At FHBA we are passionate about helping to aspire first home buyers buy their slice of the great Australia dream. One of the most frequent questions we get asked is whether or not an aspiring first home buyer has saved enough to buy their first home.

Earlier this year, we launched an innovative, yet simple tool (the FHBA Eligibility Estimator) designed to assist aspiring first home buyers self-estimate how much they need for their first home in a particular suburb of choice. We are excited to announce that we have made further enhancements to the Eligibility Estimator, ensuring it takes into consideration a range of new possibilities. The Eligibility Estimator remains free to use!

WHAT ARE THE ENHANCEMENTS?

Capitalising LMI

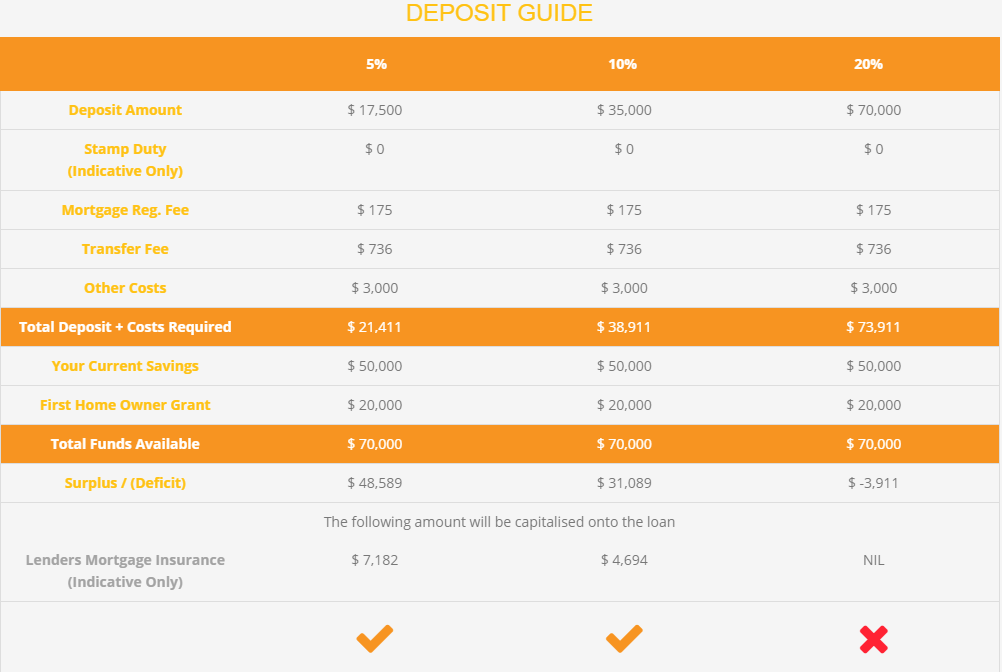

Our estimator now allows you to choose whether you prefer to pay the Lenders Mortgage Insurance (LMI) up front (as part of your deposit) or if you wish to capitalise (add) it to your loan balance. LMI is usually applicable if you have a deposit of less than 20%. This addition assists those that may be looking to get into the market sooner and bear the cost of the LMI over the life of the loan, and it also helps first home buyers that want to avoid the cost of LMI – which covers the lender, not the borrower. We also give you an approximation on how much LMI will be capitalised onto your loan!

Grants are now included in deposit calculation

More recently, a handful of lenders on the FHBA Mortgages panel are now allowing the state-based First Home Owner Grants (FHOG) to be used as part of a first home buyer’s deposit funds, especially if a good rental history is shown in the 6 months leading up to the new home purchase. The Eligibility Estimator now incorporates the FHOG (available for new homes only) in the ‘total funds available’ figure, which means you can potentially include that as part of your deposit!

To view more information on using the FHOG solely or partially for your deposit, please click here.

WHAT OTHER UPDATES HAVE BEEN MADE TO THE ELIGIBILITY ESTIMATOR?

We have incorporated these recent state government changes in the Eligibility Estimator.

Stamp Duty changes

NSW – No stamp duty for established and new homes up to the value of $650,000 & discounted stamp duty rates for homes valued between $650,000 to $800,000.

VIC – No stamp duty for established and new homes up to the value of $600,000 & discounted stamp duty rates for homes valued between $600,000 to $750,000.

FHOG changes

QLD – Remains at $20,000 (until 31 Dec 2017) for builders or purchasers of new homes up to $750,000.

VIC – First home owner grant doubled for Victoria’s regional first home buyers to $20,000 for new homes only, up to $750,000

WA – Reduced to $10,000 from 01 July 2017 for purchases up to $750,000 or $1,000,000 depending on which part of WA you are purchasing your first home.

WHAT ELSE IS AVAILABLE?

- Complimentary & comprehensive Suburb Profile Reports for the suburb of your choice (provided by APM Pricefinder) emailed straight to your inbox upon completion of each suburb entry

- Get the minimum funds required to purchase at 5%, 10% and 20% emailed straight to your inbox, allowing you to refer to it in the future

- The optional opportunity to book a free Discovery Session with an FHBA Coach regardless of whether you are ready or still saving for your first home

- Please note the Eligibility Estimator doesn’t incorporate the FHBA 50 Rebate* (as the size of this rebate varies from property to property), but this can be considered a nice bonus once you settle on your first home!

To get started all your need to select is your preferred suburb/postcode, current savings balance and email so we can instantly email you your results (and suburb profile reports) for free. Click here to get started!

Disclaimer: Eligibility conditions apply to the FHBA 50 Rebate. Is not available on all properties. The FHBA Eligibility Estimator is intended as an approximate guide only and does not incorporate all costs nor all your circumstances. It uses a mixture of the data you input, median property prices from APM PriceFinder and estimated purchasing costs. You should not rely solely on the results of the Eligibility Estimator. Please contact an FHBA Coach (who is a licensed credit adviser) for a more comprehensive estimate based on your personal circumstances.’

Written By,

First Home Buyers Australia