- Youth on the move – FHBA co-founder Taj Singh was busy in interviews last week discussing trends of youth moving due to housing affordability reasons – Younger gens moving interstate; Where the youth live in Sydney is changing

- When saving for a 20% deposit may not be such a good idea – Many aim to save a 20% deposit to avoid Lenders Mortgage Insurance (LMI), but, according to new research by Canstar there are circumstances where entering the property market with a lower deposit isn’t such a bad idea – see Canstar’s research on news.com.au or learn more about LMI in FHBA News

- Brokers are best – A great home loan is the foundation to starting off home ownership on the right foot, and when it comes to obtaining a home loan for your first time, you are almost always better off speaking to a Mortgage Broker rather than visiting a bank branch – learn why in FHBA News

Current hotspot in focus: Adelaide Hills

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Last week we revealed our very latest first home buyer hotspot – Adelaide Hills, South Australia.

- Adelaide Hills is located 33km east of Adelaide

- Around a 30 minute drive to Adelaide CBD, it is close enough if you need to travel to the city for work or other reasons, yet far away enough that you can enjoy this lovely and peaceful part of Australia in all it’s glory.

- There are plenty of suburbs across the region for you to consider calling home and with a median house price of $428,000 you will find there are plenty of properties to consider

Oh Adelaide Hills – you are so beautiful

Capital City Property Price Movements – 7/August/2017

Updated daily, The CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months. Australia’s largest two cities, Melbourne and Sydney, continue to power ahead.

- Adelaide: 486.05 (Qtr + 0.8% / Yr + 2.5%)

- Brisbane: 554.59 (Qtr – 0.8% / Yr + 3.2%)

- Melbourne: 945.75 (Qtr + 4.3% / Yr + 16.1%)

- Perth: 566.02 (Qtr – 0.3% / Yr – 2.6%)

- Sydney: 1135.70 (Qtr + 2.8% / Yr + 12.4%)

(Source: CoreLogic)

Interest Rates Update: 7/August/2017

Last week the Reserve Bank of Australia (RBA) board met to review the official cash rate. The RBA opted to leave the cash rate on hold at a record low of 1.50%.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

- Why the RBA left the cash rate on hold

New Homes of the Week (edition 66)

These are our top picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! All the homes are affordably priced for aspiring first home buyers:

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

cute ‘n’ beautiful – first home buyer home in Victoria

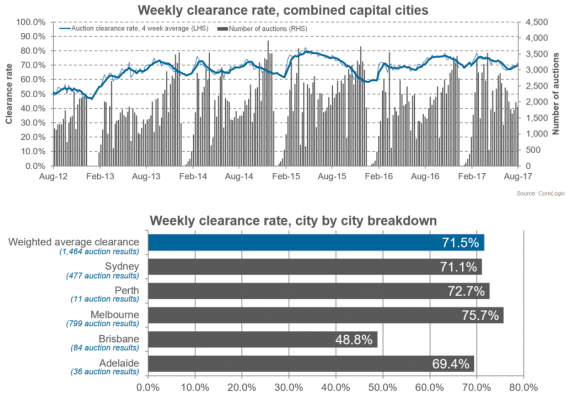

Preliminary Weekend Auction Clearance Rates (5 – 7 August 2017)

(Source: CoreLogic)

Tweet of the Week

Where young #Aussies are going to (& where they are leaving from) @TajSingh90 @ChristinaZhou44 @JennieDuke #auspol https://t.co/pamcbILn2B

— FHBA (@fhba_com_au) August 4, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia