FHBA Property Market Update: 4/October/2017

In today’s FHBA Property Market Update we take a look why property buyers are loving Brisbane right now; why millennials are struggling to save a deposit while living at home; how banks determine the borrowing capacity of home loan applicants; our latest favourite properties for first home buyers; the latest property prices around the country; the latest auction clearance rates, our new popular hotspot with first-timers and why ANZ say’s those waiting for property prices to dip shouldn’t get their hopes up.

Brisbane, Australia’s new world city, is growing in popularity with property buyers and investors according to Australian property research and data provider CoreLogic Australia.

CoreLogic Australia say’s Brisbane’s net migration (people moving to Brisbane versus leaving Brisbane) is up, with many people leaving Sydney and Melbourne for the cheaper city. CoreLogic’s head of research Tim Lawless says that while much of Brisbane’s appeal hasn’t changed over the years (cheaper housing, relaxing lifestyle, warm climate), it is the improving employment activity in the city that is making Brisbane extra appealing with young property buyers. According to Australia’s Bureau of Statistics, the unemployment rate of Australia’s 3rd largest city has improved from 6.5% 18 months ago to 5.7% in August this year.

Are you an aspiring first home buyer currently renting or living at home with the parents in Sydney and Melbourne? If you are considering the Brisbane property market statistics show you are not alone.

Two key ways first home buyers from NSW and Victoria can enter the Brisbane property market are:

- Pack up and move to Brisbane – this involves buying a home in the sunshine state, gaining employment in Queensland and departing Sydney or Melbourne (or wherever you are currently living).

- Rentvest – this involves reamaining to live down South (perhaps remain in your current accomodation) and purchase a property in Brisbane as an investment.

Generally speaking, the Brisbane property market is cheaper and therefore you will likely be able to enter the property market sooner with a smaller deposit amount. The Queensland government currently provides the following incentives to eligible first home buyers:

- A First Home Owners’ Grant (FHOG) of $20,000 for eligible first home buyers who buy or build a ‘new’ property under the value of $750,000 (please note this will fall to $15,000 on the 1st of January 2018).

- A stamp duty concession for eligible first home buyers who buy (or build) a property (new or established) under the value of $550,000.

First home buyers from Sydney & Melbourne are increasingly considering Brisbane

There is a lot to think about when contemplating moving interstate (or considering investing interstate). To help you consider this option get in touch with FHBA today and one of our friendly coaches will be more than happy to assist you compare some options – speak to an FHBA Coach about property options, finance and/or government incentives

On a separate note, last weekend’s property market was quiet due to the long weekend and footy finals being held. This weekends property market is expected to return to normal activity.

Enjoy the rest of your weekly FHBA Property Market Update.

More First Home Buyer News

- When can young Australians afford to grow up? – Older generations want younger generations to stop whinging about how hard things are, to grow up and have a real go; but the problem is it’s just so expensive, plus it is harder to grow up when you have to live at home under the parents longer – discover how living at home longer is affecting millennials in Domain

- The outlook for first home bueyrs isn’t all that encouraging says ANZ – Hoping property prices will come down a bit? Not likely say’s ANZ. With Australia’s high immigration numbers and plenty of local aspiring home buyers, there is plenty of demand for Australian property and that demand does not equal a fall in property prices – see ANZ’s full first home buyer outlook on news.com.au

- How do lenders work out my borrowing capacity? – Have you ever wondered how banks determine how much you can borrow? We reveal some of the key factors – learn about these factors in FHBA News

New hotspot in focus: Bacchus Marsh (Victoria)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our new hotspot in focus is the regional suburb of Bacchus Marsh located in the Moorabool shire of Victoria:

- Bacchus Marsh is an affordable housing area located 50km West of Melbourne

- Bacchus Marsh makes for a great option for growing first home buyers families thanks to affordable housing options, the regional Victorian First Home Owners Grant (and stamp duty concessions) and a less than 1 hour train trip to Melbourne CBD for those who work in the city

- Bacchus Marsh is surrounded by stunning state and national parks, plus is well located for exciting day drives in all directions

- Learn more Bacchus Marsh (including surrounding suburbs in the Moorabool shire) in our hotspot focus article here

Capital City Property Price Movements: 4/October/2017

Updated daily, the CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months. The main headline this week was the over the last month Sydney property prices actually dropped (slightly). Meanwhile, Hobart is still outperforming Australia’s major cities below:

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 113.17 | + 0.3% | + 5.1% |

| Brisbane: 109.24 | +0.4% | + 3.5% |

| Melbourne: 155.77 | + 2.0% | + 12.2% |

| Perth: 95.10 | – 1.3% | – 3.0% |

| Sydney: 176.69 | + 0.1% | + 10.4% |

(Source: CoreLogic)

Interest Rates Update: 4/October/2017

Yesterday the Reserve Bank of Australia (RBA) opted to leave the cash rate on hold at 1.50%. Two RBA board meetings are left for the remainder of 2017.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

New Homes of the Week (edition 74)

Below are our top picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! All the homes are affordably priced for aspiring first home buyers. Please note, we can help you compare hundreds of new property options from different a large variety of property developers and agencies – get in contact with us so we can help you with your search to find something ‘you’.

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

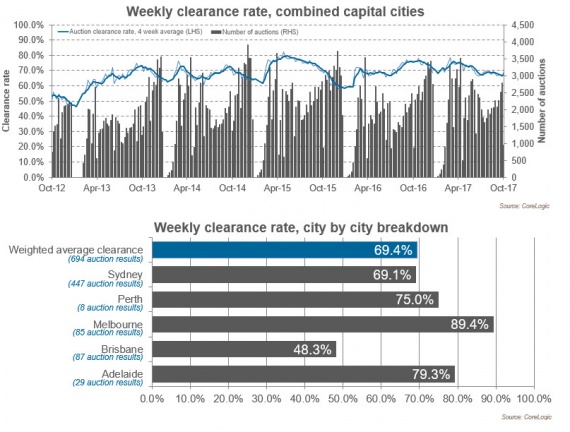

Preliminary Weekend Auction Clearance Rates (30th of September – 1st of October 2017)

(Source: CoreLogic)

Tweet of the Week

One of the major causes of #Australia's housing affordability problems @MichaelSukkarMP @TurnbullMalcolm | #aushousing #housing #realestate https://t.co/ziO4jPfTcm

— FHBA (@fhba_com_au) September 29, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

* T & C’s apply – ask an FHBA Coach for details

Are you planning on entering the property market soon?

Regardless of who you are or what you are looking for, before you commence house hunting you should get a no obligation home loan pre-approval!

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you, so you can determine your approximate borrowing capacity. A loan pre-approval comes with no obligations to proceed with a home loan application, leaving you in control and importantly, attending open homes knowing what your budget is.

Get a no cost loan pre-approval by speaking with an FHBA Lending Adviser from FHBA Mortgages today

FHBA Mortgages – Australia’s leading place for first home buyer finance

Search FHOG eligible homes from your couch

Are you in the market for a newly built property? This could be a house & land package, a townhouse or a newly constructed apartment. Search our ‘new homes’ property portal to see hundreds of Grant (& exclsuive FHBA 50 Rebate) eligible properties suitable for first home buyers!