FHBA Market Update: 25/September/2017

In today’s FHBA Property Market Update we take a look at how FOMO has been replaced by a new fear in the property market; why interest rates may rise sooner than originally thought; off-the-plan financing; the increase to Victorian first home buying activity; our latest favourite properties for first home buyers; the latest property prices around the country; why Logan is so popular with first home buyers and see the first promo video of the Affordable Housing Party – it will have you nodding your head in ‘agreeance’.

It wasn’t all that long ago that we were reporting record high auction clearance rates and record growth in property prices in our weekly FHBA Property Market Update. At that time there was a genuine fear amongst home buyers – FOMO (the fear of missing out).

Experts, including ourselves, were reminding seeking property buyers to be patient and not to worry too much, because property prices don’t always go up. But that had little effect – emotion often dictates our mind over rational thinking.

So have things changed? Real estate agent Peter Gordon of Cobden & Hayson has told realestate.com.au today that “the fear of missing out has gone, now it’s a fear of paying too much (FOPTM)”.

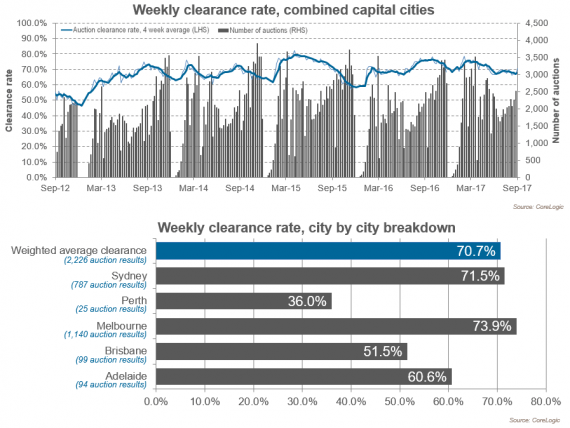

Every weekend there are hundreds of auctions across the weekend that are passing in according to Australia’s largest property data provider, CoreLogic Australia. This means there are hundreds of properties not selling. This is for a variety of reasons, but the primary reason is most likely that vendors are asking for more money than buyers are willing to offer for the properties.

What has changed? Interest rates haven’t moved, the economy hasn’t changed much and employment is steady. But property prices have been moving north in most capital cities for sometime now. And property buyers, it seems, are using some common sense now and saying “just because I have got a loan pre-approval for ‘x’ means I want to spend ‘x’. I might only want to spend a lower amount, ‘y”.

This is good news for first home buyers.

See the rest of Peter Gordon’s comments on realestate.com.au.

Read on for the rest of this week’s bumper Property Market Update.

More First Home Buyer News

- 1,850 first home buyers pay no stamp duty in Victoria – According to the Victorian government, there has been more than 2,100 first home buyers since 1 July 2017 that have claimed a government first home buyer incentive, including 1,850 first timers paying zero stamp duty – see Taj Singh’s thoughts on Domain

- Off-the-plan buying up, but how do you finance these purchases? – All you have to do is take a look around you and you can see that off the plan buying is becoming increasingly common, but how do you plan for buying your first home this way? – get some hot tips and answers in FHBA News

- The Affordable Housing Party launches first promo – New political party, the Affordable Housing Party, who is fighting to make housing affordable again has launched their first promo video. Watch it below:

https://www.facebook.com/AffordableHousingParty/videos/714128328786606/

Current hotspot in focus: Logan (Queensland)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus is the popular region of Logan in South East Queensland:

- Logan is an area growing in popularity with first home buyers thanks to the location, the local lifestyle, the climate and the price of housing

- Residents of Logan can drive to Brisbane, the Gold Coast and Ipswich all within an hour, plus there are public transport options as well

- Learn other reasons why the population of Logan is rising and check out whether it is an area you can afford to buy in here

Logan is home to a range of Grant eligible properties like this one above

Capital City Property Price Movements: 25/September/2017

Updated daily, the CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months. Aspiring first home buyers will be pleased to see that property prices over the last quarter have been relatively flat for most capital cities (except Melbourne).

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 113.24 | + 0.3% | + 5.2% |

| Brisbane: 109.03 | +0.3% | + 3.5% |

| Melbourne: 155.26 | + 1.9% | + 11.9% |

| Perth: 95.13 | – 1.5% | – 2.9% |

| Sydney: 176.76 | + 0.1% | + 10.9% |

(Source: CoreLogic)

Interest Rates Update: 26/September/2017

Three out of four of Australia’s big banks updated their predictions last week to say that they believe the Reserve Bank of Australia (RBA) will raise the official cash rate in 2018 (rather than their previous forecasts of 2019). Could this mean it will be a good idea to get a fixed rate home loan? Speak to a home loan expert to explore your options.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert about your options

3 out of these 4 banks forecast interest rates will rise in 2018

New Homes of the Week (edition 73)

Below are our top picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! All the homes are affordably priced for aspiring first home buyers. Please note, we can help you compare hundreds of new property options from different a large variety of property developers and agencies – get in contact with us so we can help you with your search to find something ‘you’.

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

Preliminary Weekend Auction Clearance Rates (23 – 24 September 2017)

(Source: CoreLogic)

Tweet of the Week

We need real action on this evolving crisis @ScottMorrisonMP @MichaelSukkarMP #FHBA #auspol #SaveGreatAustralianDream #aushousing https://t.co/1xkrLoJJSP

— FHBA (@fhba_com_au) September 20, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

https://www.facebook.com/fhbah/posts/1314109032044964