FHBA Weekend Preview: 29 – 30 April 2017

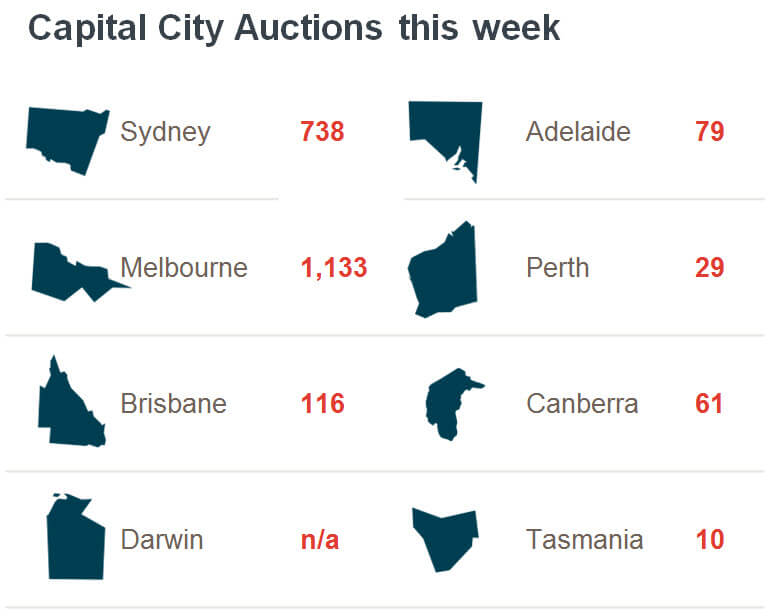

With the Easter and Anzac long weekends over, many would expect both open houses and auctions to begin to rise. According to CoreLogic Australia while there is expected to be an increase in market activity, the number of auctions scheduled for this weekend is actually almost 25% less than the same time last year.

It will be interesting to see whether sellers return to the market after the federal budget in May. If there continues to be a low level of property listings, could we see property prices get pushed up further?

It will also be intriguing to see how many buyers will be out and about this weekend. Many first home buyers have been priced out for so long that they are willing to wait a few more weeks to see what announcements (if any) will be in the budget.

In other news this week the inflation rate rose into the Reserve Bank’s target range (2% – 3%). Next week the Reserve Bank board will meet to review the cash rate (currently at a record low 1.50%). It will be interesting to see what their decision is, as well as their comments, ahead of the federal budget on Tuesday week.

Of course (as you would expect) – FHBA News will keep you updated next week on how many buyers were about on the weekend; the RBA rate decision and any federal budget leaks relating to housing affordability (along with any state government announcements).

Want to know more about this weekend’s auction activity? Visit the CoreLogic blog.

Good luck to all first home buyers this weekend!

First home buyer homes of the week: ed. 52

These are our favourite First Home Owners Grant (FHOG) eligible homes this week!

House of the week

Townhouse of the week

Apartment of the week

To search through more first home buyer homes, visit FHBA New Homes

Friday News Review

These are the top stories that affected first home buyers across Australia this week:

https://www.facebook.com/fhbah/posts

House hunting with confidence

Planning on going house hunting soon but don’t know whether a bank will lend you enough funds to buy your first home yet? You should get a no obligation loan pre-approval.

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you. Loan pre-approvals come with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak to an FHBA Broker from FHBA Mortgages today

Never miss an FHBA Market Update or FHBA Weekend Preview

Enjoy reading our free Market Updates and Weekend Previews? You’re not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!