Earlier this afternoon the Reserve Bank of Australia (RBA) board opted to leave the cash rate on hold, at a record low of just 1.50% (yet again). The RBA was a little bit more ‘dovish’ than last month.

RBA Governor Philip Lowe noted the following in the official media statement:

- Employment: “Employment growth has been stronger over recent months and has increased in all states. The various forward-looking indicators point to continued growth in employment over the period ahead. The unemployment rate is expected to decline a little over the next couple of years. Against this, however, wage growth remains low and this is likely to continue for a while yet”.

- Economy: “The Bank’s forecasts for the Australian economy are largely unchanged. Over the next couple of years, the central forecast is for the economy to grow at an annual rate of around 3 per cent” and that “an appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast”.

- Inflation: “The recent inflation data were broadly as the Bank expected. Inflation is expected to pick up gradually as the economy strengthens. Higher prices for electricity and tobacco are expected to boost CPI inflation. A factor working in the other direction is increased competition from new entrants in the retail industry”.

In relation to housing, the RBA comments were again similar to last month’s statement. Today’s media statement read “conditions in the housing market vary considerably around the country. Housing prices have been rising briskly in some markets, although there are some signs that these conditions are starting to ease. In some other markets, prices are declining. In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years. Rent increases remain low in most cities. Investors in residential property are facing higher interest rates. There has also been some tightening of credit conditions following recent supervisory measures to address the risks associated with high and rising levels of household indebtedness. Growth in housing debt has been outpacing the slow growth in household incomes”.

The next RBA board meeting will be on Tuesday the 5th of September.

Compare current home loan rates here

Compare current home loan rates here

I’m about to be in the market for a home loan

- If you are getting close to buying your first home why not check out this easy to use home loan comparison table to see a range of rates currently on offer.

- Getting ultra close? We recommend you arrange an appointment with an FHBA Lending Adviser who can discuss your circumstances, showcase home loan options you may be eligible for and go through the home loan process with you. For more on FHBA Mortgages please click here.

Compare deposit savings accounts

I’m still saving for a home deposit

Unfortunately the rate of interest on savings accounts are relatively low at the moment. But when saving for a home deposit, every bit counts. See if you can give your savings a boost by checking out these free & easy to use saving accounts comparison tables!

I want to know more about the RBA decision

To read the full RBA statement from the August board meeting please click here.

Did you know?

Did you know that you can protect yourself from a rate rise as a mortgage borrower? A fixed home loan allows you to lock in an interest rate for a period of time, such as 1 year – 5 years. This gives borrowers certainty around home loan repayments. So how do you choose whether to get a fixed home loan or the more common variable home loan? Click here to learn more about your home loan options.

Written By,

First Home Buyers Australia

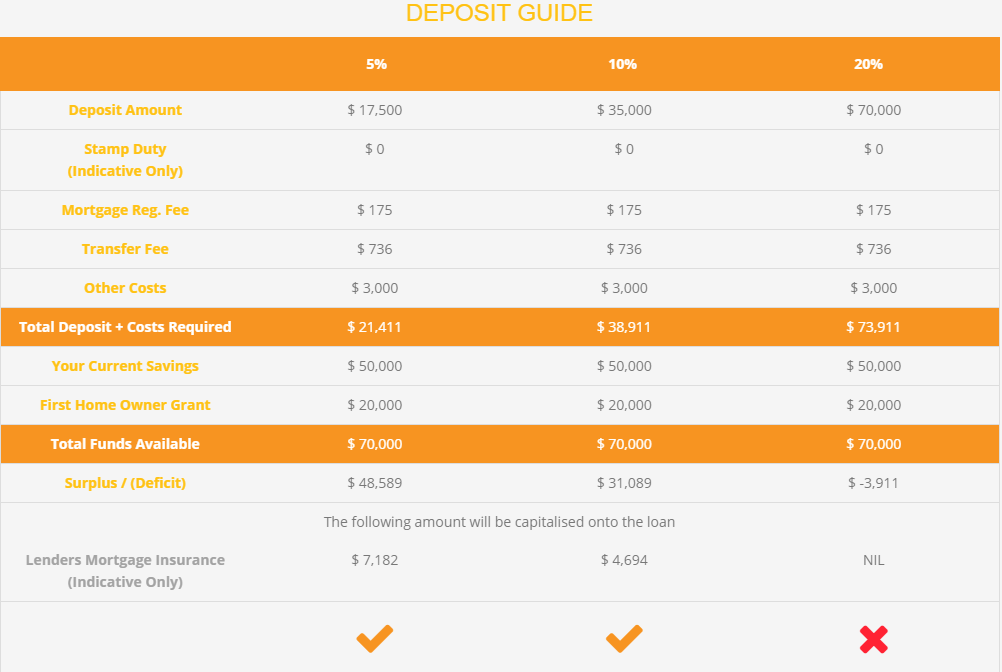

Not sure whether you have saved enough to enter the property market? Try our FHBA Deposit Estimator for free!