FHBA Market Update: 03/04/2017

The latest data from CoreLogic (Australia’s leading property data provider) show’s property prices are continuing to rise in most capital cities in 2017. In particular, Sydney & Melbourne are continuing to jump and housing affordability is deteriorating.

According to CoreLogic’s head of research Tim Lawless the main reasons for property prices rising are ” largely lower mortgage rates and a rebound in investment activity”.

For some time now FHBA has been pushing for reform first home buyers. FHBA co-founder Daniel Cohen said recently at a Housing Affordability Summit in Sydney that first home buyers have “never had it harder”. But the urgency of reform is dramatically increasing. “Despite the talk of potential oversupply in some areas, the data shows that property prices are continuing to increase. There are plenty of cashed up investors still around on the hunt for more property and the truth is they are pricing out first home buyers more and more. The government can no longer ignore this problem. They can no longer hold off on this problem. They need to act now. At the very latest they need to act at the upcoming May budget” said Daniel.

In a major interview with NewsCorp Australia last week, fellow FHBA co-founder Taj Singh said for a start, FHBA would like to see the return of the First Home Savers Account, which would help first home buyers save a deposit. “We believe it can incorporate superannuation-like features and have some tax benefits there for first home buyers so they are incentivised to put money into the account and they are incentivised to save more money for their first home”.

Your weekly FHBA Market Update includes more on the rising property prices and FHBA’s call for more help for first home buyers.

News affecting first home buyers

What should be done to address housing affordability? This has been a major talking point in mainstream news.

- More properties for first home buyers – experts are calling on more properties to be built with the consideration of first home buyers and future generation needs in mind. While properties in metro areas are getting smaller there is no reason why they can’t be made to be more ‘liveable’ – learn more in FHBA News

- Should the First Home Savers Account return? – in a major interview with NewsCorp FHBA co-founder Taj Singh has continued FHBA’s call for the return of the First Home Savers Account to help aspiring first home buyers save a deposit – see Taj’s full interview on news.com.au

- FHBA to discuss housing affordability with the Government – FHBA co-founder Daniel Cohen will meet with Federal MP John Alexander next week to discuss housing affordability and what measures FHBA believe should be considered by the federal government. We will report to you the outcome of these talks over the coming weeks (& months).

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 03/April/2017):

- Adelaide – 477.31 (Qtr + 1.2% / Yr + 2.2%)

- Brisbane – 554.17 (Qtr + 1.0% / Yr + 5.7%)

- Melbourne – 901.57 (Qtr + 4.5% / Yr + 16.9%)

- Perth – 570.32 (Qtr – 2.1% / Yr – 5%)

- Sydney – 1112.23 (Qtr + 5.5% / Yr + 19.6%)

(Source: CoreLogic)

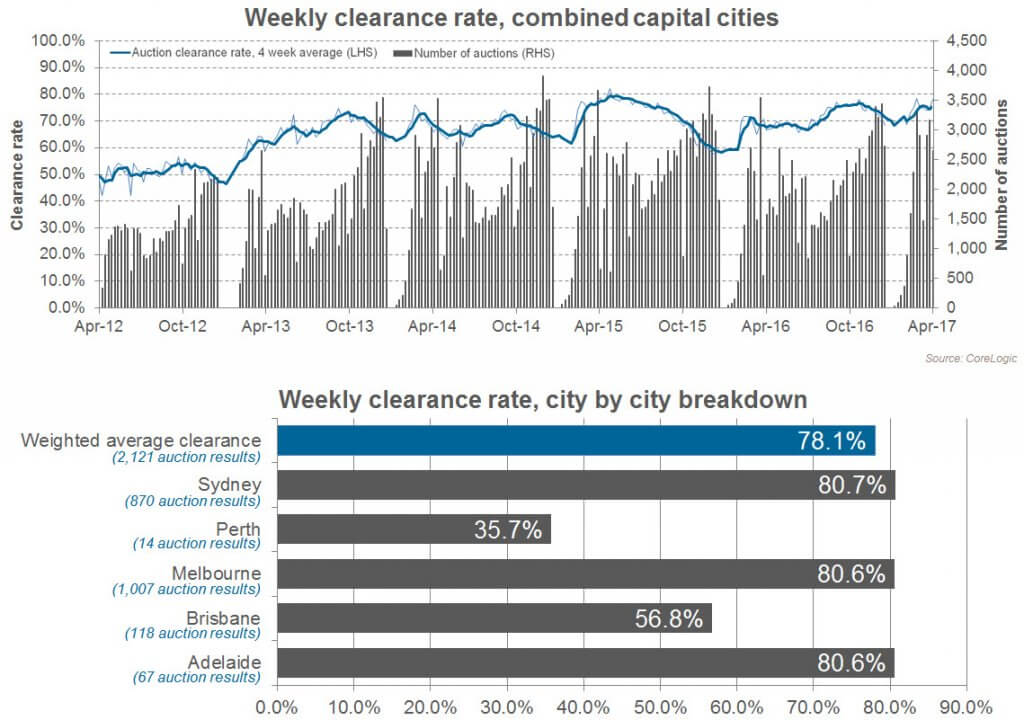

Preliminary Weekend Auction Clearance Rates (1st – 2nd of April, 2017)

Source: CoreLogic

Interest Rates Update – 03/04/2017

Tomorrow the RBA Board will meet to review the official cash rate stance. Currently, the cash rate sits at a record low 1.50%. Since the last meeting a month ago, several banks, including the big 4 banks, have increased interest rates on some of their home loan products despite no recent movements from the RBA. Stay tuned to FHBA News for a summary of the RBA’s announcement.

- Compare a range of savings account rates

- Compare a range of home loan rates

- Speak to a home loan expert

New Homes of the Week (ed. 48)

With housing affordability continuing to be a major talking point we decided to dedicate this week’s edition of FHBA New Homes of the Week to first home buyer properties priced under $400,000! The 5 homes that have been picked for this week’s edition are brand new and priced under the First Home Owners Grant (FHOG) threshold.

See this week’s best first home buyer homes

Tweet of the Week

This is how you allow first-timers to salary sacrifice into their #first home @MichaelSukkarMP @ScottMorrisonMP https://t.co/VsHsC6xMXf pic.twitter.com/S1XCO7KxRt

— FHBA (@fhba_com_au) March 31, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia