FHBA Weekend Preview: 1 – 2 April 2017

One of our favourite stories we read this week at FHBA HQ was regarding a call for property developers to build more appropriate properties for first home buyers and future generations. We couldn’t agree more!

Young people mostly accept that their first home won’t be a 5 bedroom house with a big backyard. But they also don’t want the same-old same-old 1 bedroom box under 50 sqm (obviously talking CBD’s here). We need to see more variety in housing options and even the units themselves could vary much more in terms of living space.

With housing affordability continuing to be a hotly debated issue (we don’t see this ending any time soon) we decided to dedicate this week’s edition of FHBA New Homes of the Week to first home buyer properties priced under $400,000! You can see the 5 homes we’ve picked further down in the FHBA Weekend Preview.

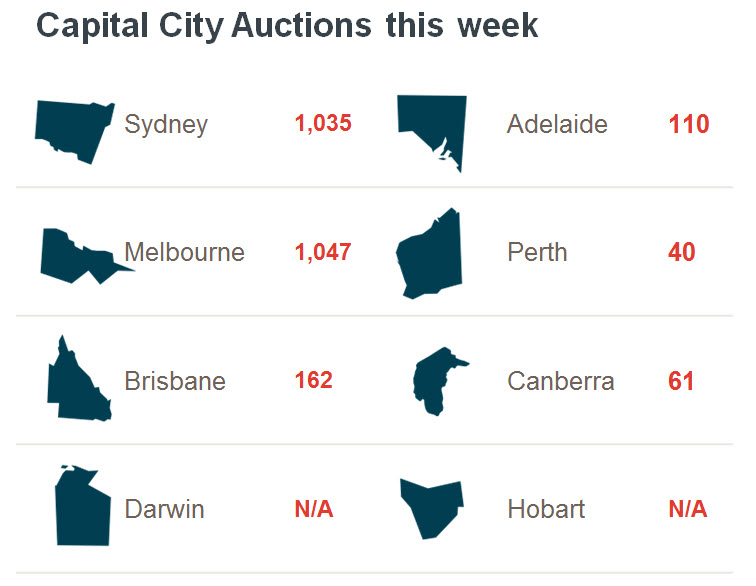

For those who are going out to auctions this weekend, there are 2,470 auctions scheduled for this weekend according to CoreLogic.

Want to know more about this weekend’s auction activity? Visit the CoreLogic blog.

Good luck to all first home buyers this weekend!

First home buyer homes of the week: ed. 48

With housing affordability being a hot topic at the moment (rightly so) we decided to dedicate this week’s edition of FHBA New Homes of the Week (edition 48) to first home buyer homes priced $400,000 or lower! Not only are they priced under $4000,000, they are all brand new and priced under each State’s threshold for the First Home Owners Grant (FHOG). Interested in any of the homes you see? Simply complete an enquiry form this weekend and one of our friendly FHBA Coach’s will be in touch to answer your queries.

- Take a closer look! FHBA New Homes of the Week – Edition 48

- To search through more first home buyer homes visit FHBA New Homes

Friday News Review

These are the top stories that affected first home buyers across Australia this week:

https://www.facebook.com/fhbah/posts/1150128108443058

House hunting with confidence

Planning on going house hunting now but don’t know whether a bank will lend you enough funds to buy your first home yet? You should get a no obligation loan pre-approval.

A loan pre-approval provides you with a written guidance of how much a particular bank is willing to lend to you. Loan pre-approvals come with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak to an FHBA Broker from FHBA Mortgages today

Never miss an FHBA Market Update or FHBA Weekend Preview

Enjoy reading our free-Market Updates and Weekend Previews? You’re not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!

Join FHBA VIP Club for FREE in under 60 seconds