FHBA Market Update: 15/May/2017

Welcome to your weekly FHBA Market Update – Budget Wrap special.

Last week Treasurer Scott Morrison delivered the Turnbull government’s budget for 2017 and as widely expected, housing affordability measures were announced by the government.

The biggest talking point from budget night (in relation to housing affordability) has been the proposed First Home Super Saver Scheme (or the FHSSS). The FHSSS, if passed by Parliament (which it may not, as opposition leader Bill Shorten has indicated the Labor party will not support the scheme), would allow first home buyers to salary sacrifice a proportion of their pre-tax wages into super in order to save a deposit for their first home, tax effectively. Here is a quick recap of the how the FHSSS would work according to the budget (if passed into law):

- From 1 July 2017, individuals would be able to make voluntary salary sacrifice contributions of up to $15,000 per year and $30,000 in total, to their existing superannuation account to save for their first home deposit (so long as you don’t go over your superannuation concessional cap)

- These contributions would be taxed at 15% on entry into the superannuation fund (the same tax rate charged to your normal employer super contributions)

- Investment earnings would be taxed at 15% in the superannuation fund (the same tax rate as current superannuation investment earnings are taxed when in accumulation phase)

- Withdrawals would be taxed at the account holders individual marginal tax rate, less a 30% tax offset

- Withdrawals would be allowed at anytime from 1 July 2018 (if you are an eligible first home buyer)

- The administration of eligibility will be run by the Australian Taxation Office (ATO)

- It would NOT be dependent on the type of property you buy (i.e. you may buy a new or existing dwelling).

Many aspiring first home buyers have been critical of the scheme saying things on our Facebook page like “the threshold is too low” and “it’s not really going to make a big difference”. A handful of economists have also pointed out a few other ‘flaws’ in the proposed scheme, such as being too complicated and that it could even inflate property prices further.

So before anyone asks “how do I set one up” Australians currently saving for a deposit are really asking “will I be better off saving a deposit using my super fund?” It’s a great question to ask and really, our co-founders Daniel Cohen and Taj Singh say there are a lot of variables to consider. It would be wise to seek financial advice before starting such a savings strategy.

To those believing that the account doesn’t help, is it really more of a question that it ‘doesn’t help at all’? Or a question of ‘it helps, but not enough’? Or it’s just all too complex to be worthwhile? Well you might be interested to know that Tim Lawless, Director of Research at Australia’s leading property data company CoreLogic, say’s the account will help first home buyers. In a note, Mr Lawless explained “there was some risk that a demand side policy aimed at first home buyers could further fuel price growth by adding to demand, however this scheme is likely to improve demand gradually and incentive a savings strategy which is a positive outcome for first home buyers”.

And our view? Well it doesn’t solve the housing affordability crisis, but the truth is, overall (subject to eligibility, your circumstances and variable economic factors of course), most aspiring first home buyers will be financially better off using this proposed scheme, than not using it.

As 1 July 2017 approaches, we will be providing more info and insights on the FHSSS.

Watch below as FHBA co-founder Daniel Cohen took to Facebook to provide a brief summary of the housing affordability measures in announced in last week’s budget or read our full summary in FHBA News.

https://www.facebook.com/fhbah/videos/1196349293820939/

First home buyer news

- Is the $30,000 cap for the proposed First Home Super Saver Scheme (FHSSS) enough? – young Australians, and industry experts including First Home Buyers Australia have said that the $30,000 total concessional cap per person for the proposed FHSSS announced in the federal government is too ‘tight’ given today’s property prices in capital cities – see what we think the cap should be in Daniel’s interview with news.com.au

- Foreign investors buying NSW property at a record rate – new data obtained by NewsCorp reveals that foreign investor activity in NSW residential property is up 400% over the last five years; and first home buyers are not happy – see Taj’s thoughts in the Daily Telegraph

- Stamp duty relief on the way for NSW first home buyers? – in recent times stamp duty concessions for first home buyers have increased in various parts of Australia (most recently in Victoria). According to leaked sources, there could be some form of much needed stamp duty relief on the way for NSW first home buyers in the NSW June budget – see the hint in the 7 News Sydney special report below!

https://www.facebook.com/7newssydney/videos/1663658063658320/

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 15/May/2017):

- Adelaide: 479.83 (Qtr + 0.9% / Yr + 0.7%)

- Brisbane: 559.82 (Qtr + 1.4% / Yr + 3.8%)

- Melbourne: 898.94 (Qtr + 3.8% / Yr + 12.9%)

- Perth: 563.37 (Qtr – 1.8% / Yr – 4.2%)

- Sydney: 1100.34 (Qtr + 1.6% / Yr + 11.8%)

(Source: CoreLogic)

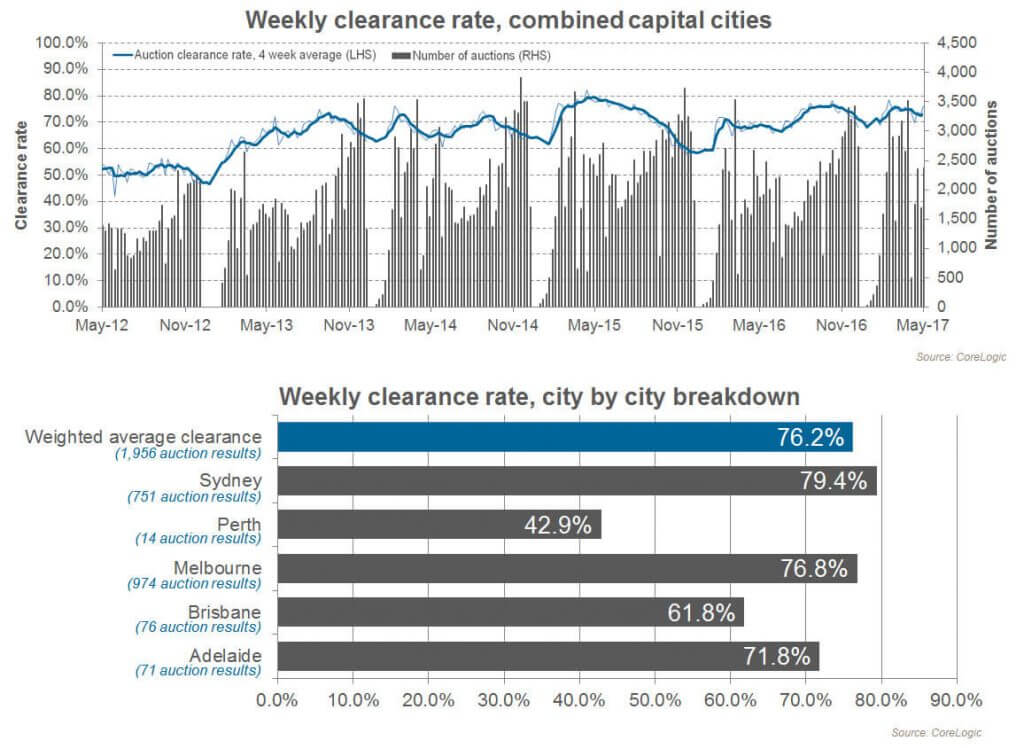

Preliminary Weekend Auction Clearance Rates (13 – 14 May 2017)

Source: CoreLogic

Interest Rates Update: 15/May/2017

In last week’s federal budget the government announced a new bank levy tax to be imposed on Australia’s largest 5 banking institutions: ANZ, Commonwealth Bank (CBA); Macquarie Bank; nab; & Westpac. The big banks have argued that this will be difficult to absorb, warning that the tax costs will likely be passed onto their customers (at least partially). FHBA co-founder Taj Singh said “this could make the big banks less attractive to save a deposit in and obtain a home loan from. It’s as important as ever when saving a deposit to compare saving account options online and when obtaining a home loan, to speak to a Mortgage Broker about your different options; as there is a lot to consider other than just the interest rate”.

- Compare a range of high interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

New Homes of the Week (ed. 54)

Are you looking for a brand new home that is eligible for the First Home Owners Grant (FHOG)? We are about to reveal some new help for first home buyers very soon – stay tuned!

House of the week – Melton, Victoria

Apartment of the week: Returns next week!

Townhouse of the week: Marsden, Queensland

Search a large range of more First Home Owner Grant homes

Tweet of the Week

This is why the @TurnbullMalcolm govt. must do more than what they announced in #Budget2017 @60Mins #60Mins #ausproperty #auspol #FHBA https://t.co/SJa8jgaRxh

— FHBA (@fhba_com_au) May 15, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia