FHBA Market Update: 28/02/2017

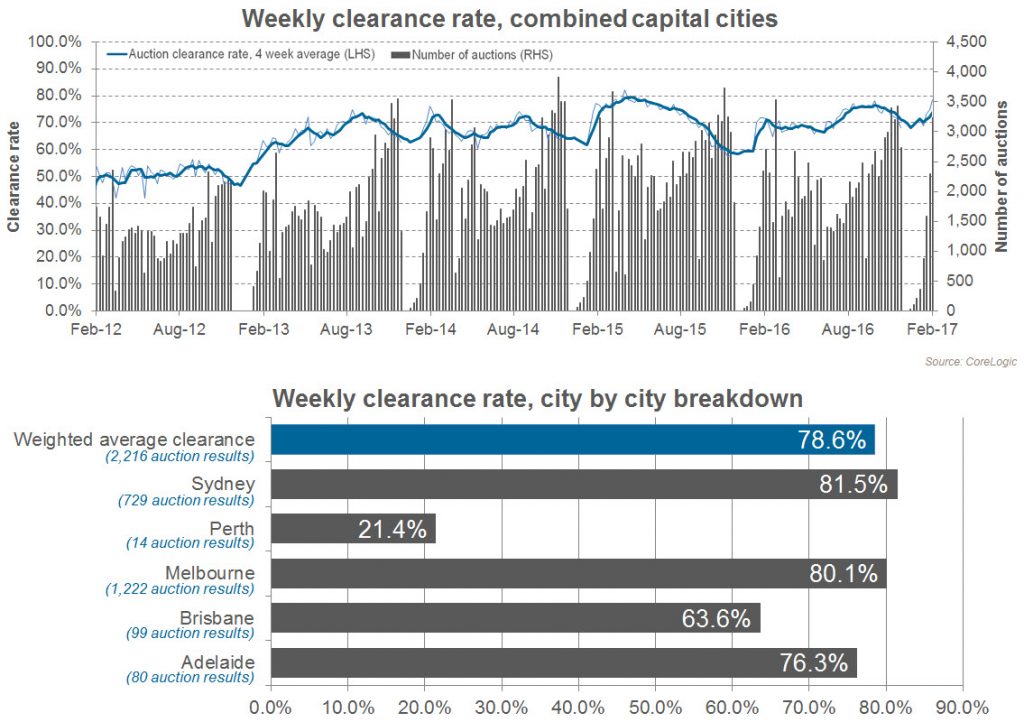

IT was dubbed ‘Super-Super Saturday’. The last weekend for summer 2016-2017 saw a massive 3,232 auctions held, the most ever recorded for the month of February. We had hoped last Friday in our FHBA Weekend Preview that the increased amount of auctions and open houses, along with poor weather conditions in key cities like Sydney, would provide first home buyers with opportunities. But bidding was strong across the country and very high clearance rates were again recorded, with Sydney, Melbourne, Canberra Adelaide & Brisbane (in that order) leading the capital city clearance rates.

In other news, it is of little surprise that housing affordability is once again dominating headlines. Various rumors are flying around that the Turnbull government is considering different options to address first home buyer woes with a possible policy announcement around the federal budget later this year. At this stage, we must stress, they are only rumors. We will be sure to let you know of any official announcements.

We are praying with you first timers.

News affecting first home buyers

Here are the top stories affecting first home buyers this week:

- Barely anywhere left affordable in Sydney – According to new analysis by Domain Chief Economist Dr Andrew Wilson they’re only 4 suburbs left in Sydney with property prices appropriate for a typical first home buyer budget. FHBA co-founder Taj Singh spoke to Domain about it in an interview last week, along with the topic of housing affordability read more in Domain

- First home buyers to be allowed to access super? – Last week NewsCorp reported that the Coalition is considering allowing first home buyers to be able to access their superannuation savings when buying their first home read more on news.com.au

- MP say’s renters should be able to get a home loan without a deposit – Have a strong rental history? Nationals MP Andrew Broad say’s you should be obtain a home loan of 100% of the property value read why on news.com.au

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 28/February/2017):

- Adelaide – 477.53 (Qtr – 0.88% / Yr + 3.64%)

- Brisbane – 550.03 (Qtr + 0.69% / Yr + 3.47%)

- Melbourne – 882.75 (Qtr + 5.51% / Yr + 13.05%)

- Perth – 568.32 (Qtr – 0.86% / Yr – 4.30%)

- Sydney – 1093.58 (Qtr + 4.47% / Yr + 18.39%)

(Source: CoreLogic)

Weekend Auction Clearance Rates (25-26th of February, 2017)

Source: CoreLogic

Interest Rates Update

Next Tuesday the RBA board will meet for the second time in 2017 to review the official cash rate. Since last month’s decision to leave the cash rate on hold the RBA has noted they are unlikely to decrease rates any further at the current time as they do not wish to add any further heat to the Australian property market.

New Homes of the Week

With housing affordability a central issue right now, we decided to make this week’s edition of FHBA New Homes of the Week dedicated to First Home Owners Grant (FHOG0) eligible homes where a deposit of less than $30,000 is required to buy the property.

See this week’s best first home buyer homes

Tweet of the Week

The State Government’s plan to ease Sydney’s housing affordability crisis for nurses, teachers, and others in important jobs. #TenNews pic.twitter.com/t4l9pTML8i

— 10 News First Sydney (@10NewsFirstSyd) February 24, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia