FHBA Weekend Preview: 5- 6 August 2017

In today’s edition of FHBA Weekend Preview we take a look at the issue of ‘spreading’ housing affordability concerns (and what you can do about it), our new hotspot in focus, our five favourite new properties for first home buyers this weekend, a review of the top first home stories this week and a preview of this weekends auctions.

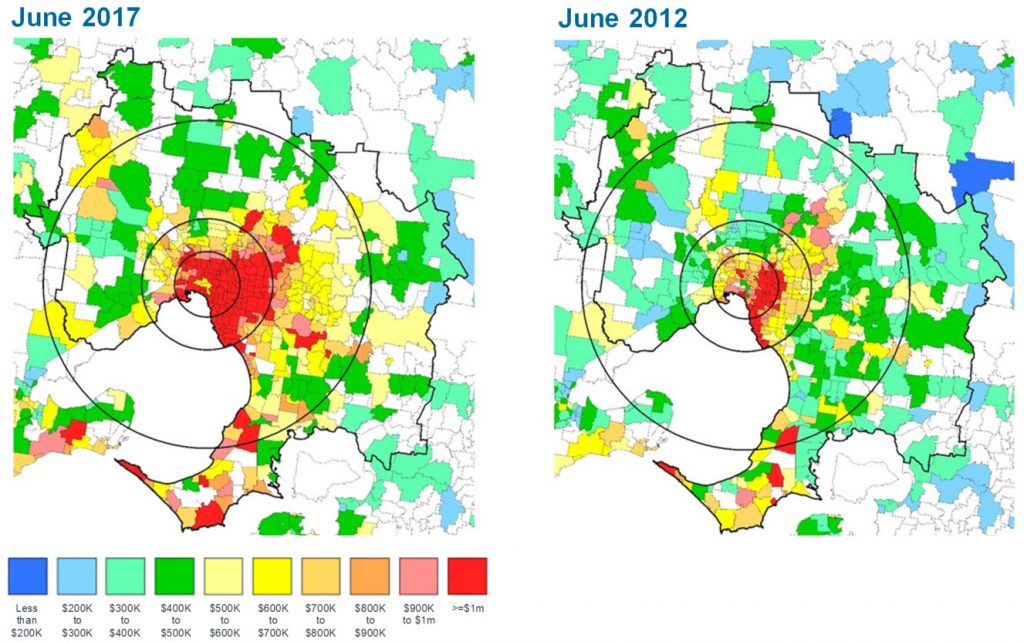

Australia’s largest property research company, CoreLogic, is always recording and reporting the latest property prices right across Australia. This week they released some ‘thematic maps’ from their 2017 Mapping the Market Report. The thematic maps show housing how the cost of housing has shifted across Australia’s capital cities by suburbs over the past five years. Below is a copy of Melbourne’s thematic maps for June 2017 v. June 2012.

The issue of housing affordability is spreading. Source: CoreLogic

The maps and report suggest that the issue of housing affordability ‘spreading’ from inner suburbs of our capital cities to outer suburbs and even regional areas. This report is just the latest evidence supporting the need for more government assistance for first home buyers on a national scale.

At FHBA we are continuing to the lobby the government for more support for first home buyers. But what can you do about rising property prices?

- Choose to move even further out? – with modern technology, do you really need to travel to the city everyday? Perhaps you can work from home (at least some days) or even get a local job? We understand this is not for everyone, but it is something that some may consider.

- Go smaller? – sometimes the reality is that you just can’t afford that spare bedroom or extra car space. Could

- Rentvest – a strategy that is growing in popularity is called rentvesting (or rentvest). Rentvesting involves buying an investment property first in a suburb you can afford to buy in while living in a suburb where you need/want to live in – learn more about rentvesting.

- Save longer? – we all want to buy sooner rather than later, but perhaps you may be able to save a little bit more by staying at home or renting a little bit longer.

- Talk to your parents? – some parents can help, some can’t (or simply choose not to). Have a chat with them to find out whether they are willing and able to help you (even if it’s only a little bit, it all helps!) – see different way’s your parents can assist you.

To see the thematic map for your capital city visit CoreLogic.

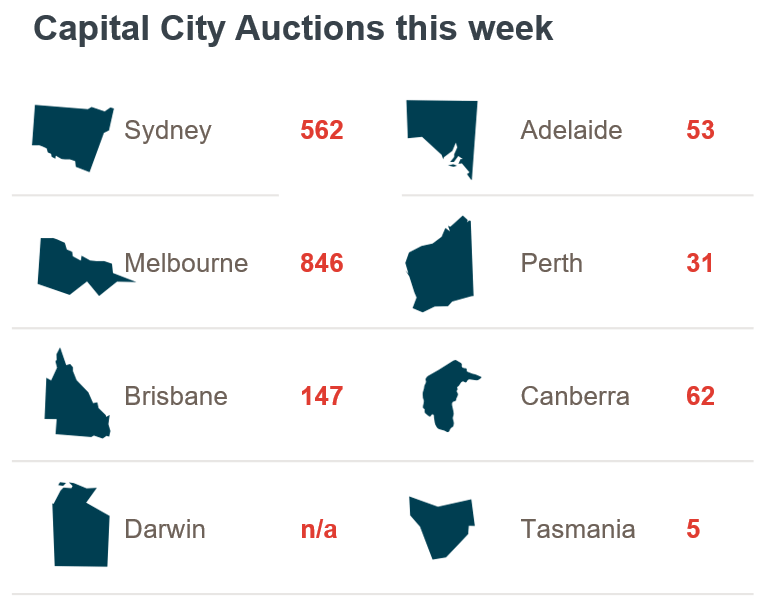

For those out and about this weekend, CoreLogic is reporting a decrease in the number of auctions being held across the country:

Want to know more about this weekend’s auction activity? See the CoreLogic blog.

Good luck to all first home buyers this weekend – and remember, if you need assistance with planning your property search (or organising your finance), don’t forget to get in touch with an FHBA Coach.

First home buyer homes of the week: edition 65

These are our favourite 5 new properties for first home buyers looking for First Home Owner Grant eligible homes, this week. These properties are also eligible for the exclusive FHBA 50 Rebate! Which one is your favourite?

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

North of Perth has got what living in Australia is all about

Open homes and auction weather

See what the weather will be like in your area before you attend open homes and auctions!

COMING SOON

New hotspot in focus: Adelaide Hills

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. This week we revealed our very latest first home buyer hotspot – Adelaide Hills, South Australia.

- Adelaide Hills is located 33km east of Adelaide

- Around a 30-minute drive to Adelaide CBD, it is close enough if you need to travel to the city for work or other reasons, yet far away enough that you can enjoy this lovely and peaceful part of Australia in all its glory

- There are plenty of suburbs across the region for you to consider calling home and with a median house price of $428,000 you will find you have plenty of options to consider.

Oh Adelaide Hills – you are so beautiful

House hunt with confidence

Planning on going house hunting soon but don’t know whether a bank will lend you enough funds to buy your first home yet?

You should get a no obligation home loan pre-approval! A loan pre-approval provides you written guidance of how much a particular bank is willing to lend to you. A loan pre-approval comes with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak with an FHBA Broker from FHBA Mortgages today

Search FHOG eligible homes from your couch

Are you in the market for a newly built property? This could be a house & land package, a townhouse or a newly constructed apartment. Search our new look ‘new homes’ portal this weekend to see hundreds of Grant eligible properties suitable for first home buyers!

Search first home buyer homes here

1 July 2017 changes to government assistance for first home buyers

On the 1st of July many state government assistance measures for first home buyers (such as the First Home Owners Grant and stamp duty concessions) had some form of change. We have summarised all the changes in a free quick guide available on our website here.

Get your free quick guide to the changes of Grants and concessions for first home buyers

Friday News Review

https://www.facebook.com/fhbah/

Never miss an FHBA Market Update or FHBA Weekend Preview!

Enjoy reading our free-Market Updates and Weekend Previews? You’re not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!

Written By,

First Home Buyers Australia

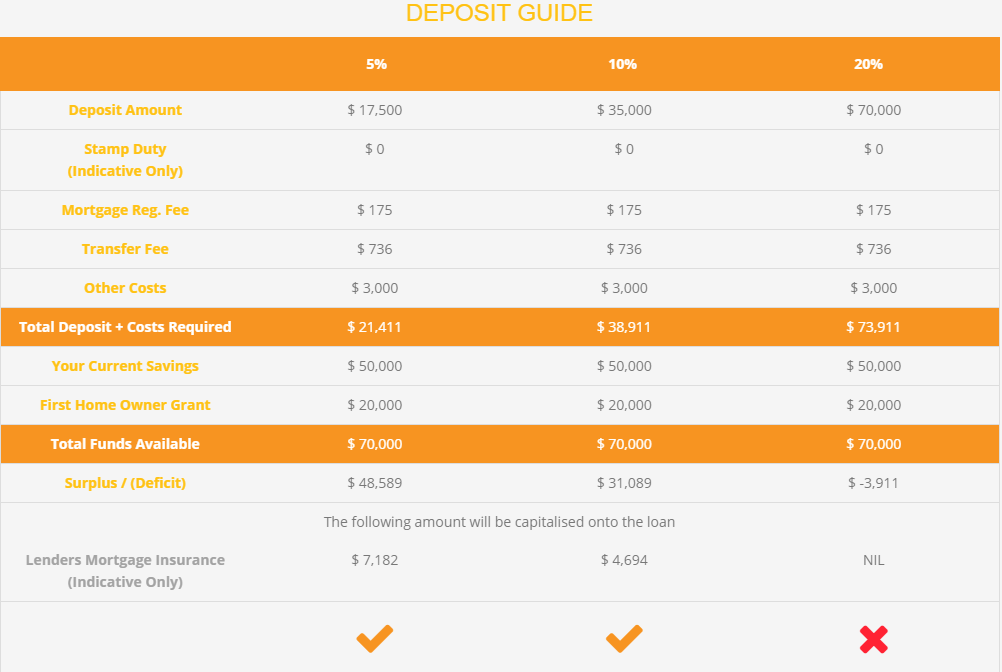

Wondering whether you have saved enough to form a deposit? Try the revamped FHBA Eligibility Estimator for free!

Self-estimate if you have saved a deposit using our revamped Eligibility Estimator