FHBA Weekend Preview: 8 – 9 July 2017

With new first home buyer incentives from the government kicking in this week to assist first home buyers with housing affordability, one question the industry is asking itself is “will the growing trend of ‘rentvesting’ continue”?

Government first home buyer incentives are mostly only available to owner-occupiers (people who will actually live in their first home). With some states first home buyer incentives from the government growing (in particular in NSW and Victoria) some are wondering whether more first timers will favour buying as an owner-occupier over rentvesting to ensure they maxmise government entitlements (such as the First Home Owners Grant [FHOG] and stamp duty concessions).

For those new to the term, ‘rentvesting’ involves buying your first home as an investment property that your budget can afford, while you continue to live (via renting) in an area need to be for employment or other reasons.

According to a Herron Todd White Residential Property Report (April 2017) 13% of first home buyers nationally now enter the property market as a rentvestor (rather than as an owner-occupier). In Australia’s two most expensive states, NSW and Victoria, the proportion is higher at 24% and 20% respectively.

FHBA co-founder Daniel Cohen said there are advantages and risks of buying your first home either way. “One of the first questions first home buyers want to know is what entitlements they are eligible for. While it’s always good to check what government entitlements you could be eligible for, you need to consider various other factors before buying your first home. What’s your budget, what do you want out of home ownership, where do you need to live for work, these are just some of the factors you need to consider”.

“The flexibility of rentvesting is what makes rentvesting so attractive. However, there are pros and cons of being either an owner-occupier and being a rentvestor, so you need to think about what’s right for you”.

Fellow FHBA co-founder Taj Singh said FHBA is well equipped to assist first home buyers in making this decision. “At FHBA we understand that every first home buyers needs are different. Regardless of your goals and requirements, as Australia’s best first home buyer specialist organisation, we offer a range of cost effective services that can help you, including a no-charge mortgage searching and settling service”.

Over the months the industry and FHBA will be monitoring to see how many first home buyers are taking advantage of government first home buyer incentives (usually titled towards owner-occupiers) versus going down the rentvesting route.

- Learn more about rentvesting

- Speak to an FHBA Coach about buying as an owner occupier versus rentvesting

- Read the HTW Residential Property Report (April 2017)

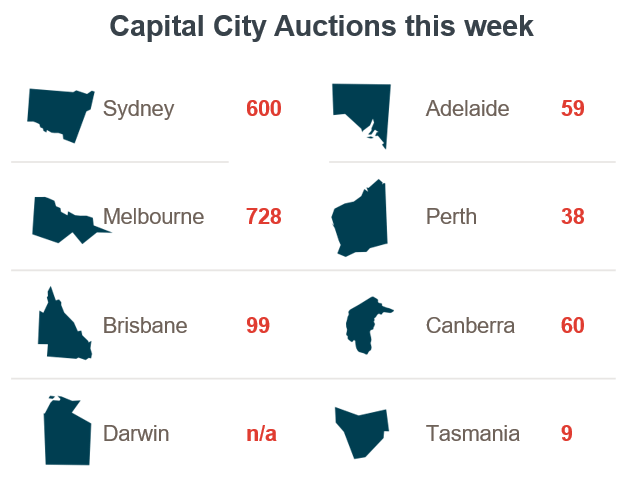

As for this weekend, according to CoreLogic there are around 1,500 auctions scheduled:

Want to know more about this weekend’s auction activity? Visit the CoreLogic blog

Good luck to all first home buyers this weekend!

First home buyer homes of the week: edition 61

These are our favourite 5 properties for first home buyers looking for new, FHOG eligible homes, this week:

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

Modern living in the outskirts of Sydney – could this be your first home?

Open homes and auction weather

See what the weather will be like in your area before you attend open homes and auctions!

COMING SOON

House hunt with confidence

Planning on going house hunting soon but don’t know whether a bank will lend you enough funds to buy your first home yet?

You should get a no obligation home loan pre-approval! A loan pre-approval provides you written guidance of how much a particular bank is willing to lend to you. A loan pre-approval comes with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak with an FHBA Broker from FHBA Mortgages today

Search FHOG eligible homes from your couch

Are you in the market for a newly built property? This could be a house & land package, a townhouse or a newly constructed apartment. Search our new look ‘new homes’ portal this weekend to see hundreds of Grant eligible properties suitable for first home buyers!

Search first home buyer homes here

1 July 2017 changes to government assistance for first home buyers

On the 1st of July many state government assistance measures for first home buyers (such as the First Home Owners Grant and stamp duty concessions) had some form of change. We have summarised all the changes in a free quick guide available on our website here. In the quick guide simply select your state for a free guide to your state’s government incentives.

Get your free quick guide to the changes of Grants and concessions for first home buyers

Friday News Review

https://www.facebook.com/fhbah/posts/1249898491799352

Never miss an FHBA Market Update or FHBA Weekend Preview!

Enjoy reading our free Market Updates and Weekend Previews? You’re not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!

Written By,

First Home Buyers Australia

In the market for a brand new home? The newly launched FHBA 50 Rebate could give you a big helping hand – find out more