FHBA Market Update: 27/03/2017

Almost everyday in the news right now there are rumors that the coalition federal government will (finally) do something at the upcoming federal budget to address housing affordability for first timers.

But first home buyers remain wary of any potential help, with ministers of the government continuing to say dumb comments like ‘”get a good paying job” or go ask your parents for help.

Over the coming period between now & the federal budget, FHBA co-founder Daniel Cohen will be given the opportunity to speak with Liberal MP John Alexander and federal Senator Nick Xenophon on housing affordability. Daniel will be using these meetings to push the housing affordability agenda, including FHBA’s 5-point plan.

Help for first home buyers can’t come soon enough with further data today showing property prices continuing to rise in many parts of the country, with properties selling very quickly.

In the meantime….first home buyers who have been fortunate enough to save a deposit are scratching their heads and ask, “should I buy now, or wait”?

Enjoy your weekly FHBA Market Update.

News affecting first home buyers

In the past week, housing affordability has yet again continued to dominate headlines:

- Should I buy now or wait? – With property prices in many capital cities continuing to rise, many aspiring first timers are asking “is it better to buy now, or should I wait”. This is an intelligent question to be asking….unfortunately the answer is not so easy – learn how to decide in FHBA News

- “Get a good and better job, a better-paid job” – It is hard to trust that the federal government will deliver any good policies for first home buyers anytime soon when the Finance minister say’s comments like this in parliament – see what the Minister had to say in SBS News

- Exclusive first home buyer properties sell fast – on the weekend property developer Mirvac sold 60 off-the-plan apartments reserved for first home buyers, in Western Sydney. Based on the success, could more exclusive first home buyer opportunities be on the way? – see what the successful first home buyers had to say in Domain

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 27/March/2017):

- Adelaide – 480.81 (Qtr + 1.9% / Yr + 3.6%)

- Brisbane – 551.88 (Qtr + 0.6% / Yr + 4.3%)

- Melbourne – 901.28 (Qtr + 4.6% / Yr + 15.5%)

- Perth – 573.71 (Qtr – 1.4% / Yr – 4%)

- Sydney – 1112.23 (Qtr + 5.5% / Yr + 19.6%)

(Source: CoreLogic)

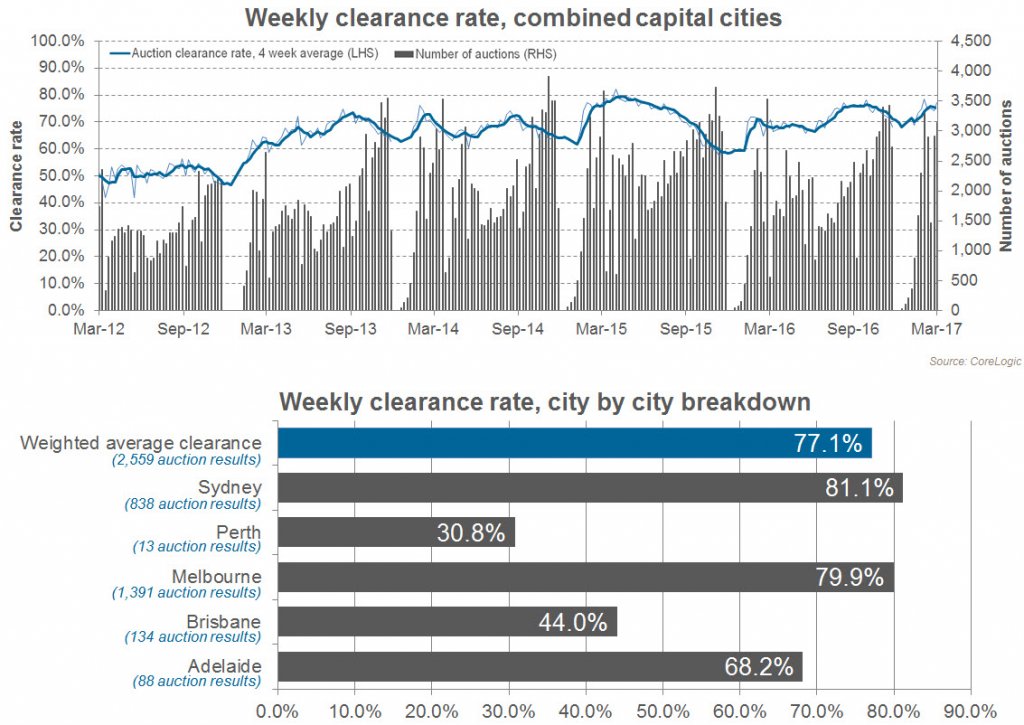

Preliminary Weekend Auction Clearance Rates (25th – 26th of March, 2017)

Source: CoreLogic

Interest Rates Update – 27/03/2017

In the past fortnight, the big 4 banks and some smaller lenders have announced an increase to home loan interest rates due to the cost of funding rising.

New Homes of the Week (ed. 47)

In this week’s edition of FHBA New Homes of the Week we selected 5 first home buyer homes where construction will be completed in 2017. All the homes are priced under the First Home Owners Grant (FHOG) threshold.

See this week’s best first home buyer homes

Tweet of the Week

To buy now or wait? That is the question: https://t.co/KUC3xcJkfV #FHBA #FHBANews #ausproperty #realestate pic.twitter.com/YY15ZJ9Iyi

— FHBA (@fhba_com_au) March 26, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia