FHBA Market Update: 22/May/2017

Is it just us or was the federal budget a big let down on housing affordability?

Based on what we have seen, on social media, while the budget should help first home buyers ‘a little bit’, most people thought it was underwhelming.

Over the last two years we have been lobbying the government for a more level playing field where first home buyers can compete with both local and foreign investor. But at the end of the day we must admit to ourselves, that existing home owners (both owner occupiers & investors) make up the vast majority of registered voters and therefore, despite some touches around the edges, the Coalition government has continued (and will likely continue) to foster a property market that supports existing home owners and investors.

This unfortunately means that the old dominate players will most likely continue to do exactly that – dominate. This includes property developers, banks, investors and real estate agents.

So what can be done to make a significant difference to first home buyers and their personal circumstances if the First Home Super Saver Scheme (and it’s $30k cap) isn’t going to be enough help?

At FHBA – we, like you, are feed up of the old way’s continuing to dominate. And we want to do something about it (other than our ongoing lobbying efforts, which we will continue to do in addition of course).

Our co-founders Daniel Cohen and Taj Singh have noticed a particular issue with the old way things are done in the property industry and have spotted an opportunity to make a significant difference to first home buyers. And the whole team at FHBA is most excited to share this with you. This Thursday we will be launching a brand new initiative, Australia wide, designed to financially help struggling first home buyers enter the property market, whether it be the expensive Sydney property market, or regional areas such as far north Queensland.

We can’t say too much more at this stage but if you want to be the first to know about this new financial help for first home buyers.

Enjoy reading the rest of our weekly FHBA Market Update.

First home buyer news

- WA First Home Owners Grant to fall by $5,000 – the new WA state Labor government has decided to reduce the WA FHOG 6 months earlier than originally scheduled – learn more about the announcement in The West Australian

- First home buyer activity rises in Sydney – for as long as anyone can remember, investors have been dominating the Sydney property market, however real estate agents across Sydney are now reporting that investor activity is falling off …….and it’s being replaced by a rise in first home buyer activity – learn more on news.com.au

- Housing affordability not an Australian wide problem – there is no shortage of news every single day about housing affordability it seems – but it isn’t an issue everywhere reports realestate.com.au

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 22/May/2017):

- Adelaide: 482.76 (Qtr + 1.4% / Yr + 1.6%)

- Brisbane: 560.18 (Qtr + 1.8% / Yr + 4.1%)

- Melbourne: 889.81 (Qtr + 1.9% / Yr + 11.7%)

- Perth: 563.01 (Qtr – 1.0% / Yr – 4.3%)

- Sydney: 1094.80 (Qtr + 0.7% / Yr + 11.0%)

(Source: CoreLogic)

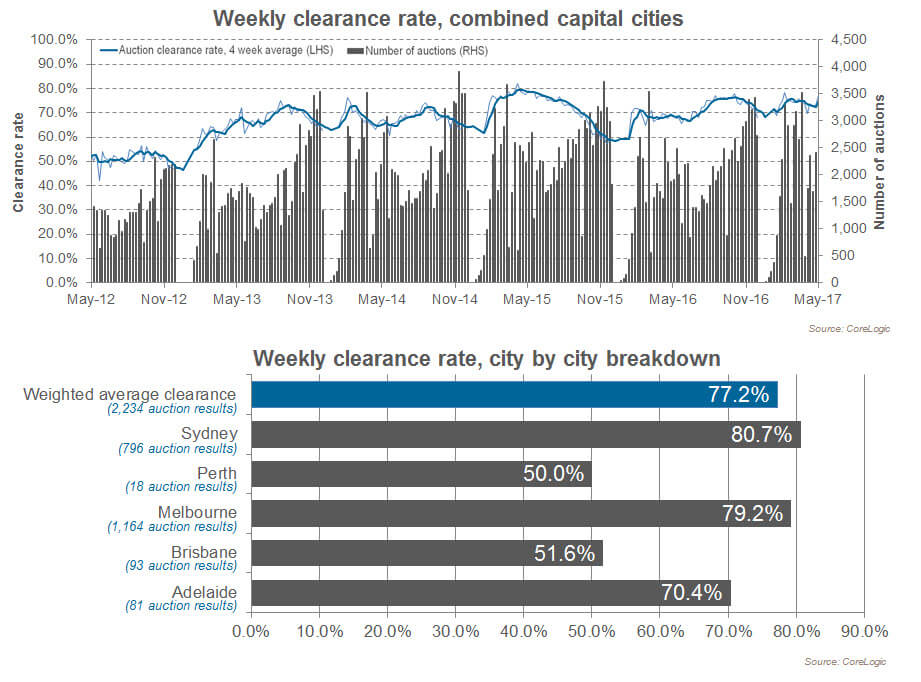

Preliminary Weekend Auction Clearance Rates (20 – 21 May 2017)

Source: CoreLogic

Interest Rates Update: 22/May/2017

With lending restrictions to investors tightening, banks are increasingly offering hot specials for first home buyers. Talk to a Mortgage Broker today to see these specials!

- Compare a range of high interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

New Homes of the Week (ed. 55)

Are you looking for a brand new home that is eligible for the First Home Owners Grant (FHOG)? We are about to reveal some new help for first home buyers very soon – stay tuned!

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

“A stunning young family home waiting for a first home buyer (under $300k)”

Tweet of the Week

On the back of a disappointing #Budget2017 we are going to do something about #housingaffordability ourselves https://t.co/2snoHsQmc1 #FHBA

— FHBA (@fhba_com_au) May 22, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia