Top story

Do you feel like you are only just getting use to the weather warming up? Well guess what guys, Spring is almost halfway over (already!). Why doesn’t winter go that fast?

Spring time is typically the busiest time of the year for the property market, so today we thought we’d give you an update so you can gain a bit of an understanding of where things are at. Most of the data is national and/or capital city data, so please note that things may be different in your area and if you want a better picture of how things are in your property market you should seek the assistance of a Buyers Advocate or get in touch with an FHBA Coach.

- Quantity of listings – Compared to both Winter and last Spring the quantity of properties listed for sale on the market has risen in most capital cities. This is good news for first home buyers as this means there are more properties to compare and choose from.

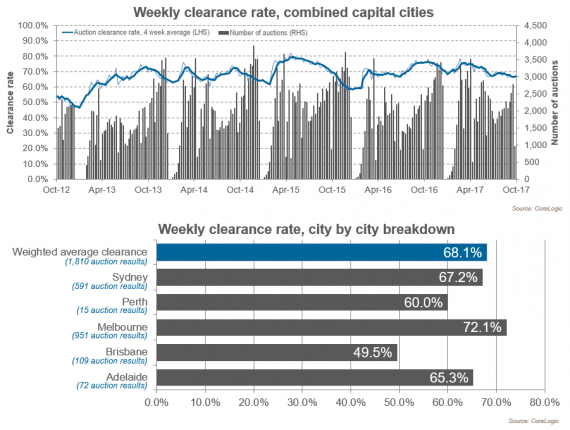

- Auction clearance rates – All of Australia’s capital cities have been experiencing small (but noticeable) declines in auction clearance rates (amount of properties sold versus passed in on auction day). This is a sign that buyers are being patient and don’t want to spend too much on a property (i.e. overpay). A few weeks ago we discussed in, a weekly FHBA Property Market Update, how new fear is replacing the ‘fear of missing out’ (aka, FOMO) that existed not all that long ago. Learn more about the physic change here.

- Property prices – According to the CoreLogic Daily Home Value Index the pace of property price increases has actually fallen in recent times. In the month of September, while property prices in Hobart jumped 1.7%, most other capital cities recorded only minor growth, while Sydney and Darwin experienced declines in property prices over the month.

- Interest rates – The Reserve Bank of Australia (RBA) has coninuted to leave the official cash rate on hold at a record low of 1.50% in their September and October board meetings. There are two meetings left for 2017. Home loan interest rates continue to be steady, with banks and lenders generally preferring owner occupier loan applicants to investors. There are also hot new fixed rates on offer for Spring. See some current Spring specials for home loans here.

- First home buyer activity – First home buyer activity has risen slightly over the last few months on the back of increased government incentives for first timers in some of Australia’s more populated states, as well as a small decline in investor activity and continued low interest rates.

Money Minute for Monday, October 9. #9Finance pic.twitter.com/N3y3GHMWTM

— 9Finance (@9Finance) October 8, 2017

So what can you expect for the remainder of Spring and the rest of 2017?

According to the real estate industry property listings activity should remain higher than the equivalent period of 2016. The major banks predict the RBA will leave the cash rate on hold until at least the second quarter of 2018 and other than a hot property market in Hobart, most analysts at CoreLogic believe proprety prices will not be rising too much further this year. However, there could be a small rush of first home buyers racing to get into the Queensland property market before the year is out, with the Queensland First Home Owners Grant (FHOG) due to decrease from $20,000 to $15,000 on the first of January 2018.

First home buyers should be patient and consider their personal circumstances and budget as always. If you need help you should seek professional advice from someone you can trust. At FHBA our friendly team are here to help whenever you are ready, so if you are looking at possibly buying before the year is out why not get in touch for a free Discovery Session with an FHBA Coach? Get a free Discovery Session with an FHBA Coach

Enjoy the rest of your weekly FHBA Property Market Update.

More First Home Buyer News

- Home ownership among younger generations falls (again) – New data shows that property ownership levels for those aged 25 – 34 has fallen from 61% in the 1980s to 45% presently, with most of the 16% decline happening in recent times – learn what the implications are in the Sydney Morning Herald

- Apartment building falls – New data shows that the construction of apartments has fallen considerably over the last few months – learn why on realestate.com.au

- How can I save more money over the long term? – Looking to save a deposit and wondering how you can get there sooner? FHBA co-founder Daniel Cohen spoke with a leading online retailer about some tips to fast track your savings – see Daniel’s and other experts money saving tips on mydeal.com.au

Current hotspot in focus: Bacchus Marsh (Victoria)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus is the regional suburb of Bacchus Marsh located in the beautiful Moorabool shire of Victoria:

- Bacchus Marsh is an affordable housing area located 50km West of Melbourne

- Bacchus Marsh makes for a great option for growing first home buyers families thanks to affordable housing options, the regional Victorian First Home Owners Grant (and stamp duty concessions) and a less than 1 hour train trip to Melbourne CBD for those who work in the city

- Bacchus Marsh is surrounded by stunning state and national parks, plus is well located for exciting day drives in all directions

- Learn more Bacchus Marsh (including surrounding suburbs in the Moorabool shire) in our hotspot focus article here

Capital City Property Price Movements: 10/October/2017

Updated daily, the CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months.

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 113.22 | + 0.2% | + 4.9% |

| Brisbane: 109.30 | +0.5% | + 3.5% |

| Melbourne: 155.95 | + 2.0% | + 11.9% |

| Perth: 95.12 | – 1.2% | – 2.9% |

| Sydney: 176.60 | + 0.1% | + 9.8% |

(Source: CoreLogic)

Interest Rates Update: 10/October/2017

Over the last few weeks several banks and lenders have started to lower fixed rate loan offers, in particular for owner-occupier borrowers (such as first home buyers!). Not sure whether to go fixed or variable for your home loan finance needs? Our Lending Advisers are here to help you find a suitable solution based on your circumstances, so why not book a complimentary appointment today?

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

New Homes of the Week (edition 75)

The table below shows our top five picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! All the homes are affordably priced for aspiring first home buyers.

| New home of the week | State FHOG* | FHBA 50 Rebate* | Stamp Duty* |

|---|---|---|---|

| New South Wales | $10,000 | ‘on enquiry’ | NIL |

| Queensland | $20,000 | $3,710 | NIL |

| South Australia | $15,000 | $6,560 | fr: $19,352 |

| Victoria | $10,000 | $8,800 | NIL |

| Western Australia | $10,000 | $2,025 | NIL |

*Grant, Rebate and Stamp Duty concessions are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details. To see your state property of the week click on your state: NSW, Queensland, South Australia, Victoria, Western Australia.

Did you know that via our FHBA New Homes service we can help you compare hundreds of new property options from a large variety of property developers and agencies? Get in contact with us so we can help you with your search to find something ‘you’ today! Yes please!

Nestled on a gentle hillside overlooking the southern coastline of Adelaide – this is Vista

Preliminary Weekend Auction Clearance Rates (7th – 8th of October)

(Source: CoreLogic)

Tweet of the Week

Increasingly, Australians want to live in #Australia's 3rd largest city #Brisbane #Queensland #BrisRE #aushousing https://t.co/WQECTOEvV1

— FHBA (@fhba_com_au) October 5, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

Are you planning on entering the property market soon?

Regardless of who you are or what you are looking for, before you commence house hunting you should get a no obligation home loan pre-approval!

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you, so you can determine your approximate borrowing capacity. A loan pre-approval comes with no obligations to proceed with a home loan application, leaving you in control and importantly, attending open homes knowing what your budget is.

Get a no cost loan pre-approval by speaking with an FHBA Lending Adviser from FHBA Mortgages today

FHBA Mortgages – Australia’s leading place for first home buyer finance

Search FHOG eligible homes from your couch

Are you in the market for a newly built property? This could be a house & land package, a townhouse or a newly constructed apartment. Search our ‘new homes’ property portal to see hundreds of Grant (& exclusive FHBA 50 Rebate) eligible properties suitable for first home buyers!