FHBA Property Market Update – Top story

Over the last several months or so market conditions have been changing in quiet a few property markets according to property data houses such as CoreLogic Australia. Some areas have seen ‘stronger’ conditions, such as Canberra and Hobart, while other areas have been a little ‘softer’ compared to where they have been, such as Sydney.

While true property negotiating pros like Buyers Agents will have different negotiating strategies for different market conditions, some general negotiating tips are applicable in most market conditions. Please note, these tips are general in nature and we take no responsibility for the results they provide you (as each sale and circumstance is different). If you would like some negotiating help with your first home purchase then please get in touch.

- Know what you are looking for – before you begin negotiating on a property you need to know your own circumstances. What is your budget? What is your ideal settlement date? These are just a few examples of important things you need to know.

- Be confident and assertive – Show the selling agent and vendor that you are a confident and serious home buyer. Agents are usually busy people and they will give their most time to prospect buyers whom they believe are the most serious and genuine about buying the property they are selling. Show them you are interested and that you are willing to chat about a potential deal.

- Always listen (always) – Information is key to any property purchase. When the agent is talking to you, listen (don’t interrupt). When the agent is talking to someone else but is within your hearing range, listen. Why? You may hear things that will assist you in your negotiations. You will often learn far more about the property and what it will take to be the successful buyer by listening rather than talking. See if you can find out what the motive is for the vendor selling the property (plus other info like what is their ideal buyer? Is price important? Is a stress free settlement important? Is time important? etc). And maybe you can get an idea for the quantity and quality of your competition among other home buyers.

- Be patient – The party that is most patient often gets more negotiating power. If you show that while you are a serious property buyer with finance ready to go, but you are not in a hurry (because you are willing to wait for the right property at the right price), it places pressure on the agent and vendor to make their property as appealing to you as possible. Even if you have high emotion for the property you want to buy (and want to make it your own) try to not reveal this emotion, as this will give the upper-hand to the selling party. Lastly, if it is out of your budget, or you are uncomfortable about other matters such as the contract or the condition of the property, be willing to walk away. There are currently an increasing quantity of property listings and over the last several years more than 600,0000 new properties come onto the market, so be patient.

Lastly, if you need help, don’t be afraid to ASK. But don’t ask the selling agent (they are their to help the vendor with the property sale). Ask people whom will act in your best interests such as Buyers Advocates or us, Australia’s leading help for first home buyers.

Don’t be afraid to ask for help so that you can move into your first home with a lot less stress!

Enjoy the rest of your weekly FHBA Property Market Update.

More First Home Buyer News

- Queenslanders love the $20,000 Grant – Since the $20,000 First Home Owners’ Grant in Queensland was extended until 31 December 2017 (when it is due to fall to $15,000) there has been more than 3,000 grant claims lodged. Could the Queensland government extend the FHOG boost again? – learn more about recent first home buyer activity in Queensland on realestate.com.au

- First home buyer activity surges in NSW and Victoria – New finance data from the Australian Bureau of Statistics (ABS) suggests first home buyers just love the stamp duty concessions (& exemptions) in Australia’s two most populated states says ANZ – see where else first home buyer activity is up in Domain

- Who said Chinese investment in Australian property will decrease? – Credit Suisse says Chinese money flowing into Australia’s residential property market will increase further despite foreign investment taxes – read why it is unlikely that foreign property taxes in NSW, Queensland and Victoria will deter Chinese investment in Domain

Current hotspot in focus: Bacchus Marsh (Victoria)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus is the regional suburb of Bacchus Marsh located in the beautiful Moorabool shire of Victoria:

- Bacchus Marsh is an affordable housing area located 50km West of Melbourne CBD

- Bacchus Marsh makes for a ‘must-consider’ option for growing first home buyers families thanks to affordable housing options, the regional Victorian First Home Owners Grant (and stamp duty concessions) and a less than 1 hour train trip to Melbourne CBD for those who work in the city

- Bacchus Marsh is surrounded by stunning state and national parks, plus is well located for adventurous day drives in all directions

- Learn more Bacchus Marsh (including surrounding suburbs in the Moorabool shire) in our hotspot focus article

Capital City Property Price Movements: 16/October/2017

Updated daily, the CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months. Two interesting changes this week which we reported on our Facebook page. Firstly, there are signs of the Perth property market improving (prices aren’t falling as much) and secondly, Sydney has seen a slight fall in property prices over the last 3 months.

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 113.22 | + 0.2% | + 4.9% |

| Brisbane: 109.34 | +0.6% | + 3.4% |

| Melbourne: 156.07 | + 2.0% | + 11.6% |

| Perth: 95.32 | – 0.9% | – 2.6% |

| Sydney: 176.33 | – 0.2% | + 9.0% |

(Source: CoreLogic)

Interest Rates Update: 16/October/2017

What is happening to interest rates? Can they be on hold forever? This week Fairfax journalist Jessica Irvine wrote a major piece on interest rates and what the Reserve Bank of Australia (RBA) might do next. Ms Irvine concluded “so you can bet that interest rate rises are coming. But you can also bet that they won’t be as steep”. See how Ms Irvine reached this conclusion in the Sydney Morning Herald.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

New Homes of the Week (edition 76)

Introducing our top five picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! All the homes are affordably priced for aspiring first home buyers (of course):

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | $7,875 | See property. |

| Queensland | $20,000 | $10,100 | See property. |

| South Australia | $15,000 | $6,560 | See property. |

| Victoria | $10,000 | $8,660 | See property. |

| Western Australia | $10,000 | ‘on enquiry’ | See property. |

*FHOG & FHBA 50 Rebate amounts are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details.

Did you know??

Via our FHBA New Homes service we can help you compare hundreds of new property options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Get in contact with us so we can help you with your search to find your special slice of the great Australian dream today! Sounds good!

Nestled on a gentle hillside overlooking the southern coastline of Adelaide – this is Vista

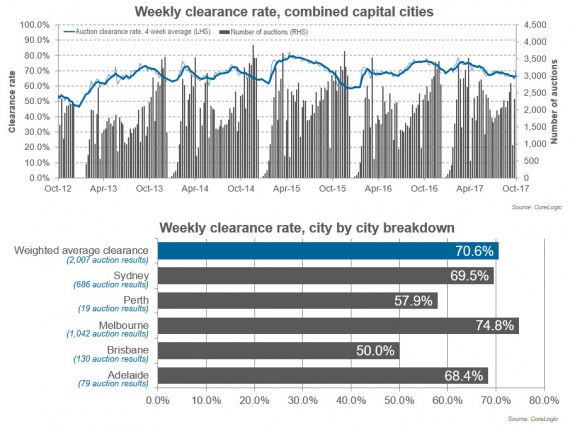

Preliminary Weekend Auction Clearance Rates (14th – 15th of October)

(Source: CoreLogic)

Tweet of the Week

The @LiberalAus insists #housingaffordability is a 'supply' problem. This is only 50% true! Other 50% is demand #auspol #aushousing #udiansw https://t.co/u7roVGUyb2

— Daniel Cohen (@DanielPCohen1) October 12, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

Jessica Irvine’s Diary of a First Home Buyer: Week 4

https://www.facebook.com/fhbah/posts/1333833066739227

Are you planning on entering the property market soon?

Regardless of who you are or what you are looking for, before you commence house hunting you should get a no obligation home loan pre-approval!

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you, so you can determine your approximate borrowing capacity. A loan pre-approval comes with no obligations to proceed with a home loan application, leaving you in control and importantly, attending open homes knowing what your budget is.

Get a no cost loan pre-approval by speaking with an FHBA Lending Adviser from FHBA Mortgages today

FHBA Mortgages – Australia’s leading place for first home buyer finance