The end of the financial year (i.e. 30 June/EOFY) is now only a matter of days away. Many aspiring first home buyers will see EOFY special offers with cars, electronic items & furniture goods. The good news is that the EOFY specials aren’t just limited to these items, many Australian lenders are now offering some competitive home loan deals, some exclusively available to first home buyers!

As most aspiring first home buyers already know, the first and most important step of your first home buying journey is the ‘home loan pre-approval‘. At FHBA, our team of expert FHBA Coaches, who are also fully qualified Lending Advisers (Mortgage Brokers), always suggest our clients get a home loan pre-approval before taking on the more exciting step of searching, inspecting & bidding for your first home.

For first home buyers who are looking to purchase their first home in the busy Autumn season, this is a must-read edition of our home loan specials. We have handpicked some of the latest first home loan offers that are currently available through our exclusive first home buyer home loan service – FHBA Mortgages, below:

1. New variable rate 3.39% (Comparison rate 3.45%)

One of the lowest rates on offer from one of Australia’s niche lenders. By selecting this product, you can achieve :

- 100% Home Loan Offset account

- No ongoing fees

- No credit scoring

- 20% minimum deposit requirement

This product is not available directly to first home buyers, only through mortgage brokers!

2. Get a super low rate if you have an 8-10% deposit

If you have at 5% saved in the form of a deposit and are looking to take advantage of your state’s First Home Owners Grant (FHOG) then this may be a product you can consider, provided the total deposit. Here is an example:

- An exclusive 3 Year Fixed Rate² offer from 3.79% with:

- $0 Establishment Fee

- $0 Monthly Account Fees

- An exclusive 5 Year Introductory Variable Rate offer from 3.79% with:

- $0 Establishment Fee

- $0 Monthly Account Fees

- A 2 Year Introductory Variable Rate offer from 3.59% with:

- $0 Establishment Fee

- $0 Monthly Account Fees

An FHBA Coach can negotiate with all big 4 banks, ensuring you get the most appropriate product for your needs.

Furthermore, if you are looking to get your first home loan directly with your current bank, we may be able to get you a home loan with better rates & features than if you went straight to the branch- after all, we are the home loan specialists

3. Short term ‘casually’ or ‘permanently’ employed applicants (3 or 6 months)

Have you only been in your casual job for a period of 3 – 6 months and have been knocked by most lenders?

We can help you! We have several lenders who are willing to lend up to 95% of the property value if you are concerned about not being able to get a loan due to the short-term nature of your job duration. You will still be eligible for the standard rates offered by lenders, starting from 3.59%!

Have you only started your part-time or full-time permanent job?

We can also help you, as we have access to lenders who only require one payslip if you are employed on a permanent basis, with or without a probation period – you can also borrow up to 95% of the property value.

Simply click below to speak to a first home buyer broker to learn more about how we can help you:

4. Increase your borrowing capacity with a 40-year loan term

One of our most popular & specialist lenders amongst first home buyers understands the battles that first home buyers face with the housing affordability crisis. Therefore, they are offering 40-year loan terms, rather than the standard 30 year terms provided by mainstream lenders. This effectively allows you to maximise your borrowing capacity more than what any other lender can offer you. The low fixed rate offers include:

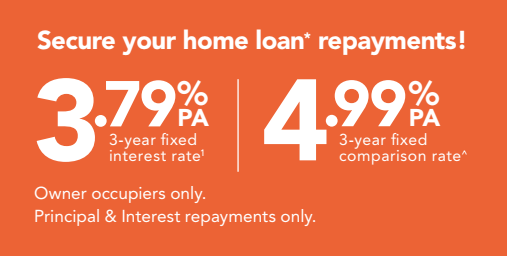

- 3 year fixed rate of 3.79% (comparison rate 4.99%)

- 2 year fixed rate of 3.69% (comparison rate 5.10%)

- 1 year fixed rate of 3.79% (comparison rate 4.99%)

Key features of this lender include:

- Minimum deposit required is 5%

- Non-genuine savings³ are acceptable

- Lower your repayments with a 40-year loan term

- Satisfactory rental ledger for the last 6 months can be used in lieu of genuine savings (ask us about this!)

- 100% offset account available on fixed rate loan splits

- LMI capitalisation¹ available above 95% of the property value

- Family members of University students/graduates or teachers are eligible for this product too!

Are you looking to fix your interest rate for a period of 1, 2 or 3 years? Then click below to book your complimentary consultation with an FHBA Coach.

Glossary of Terms:

¹LMI Capitalisation – Whereby the Lenders Mortgage Insurance premium is not paid upfront by the borrower but instead added onto the total loan balance and therefore paid over the term of the loan by the borrower

² Fixed Rate – A fixed interest rate loan is a loan where the interest rate doesn’t change during the fixed rate period of the loan giving you certainty in your repayments

³ Non-Genuine Savings – These are sums of money that may have been gifted to you or received as a lump sum from a transaction, but have not been genuinely saved over time, e.g. Gifts, tax refunds, inheritances etc…

Every aspiring first home buyer’s situation is different; therefore it is important to get some expert advice on which product is suited to your needs. Are you looking to compare these different home loan products? Perhaps you just want to know your borrowing capacity or get a better understanding of how your first home loan works? Click here to speak with an FHBA Mortgage Broker.

Disclaimer: The information on our website including this page is general in nature and should be solely relied upon. The advertised rates above were true and correct at the time of the publication. The rates do not take into account other fees and charges which you should also consider. The comparison rates are true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. The credit license responsible for the mortgage service offered to clients is Mortgage Australia Group Pty Ltd, Australian Credit License (ACL) number 377294, Australian Business Number (ABN) 99 091 941 749. Mortgage Australia Group Pty Ltd is a member of the Mortgage & Finance Association of Australia (MFAA). FHBA Pty Ltd is an authorised credit representative of Mortgage Australia Group Pty Ltd. You should seek professional advice when obtaining finance and purchasing your first property.

Written By,

First Home Buyers Australia

Get a great finance deal to assist you with your first home purchase