The start of 2018 has coincided with Australian lenders dropping their variable and fixed rates even further than what they ended 2017 with. In 2017, we saw non-major lenders drop their interest rates to gain a competitive advantage, however, so far in 2018 we have seen the major (big 4) banks close the gap on the smaller lenders by offering some higher discounts to owner-occupiers.

As most of you already know, the first and most important step of your first home buying journey is the ‘first home loan pre-approval‘. At FHBA, our team of expert FHBA Coaches, who are also fully qualified Lending Advisers (Mortgage Brokers), always suggest our clients get a home loan pre-approval before taking on the more exciting step of searching and inspecting your first home.

For first home buyers who are looking to purchase their first home in the 1st quarter of the 2018 calendar year, this is a must read edition of our home loan specials. We have handpicked some of the new year home loan offers that are currently available through our exclusive first home buyer home loan service – FHBA Mortgages. Regardless of what your financial position, FHBA is well equipped to provide qualified credit advice to all first home buyers. And if you aren’t quite ready yet, we will give you guidance and advice on what you need to do in order to be ready.

1. Big 4 banks further decrease their variable + fixed² interest rates

At FHBA Mortgages we are all about providing choice to our first home buyer clients. There are several first home buyers who prefer to choose a big 4 bank for their first home loan due to factors such as reputation, access to branches and a superior suite of products. Some of the products/rates include:

- Introductory variable rate of 3.59% for 2 years (Comparison rate 4.42%)

- Package variable rates from 3.79% (Comparison rate 3.91%)

- 2 year fixed rate from 3.69% (Comparison rate 4.86%)

- 3 year fixed rate from 3.89% (Comparison rate 4.82%)

It is a good idea to not waste your time negotiating with all the banks, let someone do it for you, at no charge to you! An FHBA Coach can negotiate with all big 4 banks, ensuring you get the most appropriate product for your needs.

Furthermore, if you are looking to get your first home loan directly with your current bank, we may be able to get you a home loan with better rates & features than if you went directly to the bank. Click below to learn how!

2. Special variable and fixed rates exclusively available for first home buyers

One of Australia’s top 6 lenders are offering a special product enabling borrowers to avoid fees associated with the loan, the features include:

- First home buyers only!

- Low variable rate of 3.79% (comparison rate 3.80%) – Further discounts available subject to loan amount and deposit

- Ability to fix all or a portion of your loan at a 5 year fixed rate of 3.99%

- Annual package fee ($375) waived for the life of the loan, resulting in savings of $11,250

- Minimum borrowing amount is $150,000

- Maximum borrowing is 95% of property purchase price

- Can be used for the construction of your first home

- 100% offset account is included in the package (ask your FHBA Coach for more info)

Click below to see if you qualify for this special product.

3. Non-credit scoring³ loans up to 95% of property purchase price

One lender on the FHBA Mortgages panel is helping aspiring first home buyers who may not have a great credit history or credit score.

Through this lender, we have helped many borrowers who have experienced a wide variety of small to large credit impairments including:

- Currently or previously in arrears

- Missed or unpaid bills

- Credit file with ‘too many’ credit checks

- Registered Credit defaults

- Discharged Bankruptcy

- Part 9 or 10 Debt Agreement.

The lender takes a far more conservative approach and gives aspiring first home buyers a second chance. When they assess your application for a home loan, they will ask us about it. They’re more interested in your circumstances. What happened? Why did it happen? And how likely is it to happen again? What’s more, they take into account the current financial situation, not just your past defaults.

4. Low 2 year fixed rate² offer for University Graduates, Education professionals & Emergency services personnel

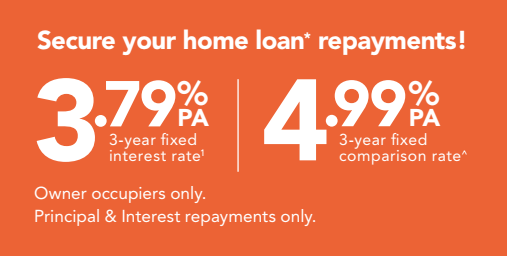

One of our most popular lenders amongst first home buyers with three brands is offering first home buyers a certainty in repayments. These products are particularly good for first home buyers with low deposits. The fixed rate offers include:

- 3 year fixed rate of 3.79% (comparison rate 4.99%)

- 2 year fixed rate of 3.69% (comparison rate 5.10%)

- 1 year fixed rate of 3.79% (comparison rate 4.99%)

Key features include:

- Minimum deposit required is 5%

- Non-genuine savings are acceptable

- Satisfactory rental ledger for the last 6 months can be used in lieu of genuine savings (ask us about this!)

- 100% offset account available on fixed rate loan splits

- LMI capitalisation¹ available above 95% of the property value

- Family members of University students/graduates or teachers are eligible for this product too!

Are you looking to fix your interest rate for a period of 1, 2 or 3 years? Then click below to book your complimentary consultation with an FHBA Coach.

5. Parental Assistance Loans – No gift required

Get your home sooner when a family member guarantees part of your home loan. One family pledge product that FHBA Mortgages has access to, allows parents to provide their property as security to their child without it impacting their capacity to borrow more money for another property. Some of the key features include:

- The guarantor can use their home’s equity to guarantee part of their child’s loan

- There’s no cash to pay and you choose the amount – a partial family pledge

- Request to release guarantee when the loan to property value falls below 80%

- Helps you reduce or avoid Lender’s Mortgage Insurance, saving you money when you need it most

- Variable rates start from 3.68% (Comparison rate 3.69%)

Click below to find out more about this product:

Glossary of Terms:

¹LMI Capitalisation – Whereby the Lenders Mortgage Insurance premium is not paid upfront by the borrower but instead added onto the total loan balance and therefore paid over the term of the loan by the borrower

² Fixed Rate – A fixed interest rate loan is a loan where the interest rate doesn’t change during the fixed rate period of the loan giving you certainty in your repayments

³ Credit Scoring – Your credit score is a number based on an analysis of your credit file, at a particular point in time, that helps a lender determine your creditworthiness, i.e. your ability to get a home loan in the future.

Every aspiring first home buyer’s situation is different; therefore it is important to get some expert advice on which product is suited to your needs. Are you looking to compare these different home loan products? Perhaps you just want to know your borrowing capacity or get a better understanding of how your first home loan works? Click here to speak with an FHBA Mortgage Broker.

Disclaimer: The information on our website including this page is general in nature and should be solely relied upon. The advertised rates above were true and correct at the time of the publication. The rates do not take into account other fees and charges which you should also consider. The credit license responsible for the mortgage service offered to clients is Mortgage Australia Group Pty Ltd, Australian Credit License (ACL) number 377294, Australian Business Number (ABN) 99 091 941 749. Mortgage Australia Group Pty Ltd is a member of the Mortgage & Finance Association of Australia (MFAA). FHBA Pty Ltd is an authorised credit representative of Mortgage Australia Group Pty Ltd. You should seek professional advice when obtaining finance and purchasing your first property. Written By, First Home Buyers Australia

Get a great finance deal to assist you with your first home purchase