FHBA Market Update: 10 July 2017

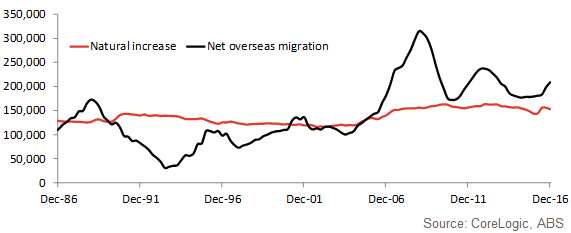

Australia’s population continues to rise according to the latest demographic data from the Australian Bureau of Statistics (ABS). Australia’s population increase is due to two key factors: natural increase (as we are living longer) and net overseas migration increasing (that is more people are arriving in Australia than leaving Australia). This is shown in the graph below.

Components of national annual population growth – source: CoreLogic

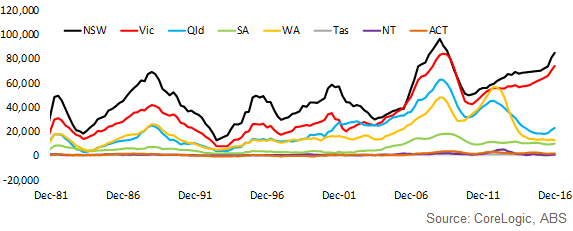

As our population rises more people need housing to live in, whether it’s a property people own or rent. Now this is where the issue lies for first home buyers, in particular for those of Melbourne and Sydney. The next graph show’s where that growing net overseas migration (highlighted above) is going.

Annual net overseas migration across the states & territories – source: CoreLogic

Overseas immigration is largely coming to NSW and Victoria. Is it any wonder why property prices have soared in the capital cities of Melbourne and Sydney? Additionally, inter-state migration (where Australians are moving) figures show a lot of Aussies moving to Victoria, while Sydney has had an ongoing undersupply issue. This has put further upwards pressure on property prices in Melbourne and Sydney.

Owning your first home in Melbourne and Sydney has never been harder. The new government incentives (such as stamp duty relief) in NSW and Victoria does help, but, local first home buyers are continuing to compete with overseas migration as well as investors (with both local and foreign investor activity currently around all time highs).

An alternative strategy for entering the property market that has gained some momentum in recent times, in particular with young Melbourne & Sydney citizens, is ‘rentvesting’. Rentvesting (or rentvest) involves buying a property in a more affordable area that is within your budget and has good investment return prospects while continuing to rent (or live with your parents) in an area you need too. Rentvesting does come with risks and certainly is not for everyone (make sure you seek advice first), but with housing affordability woes continuing, it is of little surprise that local first home buyers continue to search for alternative ways to enter the property.

There is a lot to consider when buying your first home – not just emotional factors like a backyard for the BBQ and a spare room for a study or media room. You are not expected to know everything to consider – it is your first time after all. That’s why we are here to help. Get in touch with an FHBA Coach today and learn how we can help you buy your first home.

FHBA can help you consider a range of factors when buying your first home

First Home Buyer News

- Do government benefits favour owner occupiers over rentvestors? – While rentvesting activity has increased, new government incentives favour owner-occupiers – so how do you decide what’s best for you? – learn more in FHBA News

- Can I use the First Home Owners Grant to form my deposit? – This is one of our most frequently asked questions – now we take a closer look at the answer so you can consider your options – see the answer in FHBA News

- First Home Super Saver Scheme isn’t law (so far) – In the May budget the government announced a proposal of a scheme that would allow first home buyers to save for their deposit in their existing superannuation fund – but so far, this proposal has not been passed as law by the Australian Parliament – find out why in FHBA News

Current hotspot in focus: Ipswich

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus in Ipswich, Queensland!

- Ipswich is located 44km south west of Brisbane

- The city is renowned for its architectural, natural and cultural heritage with over 6,000 heritage listed sites and 500 parks for residents to enjoy

- With a variety of affordable housing options, transport & good roads to Brisbane, plus infrastructure spending on the rise in the area, it is not hard to see why Ipswich is popular with first home buyers

Learn more about Ipswich including current opportunities to enter the Ipswich property market

Current first home buyer hotspot: Ipswich

Capital City Property Price Movements – as at 10/July/2017

Updated daily, The CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months:

- Adelaide: 479.51 (Qtr – 0.2% / Yr + 1.9%)

- Brisbane: 559.67 (Qtr + 1.0% / Yr + 3.7%)

- Melbourne: 930.87 (Qtr + 2.9% / Yr + 15.6%)

- Perth: 570.34 (Qtr + 0.6% / Yr – 2.3%)

- Sydney: 1130.23 (Qtr + 1.2% / Yr + 13.2%)

(Source: CoreLogic)

Interest Rates Update: 10/July/2017

Last Tuesday the Reserve Bank of Australia (RBA) opted to leave the official cash rate on hold. Monitoring our leading banks, FHBA Mortgages has noticed that banks continue to favour owner-occupier loans over investor loans.

- Compare a range of high interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

- Why the RBA left the cash rate on hold

New Homes of the Week (edition 62)

These are our top picks for First Home Owner Grant (FHOG) eligible properties this week! All the homes are affordably priced for aspiring first home buyers:

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

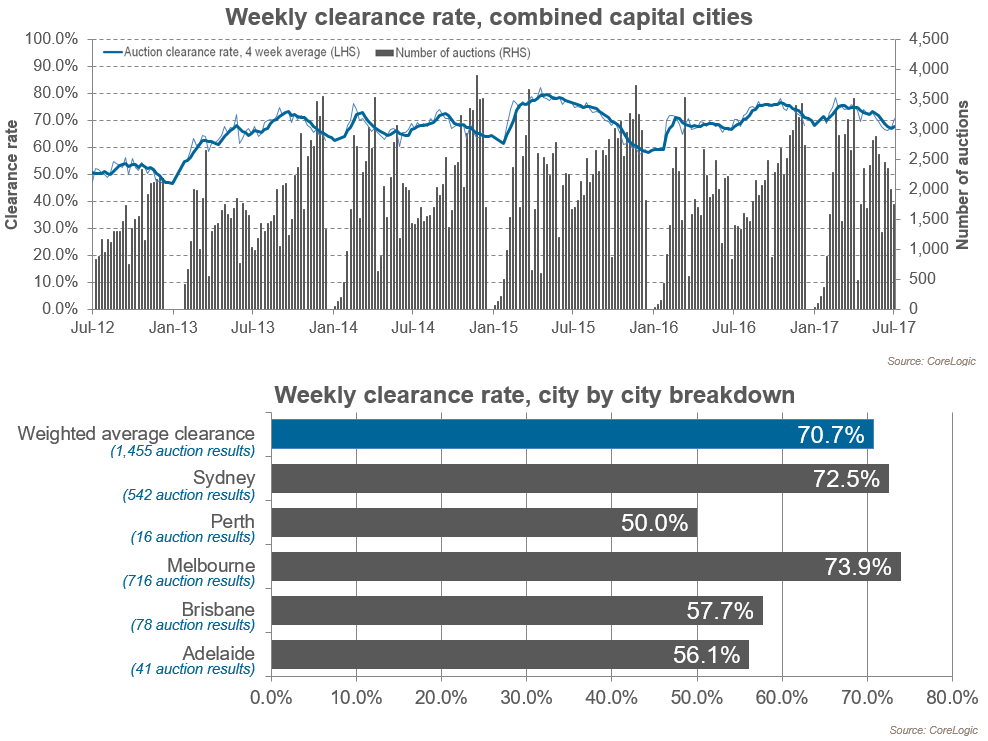

Preliminary Weekend Auction Clearance Rates (8 – 9 July 2017)

(Source: CoreLogic)

Tweet of the Week

With the better first home buyer govt. incentives around, will rentvesting activity fall? https://t.co/r11lo9n5QO #ausproperty #rentvest

— FHBA (@fhba_com_au) July 7, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia