FHBA Market Update: 1/May/2017

One more week until budget night. Just one more week.

Rumours and budget leaks about what will be in the federal budget in relation to housing affordability continues to grow. The latest budget leak came out yesterday via NewsCorp. The Sunday Telegraph reported that the government is considering creating provisions for aspiring first home buyers to be able to salary sacrifice a proportion of their pre-tax wages into a special account, to assist first timers build a deposit.

Similar to what the Rudd government previously introduced (the First Home Savers Account) – the scheme, if true, would be more attractive as the previous account only accepted after-tax contributions (not pre-tax as per the budget leak).

We have been lobbying the government over two years for a policy like this. The housing affordability problem has multiple contributing factors and requires multiple policies to fix it:

- More affordable housing supply is needed in places where first home buyers need to live

- Strong investor demand needs to be decreased via lowering generous tax concessions investors receive (i.e. tax reform to negative gearing, Capital Gains Tax (CGT) discount)

- First home buyers need assistance building a deposit (e.g. a tax effective savings account)

All this speculation is very confusing. At this stage nothing is official. First home buyers are left with their fingers crossed that something good will be in the federal budget.

As soon as the government policies are announced at next week’s budget we will be sharing the official news with our FHBA VIP club members and fans.

Meanwhile, according to CoreLogic Home Value index, property price growth slowed considerably in April. First timers everywhere are hoping that this is the start of a new trend and not just a single month of market slow down.

News affecting first home buyers

- First home buyers could be able to salary sacrifice a home deposit soon – According to an exclusive NewsCorp budget leak, the government is considering giving first home buyers tax relief to help them build a deposit faster – learn about the budget leak in news.com.au

- Multi generations living together – Due mainly to the high cost of housing, more multi generation families are living together and we need home designs that refelct this reality – see what features are being built in multi generation homes in Domain

- How can low income families save a deposit? – With the high cost of renting, in comparison to income being earned, how will low income families ever be able to save a deposit? – see the scary reality in The Guardian

FHBA co-founder Taj Singh spoke to 7 News last night about the latest budget speculation. Watch below:

Inspired new approach to property prices, or a paint job on an old, failed first home buyers plan? Here's #7news on a rumoured tax change. pic.twitter.com/FgIVwJolI1

— Tim Lester (@telester) April 30, 2017

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 1/May/2017):

- Adelaide – 482.52 (Qtr + 1.6% / Yr + 1.3%)

- Brisbane – 555.59 (Qtr + 0.8% / Yr + 3.1%)

- Melbourne – 9083.02 (Qtr + 3.9% / Yr + 15.4%)

- Perth – 56834 (Qtr – 2.4% / Yr – 5.9%)

- Sydney – 1108.80 (Qtr + 3.9% / Yr + 16.1%)

(Source: CoreLogic)

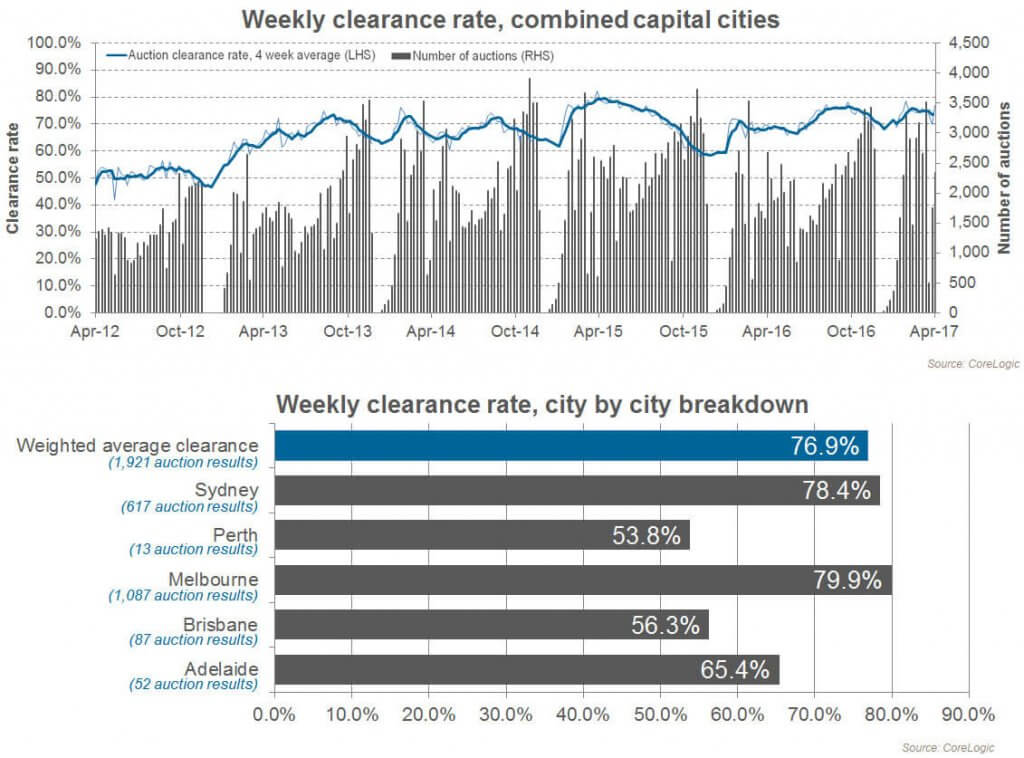

Preliminary Weekend Auction Clearance Rates (29 – 30 April 2017)

Source: CoreLogic

Interest Rates Update – 1/May/2017

Tomorrow the Reserve Bank of Australia (RBA) board will meet for their fourth time this year to review the official cash rate. Stay tuned to FHBA News tomorrow for the announcement and reactions.

- Compare a range of high interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

New Homes of the Week (ed. 52)

House of the week – Mandurah, Western Australia

Apartment of the week: Preston, Victoria

Townhouse of the week: Toowoomba, Queensland

Search a large range of First Home Owner Grant homes

Tweet of the Week

This policy is needed to assist people save a deposit. But increasing supply & reducing investor demand is also needed. #FHBA #ausproperty https://t.co/VAfr2i5pb5

— Daniel Cohen (@DanielPCohen1) May 1, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia