FHBA Market Update: 31 July 2017

In today’s FHBA Market Update we take a look at why housing affordability has returned to the headlines, the very latest on the First Home Super Saver Scheme, lenders mortgage insurance (what is it and should we avoid it?), why outer Sydney is growing so fast, our latest favourite properties for first home buyers, the latest property prices, the weekend auction clearance rates around the country and a whole lot more.

When the Turnbull government announced their housing affordability package in May (with the center piece being the First Home Super Saver Scheme [FHSSS]) they would have been hoping that finally housing affordability would stop being debated so much in the news. And for a short moment, it looked as though their wish might come true. At FHBA headquarters in Sydney we witnessed housing affordability go from a daily appearance in main stream media earlier in the year to a small mention here and there.

But that brief pause appears to be over now. Why? Well let’s take a quick look:

- Housing prices continue to move higher, in particular in Melbourne and Sydney;

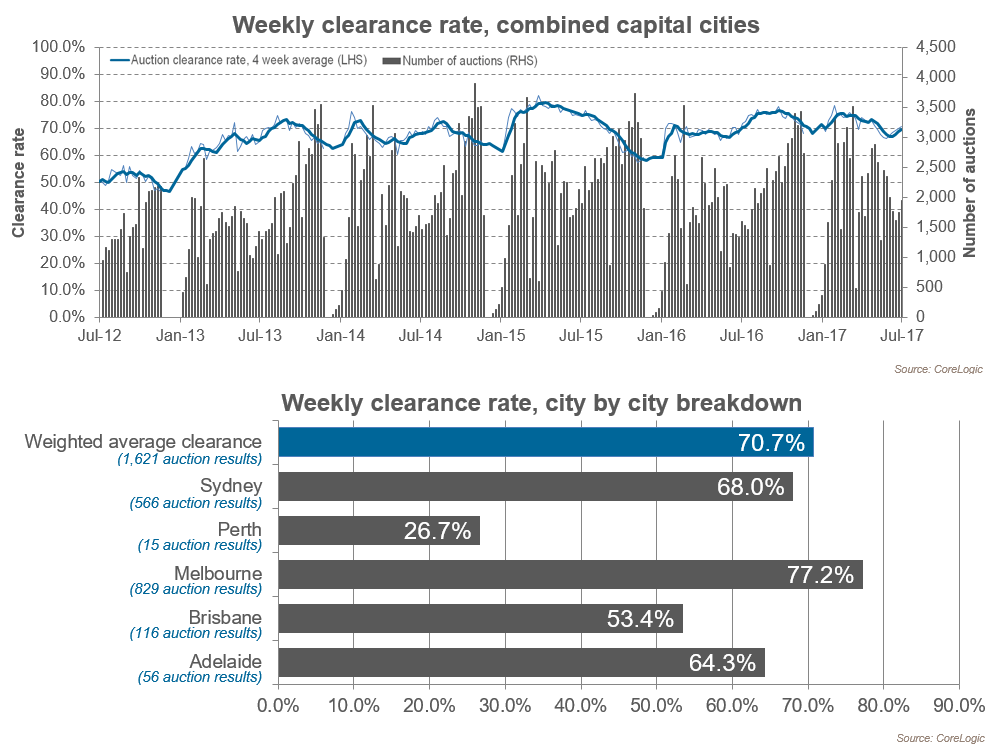

- Auction clearances rates continue to be relatively high as buyers continue to participate in the market;

- Low interest rates continue to cater for ‘cheap’ access to credit,

- The government’s FHSSS isn’t law yet and there has been doubts about its effectiveness in helping Australian first home buyers

- Recently the Labor Party restated their position on housing affordability while on the weekend the Greens Party announced what their policy position is on the issue as well. Both parties positions appear to be much more pro first home buyers, anti investors.

The Coalition is set to soon introduce the FHSSS and other housing affordability legislation to Parliament. And with Labor and the Greens showing their strong position, this could become a heated debate in itself. Coupled with investor activity dropping only slightly and the other factors outlined above, one could imagine that housing affordability is going to start dominating headlines around Australia once again.

So what is our take on this?

Well, we see this as a good thing. The government’s position on housing affordability has been underwhelming, so renewed attention on this issue can only put more pressure on the government for better policy while encourage the opposition to continue their attack.

And we too will continue to push for better policies for first home buyers – because what was announced in May Mr Turnbull, well, that simply wasn’t enough. Sorry PM, you better get ready for another round of battling on this front.

More First Home Buyer News

- Has the First Home Super Saver Scheme (FHSSS) started? – Well, sort of yes, sort of no. But don’t worry, we have got you covered! – see the latest in FHBA News

- Areas ‘affordable’ for first home buyers moving up the fastest – This week FHBA co-founder Taj Singh spoke to Domain about the frustration of how far out you have to buy in Sydney if you are a first home buyer – Taj’s comments in Domain

- Should I avoid Lenders Mortgage Insurance (LMI)? – What is LMI, how does it effect me, what are my options? – get answers in FHBA’s LMI Guide

Current Hotspot in Focus: Geelong

Our current hotspot in focus Geelong, Victoria – a real favourite with Victorian first home buyers. On Wednesday we reveal our next hotspot in focus – stay tuned!

- Geelong is located 75km to the south of Melbourne

- Geelong has absolutely everything you need, transport, hospitals, schools, a great lifestyle and affordably priced housing!

- Geelong is set to be even more popular with first home buyers on the back of new stamp duty exemptions and the regional Victorian First Home Owners Grant of $20,000 that commenced on the 1st of July

Learn more about Geelong including current opportunities to enter the Geelong property market

Current first home buyer hotspot: Geelong

Capital City Property Price Movements – as at 31/July/2017

Updated daily, The CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Australia’s largest two cities, Melbourne and Sydney, continue to power ahead.

- Adelaide: 483.93 (Qtr + 0.1% / Yr + 2.1%)

- Brisbane: 552.73 (Qtr – 0.6% / Yr + 3.2%)

- Melbourne: 941.55 (Qtr + 4.1% / Yr + 15.9%)

- Perth: 566.53 (Qtr – 0.3% / Yr – 2.1%)

- Sydney: 1133.36 (Qtr + 2.2% / Yr + 12.4%)

(Source: CoreLogic)

Interest Rates Update: 31/July/2017

Tomorrow the Reserve Bank board will meet to review the official cash rate. Stay tuned to our facebook page for the announcement.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

- Last chance: July home loan specials!

https://www.facebook.com/fhbah/posts/1271399302982604

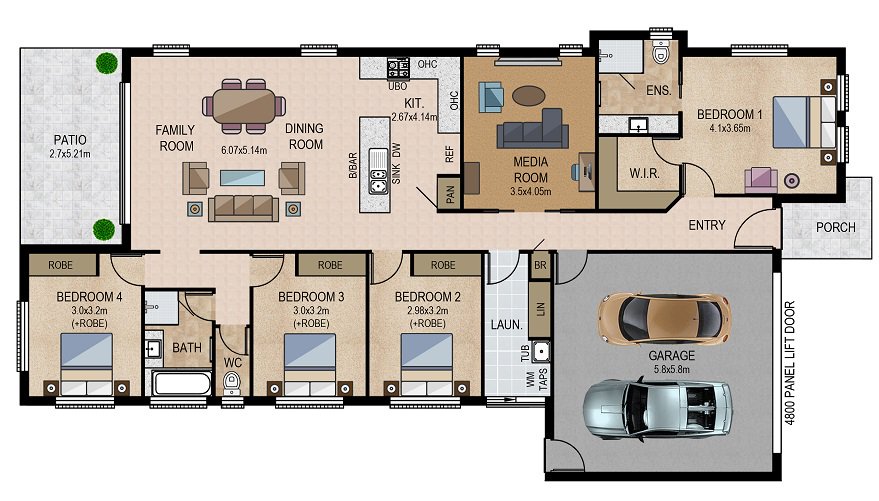

New Homes of the Week (edition 65)

These are our top picks for First Home Owner Grant (FHOG) eligible properties this week! All the homes are affordably priced for aspiring first home buyers:

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

Could you see yourself living with a young family in this plan?

Preliminary Weekend Auction Clearance Rates (29 – 30 July 2017)

(Source: CoreLogic)

Tweet of the Week

Is previous performance an indicator of future performance? #FHBA #ausproperty #realestate https://t.co/xyhM4lBCf7

— FHBA (@fhba_com_au) July 28, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia