FHBA Property Market Update 27/11/17

At the 2016 Australian federal election, the Australian Labor Party promised that if they won power they would abolish negative gearing on established properties. While they marginally lost, the Labor Party still has this policy in place. With the Coalition Government looking shaky, SQM Research recently took a look at the question: what would happen if Labor won power and ended negative gearing on established housing?

During last year’s election there was plenty of analysts looking at Labor’s proposed negative gearing reform. There was also plenty of others weighing in on the debate too: banks, politicians, developers, the real estate industry (and us too). The views, not surprisingly, varied greatly.

Now that all that ‘election noise’ is over, one of Australia’s leading property research houses, SQM Research, has decided to take a closer look at Labor’s controversial policy to abolish negative gearing for investments in established (existing) housing.

On this topic, SQM Research has released a full ‘Market Viewpoint Report’. In summary, SQM Research concluded:

- Rent prices would likely remain stable;

- Property prices would overall fall slightly over a 1 – 4 year period (the amount of the fall would depend on a variety of factors such as if the Reserve Bank acted in a way to offset the impact by reducing the cash rate);

- The quantity of property listings would most likely fall

So would Labor’s policy benefit aspiring first home buyers of the present and future? If you agree with the SQM Research views, it would help future first home buyers. For example, deposit sizes required to enter the property market would fall while renting costs shouldn’t be impacted.

But one key problem with Labor’s policy is that investors would still be allowed to negative gear through new property investments. The properties that first home buyers are also encouraged to buy through the First Home Owners Grant (FHOG). We therefore agree with SQM Research that Labor should revise this policy. Negative gearing certainly needs looking at (and reducing). But this might not be the best way to alter the outdated negative gearing system.

What should be done to fix housing affordability?

Enjoy the rest of your weekly FHBA Property Market Update.

New Homes of the Week (edition 82)

Introducing our top five picks for First Home Owner Grant* (FHOG) (& FHBA 50 Rebate) eligible properties for this week. All of this week’s best properties are ‘off-the-plan’, meaning they are waiting for you to make your very own.

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | ‘on enquiry’ | See property |

| Queensland | $20,000 | $9,750 | See property |

| South Australia | $15,000 | $5,950 | See property |

| Victoria | $20,000 | $8,000 | See property |

| Western Australia | $10,000 | Fr $5,300 | See property |

Did you know??

Our FHBA New Homes service can help you compare thousands of new home options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Not to mention, we are the only ones to offer the FHBA 50 Rebate on top of the First Home Owners Grant*! Don’t be shy, say g’day to us so we can help you with your search to find your unique slice of the great Australian dream today! G’day!

*FHOG & FHBA 50 Rebate amounts are estimates only. The FHOG is only available on properties priced under the relevant state threshold. Other eligibility rules apply. The Speak to an FHBA Coach for details.

Interest Rates Update: 27/November/2017

Lenders are continuing to use different tactics to lure in customers. While the ultimate winner should be the borrowers, it can make comparing and choosing your first home loan even more tricky. While online comparison sites are a decent place to start looking, you certainly shouldn’t commit to any loan provider until you have spoken with a professional Mortgage Broker.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak to a first home buyer Mortgage Broker

New hotspot in focus: ‘The Garden City’

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Introducing our new ‘hotspot in focus’, the beautiful Toowoomba (nicknamed the ‘Garden City’) of the sunshine state (Queensland):

- Where is Toowoomba? Toowoomba is located approximately 125km west from Brisbane CBD and is 90km from Ipswich

- What is the median property price of Toowoomba? Houses – $350,000. Apartments – $308,000

- What is the current population of Toowoomba? Approximately 161,000

- Why is Toowoomba considered a hotspot for first home buyers? Click here to learn more about Toowoomba and it’s popularity

Could you see yourself living in your very own beautiful home in the Garden City?

Not interested in Toowoomba? See previous ‘hotspots in focus’ here

Capital City Property Price Movements: 27/November/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Over the last 3 months, Brisbane has been the second strongest performing property market out of the top 5 capital cities by population. Elsewhere, Perth is starting to improve, while Sydney has seen property values fall further.

| Capital City Index Score | 3 months % Change | Yearly % Change |

|---|---|---|

| Adelaide: 113.15 | + 0.0% | + 3.4% |

| Brisbane: 109.35 | + 0.4% | + 2.7% |

| Melbourne: 157.11 | + 1.9% | + 10.0% |

| Perth: 95.44 | + 0.2% | – 2.7% |

| Sydney: 174.64 | – 1.2% | + 5.2% |

(Source: CoreLogic)

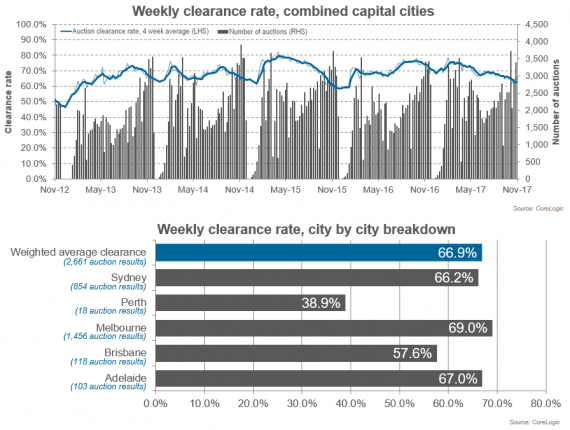

Preliminary Weekend Auction Clearance Rates (25th – 26th of November)

(There was more than 3,400 auctions on the weekend. Source: CoreLogic)

More First Home Buyer News

- First home buyers are disadvantaged when it comes to getting a home loan – Unfortunately, there are just so many hoops for first home buyers to jump through when it comes to getting a home loan, and even if you can jump those hoops, you may still get a worse loan offer than another property buyer – read the thoughts and tips of FHBA Co-Founder Taj Singh on Domain

- First home buyer opportunities in Sydney – If you take a break from looking at median property prices so much and look outside of inner city suburbs, you might be surprised what you will find – see examples and Taj Singh’s thoughts on Domain

- Help – I don’t think I can afford repayments on a loan for a house I am building while also paying rent! – Many first home buyers decide to build their first home due to the First Home Owners Grant, as well as the opportunity to make a home that is truly ‘their own’, but this means you need to plan for construction costs while also renting somewhere else why you wait for your home build to be completed – learn how to organise this in FHBA News

Written By,

First Home Buyers Australia

Wan to buy your first home soon? Organise a FREE FHBA Discovery Session with an FHBA Coach today