Last month we launched our new monthly ‘FHBA Property Market Update’, designed to keep first home buyers right across Australia informed with what is going on in the property market (including matters that could impact your deposit saving, property planning and purchasing related decisions).

Each month’s FHBA Property Market Update includes the following segments that matter to first home buyers:

- CoreLogic Market Reports (Video)

- CoreLogic Property Values

- Interest Rate Insights

- Listings Insights

- First Home Buyers Insights

- Grants & Benefits Watch

- New Homes of the Month

- Location Location Location

- Hot First Home Buyer Tips

This is the second edition of the new look FHBA Property Market Update (April 2018).

Disclaimer: The FHBA Property Market Update is general in nature and should not be considered as advice to act on. It includes a mix of internal and external information. You should seek professional advice before making any financial or property related decisions. To speak to an FHBA Coach please click here.

CoreLogic Market Reports (April)

The following CoreLogic videos discuss property market conditions across Australia’s capital cities. The video reports consider a range of factors (including those that you don’t typically read in Domain or realestate.com.au online reports!). They are presented by the Head of Research at CoreLogic Australia, Tim Lawless.

CoreLogic National Housing Market Update: April 2018

CoreLogic Melbourne Housing Market Update: April 2018

CoreLogic Sydney Housing Market Update: April 2018

View the CoreLogic April video reports for Australia’s other large capital cities:

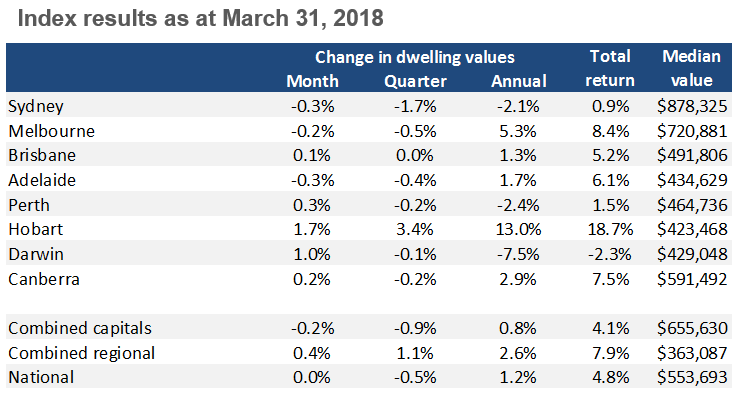

CoreLogic Property Values (31 March)

The following table shows how residential dwelling values have changed over the month, quarter and year to the 31st of March 2018. Please note, the total return column takes into consideration rental returns (in addition to changes in property values).

Source: CoreLogic Hedonic Home Value Index

Highlights:

- Strongest performing city (March) – Hobart

- Weakest performing city (March) – Sydney

- Highest rental yield – Darwin (5.8%)

- Lowest rental yield – Melbourne (2.9%)

- The unit sector across Melbourne and Sydney has shown stronger conditions relative to detached housing.

- Rental markets appear to be easing, with weekly rents rising 1.1% over March 2018 quarter compared with a growth rate of 1.5% over the march 2017 quarter.

- For deeper analysis you can download the CoreLogic April Press Release here.

Interest Rate Insights (April)

| RBA rate decision (April) | Hold |

|---|---|

| Current RBA ‘Cash Rate’ | 1.5% |

| RBA rate prediction (May)* | No change |

| FHBA Mortgages specials | April |

*Based on the ASX RBA Rate Indicator, as at the 19th of April 2018

See current home loan specials for first home buyers in FHBA News!

Listings Insights (March)

The following table shows the total quantity of property listings in Australia’s capital cities, including those sold or withdrawn in the month of March 2018.

| Capital city | No. of listings |

|---|---|

| Adelaide | 17,000 |

| Brisbane | 32,500 |

| Canberra | 4,000 |

| Darwin | 2,000 |

| Hobart | 2,500 |

| Melbourne | 36,500 |

| Perth | 28,000 |

| Sydney | 35,000 |

Source: SQM Research. Based on the metropolitan areas of each capital city. National number includes capital cities plus regional areas. Number of listings is rounded to nearest 500 and includes houses, apartments and land.

Highlights:

- There was a jump in the quantity of listings in the month of March as more sellers entered the property market.

- Every single capital city saw an increase in listings, with the largest increase occurring in Melbourne.

- Despite the increase in listings, Hobart’s overall listings levels are quite low compared to historical levels, indicating just how strong the Hobart market currently is.

First Home Buyer Insights (February)

The following table shows the level of first home buyer activity / participation in the national property market, as well as the average loan size, for the month of February 2018:

| State / Territory | First home buyers (%) | First home buyers (no.) | Average Loan Size |

|---|---|---|---|

| ACT | 25.6% | 261 | $290,000 |

| NSW | 15.2% | 2,246 | $373,000 |

| NT | 19.4% | 52 | $297,000 |

| QLD | 19.3% | 1,839 | $291,500 |

| SA | 13.0% | 443 | $274,500 |

| TAS | 13.9% | 137 | $240,000 |

| VIC | 18.3% | 2,619 | $342,500 |

| WA | 25.0% | 1,185 | $305,500 |

| National | 17.9% | 8,782 | $328,000 |

Source: Australian Bureau of Statistics Housing Finance, February 2018. Loan size rounded to nearest $500.

Highlights:

- Highest level of first home buyer activity – ACT

- Lowest level of first home buyer activity – South Australia

- Highest average first home buyer loan size – NSW

- Lowest average first home buyer loan size – Tasmania

- Proportion of first home buyer loans fixed for 2 years + – 14.4%

- Nationally, first home buyer participation slipped from 18% to 17.9% in February 2018 (compared to January 2018). However, this level is still around 5 year highs, largely driven by increased first home buyer government incentives in some states.

Not in the market? Estimate how much more you need to save with our FHBA Eligibility Estimator

Grants & Benefits Watch

The FHBA Grants & Benefits Watch section is where we report any changes to government benefits for first home buyers, such as the First Home Owners Grant (FHOG), stamp duty concessions, shared home equity programs, the First Home Super Saver (FHSS) scheme and more. If there are any significant proposals to alter first home buyer benefits, we will also report about these proposals to keep you informed.

In the month of April there were no official changes to report of. However, there have been some changes in recent times, which prompted Domain to run an article on the current government benefits available, including the pros and cons. FHBA Co-Founder Taj Singh appeared in this Domain story. You can see it here.

https://www.facebook.com/fhbah/posts/1512819645507234

We would also like to take this opportunity to remind Queenslanders that the Queensland First Home Owners’ Grant (FHOG), which is currently at a ‘boosted’ amount of $20,000 for eligible first home buyers, is due to decrease to $15,000 (the non-boosted amount) from the 1st of July this year. At this stage the Queensland Government has indicated that the extra $5,000 ‘boost’ amount will not be extended beyond the 30th of June. If you would like to buy your first home in Queensland, including applying for government benefits available, check out our Queensland promotion page.

To view the current government benefits available in your state please visit our Grants Info Hub

New Homes of the Month (April)

Many first home buyers choose to buy or build a brand new property for their first home because of the government benefits available, as well as because it is also an opportunity to own something that has that ‘new’ feel, in an area that is changing and a property that should have lower maintenance requirements in comparison to most established properties.

To help those whom are looking for a brand new property for their first home we offer first home buyers a leading service called FHBA New Homes. This service helps first home buyers compare, find and secure a brand new property for their first home. This is a complimentary service for FHBA clients.

As a first home buyer, a major benefit of taking advantage of this service to find and secure your first home is that in addition to government incentives such as the FHOG, you may also be eligible for the FHBA 50 Rebate (a first home buyer cash rebate available exclusively to FHBA clients) in addition to the government incentives. For more on the FHBA 50 Rebate please click here.

Every edition of the FHBA Property Market Update, our team selects 3 awesome properties (a house, townhouse and apartment) suitable for first home buyers to be our new homes of the month. Here are this month’s winners!

- House of the month – Family living in NSW’s premier wine region. Total first home benefits from $35,250*. Priced from $443,950.

- Townhouse of the month – Modern, location and price, check this out young Brisbane professionals’. Total first home buyer benefits from $33,750*. Priced from $414,900.

- Apartment of the month – Location, location, location and construction already underway. 6 to choose from. Total first home buyer benefits $27,500*. 2 bedroom apartments from $349,000.

*Total first home buyer benefits are an estimate only. They are based on a client being eligible for their states FHOG, stamp duty concession and the FHBA 50 Rebate. Talk to a New Homes expert to find out more.

Would you live in NSW’s premier wine region?

Location Location Location (April)

In April, our location hotspots in focus have included the lovely Nollamara near Perth CBD in Western Australia and Oxenford in South East Queensland. What is so special about these hotspots for first home buyers? Check out hotspot in focus articles below:

- First home buyer hotspot 1: Nollamara (Western Australia)

- First home buyer hotspot 2: Oxenford (Queensland)

Nollamara (above) is located within 10km of Perth CBD

Hot First Home Buyer Tips

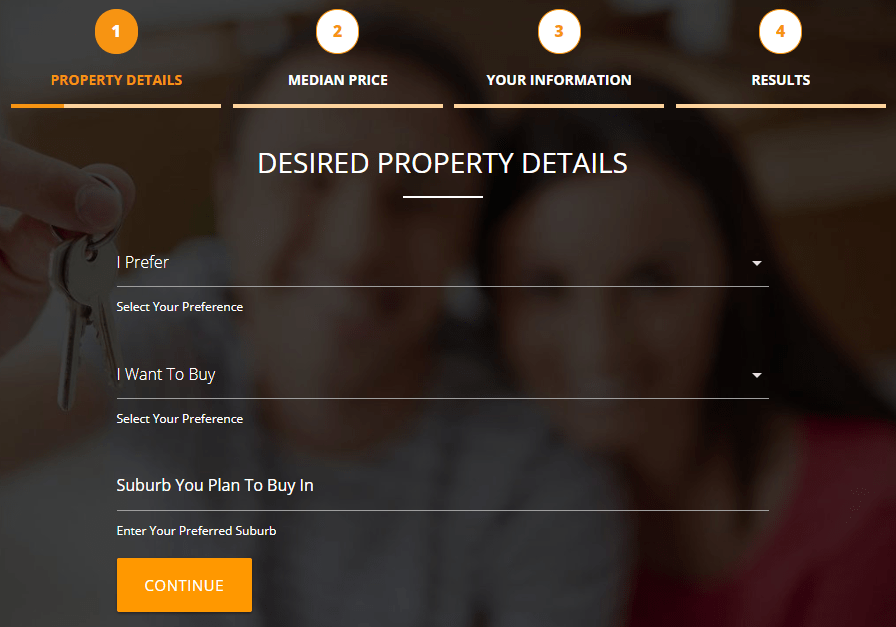

Have you ever wondered how much you need as a deposit to buy a property in your dream location? Is it 5% of the property value, 10% of the property value, 20% of the property value, or perhaps a different amount?

We admit this can be tricky to work out and at FHBA we are determined to help make working how much you need to save in order to successfully enter the property market easier to work out.

This month we have launched our new and improved FHBA Eligibility Estimator. This online tool helps you self-estimate your deposit requirements plus your eligibility for government benefits. Learn more about this handy (and free!) tool in FHBA News.

Have you tried our updated FHBA Eligibility Estimator?

In our other tip article this month, FHBA Co-Founder Taj Singh took a look at whether temporary residents can get finance to purchase their first home in Australia. Or should we say, how to get a loan when you are a temporary resident. If you or your partner is a temporary resident, you don’t want to miss Taj’s special investigation – view it now!

To see hotter first home buyer tips please visit the FHBA blog.

We hope you enjoyed our new FHBA Property Market Update. Our next edition will be in May.

Written By,

First Home Buyers Australia