FHBA Property Market Update – Top story

Earlier this year the NSW & Victorian governments introduced changes to stamp duty for eligible first home buyers, including:

- An exemption from stamp duty for NSW properties under $650,000

- A discount (concession) on stamp duty for NSW properties priced between $650,001 and $800,000

- An exemption from stamp duty for Victorian properties under $600,000

- A discount (concession) on stamp duty for Victorian properties priced between $600,001 and $750,000.

FHBA welcomed these changes because we know from working with first home buyers everyday that saving a deposit is one of the hardest parts of being a first home buyer and that the amount of money a first home buyer would need to save in these states would become less. Some experts warned that these changes would do little to help first home buyers though, stating that the extra funds in the pockets of first home buyers would just cause property prices to rise further.

So what is the verdict? Have these measures helped first home buyers?

Yes say’s popular economist blogger Greg Jericho in his column for The Guardian. And we agree.

Mr Jericho reports that “a surge of new buyers taking advantage of stamp duty cuts hasn’t resulted in a corresponding jump in prices”.

Melbourne property prices have been growing at a fast rate over the last 12 months. But there has been no noticeable change in trends since the stamp duty cuts for Victorian first home buyers kicked in.

And what about Sydney? Well after a long (5 years +) period of rising property prices, property prices have been flat over the last few months.

Meanwhile, according to government data, the level of first home buyer activity has increased.

So why hasn’t the extra $$ in the pockets of first home buyers resulted in property price increases? Firstly, first home buyers only represent a small proportion of the total property market. Secondly, not all first home buyers are eligible for the first home buyer incentives. Thirdly, of those who are eligible, not all will choose to purchase or pay extra as a result of the benefits. For example, someone who was targeting a $500,000 property with a 10% deposit of $50,000 might still target a $500,000 property with a 10% deposit, but not worry about saving for the stamp duty costs on top as well.

With property prices not rising as much, decent sized government incentives available and continued low interest rates, you may be asking is now a good time to buy your first home?

“The housing market does appear to be moderating and with continuing low interest rates, getting into the market remains as good as ever” says Mr Jericho.

See Greg Jericho’s column in The Guardian.

Unsure what government assistance is currently available in your state? See our free state guides to government incentives here.

First home buyers have returned to the market on the back of government incentives

Enjoy the rest of your weekly FHBA Property Market Update.

More First Home Buyer News

- Housing ownership levels in the 25 – 34 age bracket drops – new data released last week show’s that the number of Australians aged 25 – 35 who own their own home has fallen from around 60% in 1988-89 to approximately 39% in 2013-14 – watch FHBA’s Taj Singh’s thoughts on SBS News

- A new lobby group for investors? – Poor old investors. They have got it so hard, don’t they? So hard a new lobby group is being formed to represent their interests and stop laws getting tougher for them – see Taj Singh’s fiery response to this new lobby group in Domain

- First Home Super Saver Scheme another step closer to being law – Last week the coalition government got their First Home Super Scheme through the lower house despite opposition from Labor and the Greens – see other housing affordability laws passed in the lower house on Domain

Capital City Property Price Movements: 23/October/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. While we have been seeing some expert opinions that the Perth property market is ‘strengthening’, these latest index figures show that property prices in Perth have been declining further.

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 113.21 | + 0.1% | + 4.9% |

| Brisbane: 109.35 | +0.6% | + 3.3% |

| Melbourne: 156.14 | + 1.9% | + 11.2% |

| Perth: 95.18 | – 1.0% | – 2.9% |

| Sydney: 176.16 | – 0.3% | + 8.5% |

(Source: CoreLogic)

Interest Rates Update: 23/October/2017

What is happening to interest rates? Is it a good time to have a variable interest rate, a fixed interest rate or perhaps a split between the two for your first home loan? FHBA co-founder Taj Singh has prepared a blog this week on why many are looking at split loans. See Taj’s blog here

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

New Homes of the Week (edition 77)

Introducing our top five picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! This weeks winners are all house & land packages priced for first home buyers – they are just waiting for you to order the construction of your first home!

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | $10,100 | See property |

| Queensland | $20,000 | $8,660 | See property |

| South Australia | $15,000 | $7,200 | See property |

| Victoria | $10,000 | $8,660 | See property |

| Western Australia | $10,000 | $7,200 | See property |

Did you know??

Our FHBA New Homes service we can help you compare hundreds of new property options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Plus, we are the only ones to offer the FHBA 50 Rebate on top of the First Home Owners Grant*. Get in contact with us so we can help you with your search to find your unique slice of the great Australian dream today! Sounds great!

*FHOG & FHBA 50 Rebate amounts are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details.

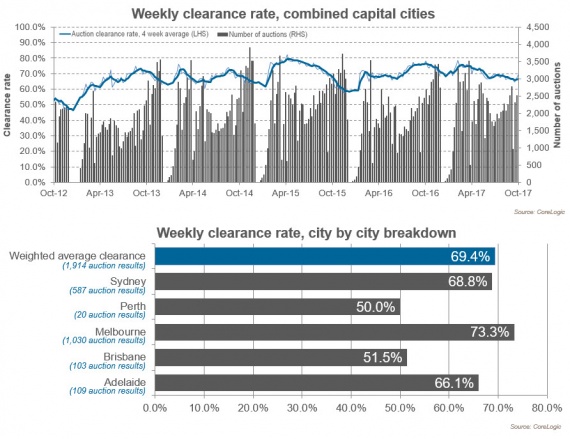

Preliminary Weekend Auction Clearance Rates (21th – 22th of October)

(Source: CoreLogic)

Current hotspot in focus: Bacchus Marsh (Victoria)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus is the regional suburb of Bacchus Marsh located in the beautiful Moorabool shire of Victoria:

- Bacchus Marsh is an affordable housing area located 50km West of Melbourne CBD

- Bacchus Marsh makes for a ‘must-consider’ option for growing first home buyer’s families thanks to affordable housing options, the regional Victorian First Home Owners Grant (and stamp duty concessions) and a less than 1 hour train trip to Melbourne CBD for those who work in the city

- Bacchus Marsh is surrounded by stunning state and national parks, plus is well located for adventurous day drives in all directions

- Learn more Bacchus Marsh (including surrounding suburbs in the Moorabool shire) in our hotspot focus article

Tweet of the Week

Stamp duty concessions for first timers in #NSW & #Victoria have not caused #ausproperty prices to go up #FHBA 🏠https://t.co/JYcPZyWz3U

— FHBA (@fhba_com_au) October 17, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

Jessica Irvine’s Diary of a First Home Buyer: Week 5

https://www.facebook.com/fhbah/posts/1339423339513533

Are you planning on entering the property market soon?

Regardless of who you are or what you are looking for, before you commence house hunting you should get a no obligation home loan pre-approval!

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you, so you can determine your approximate borrowing capacity. A loan pre-approval comes with no obligations to proceed with a home loan application, leaving you in control and importantly, attending open homes knowing what your budget is.

Get a no cost loan pre-approval by speaking with an FHBA Lending Adviser today