FHBA Weekend Preview: 2 – 3 September 2017

In today’s edition of FHBA Weekend Preview we take a look at the top tips for first home buyers preparing for the Spring property market, our latest hotspot for first home buyers, our five favourite new properties for first home buyers this weekend, a review of the top first home buyer stories this week and a preview of this weekends auctions.

WINTER IS OVER. Game of Thrones (unfortunately) is over until the next season and Winter 2017 is now behind us. Today, the first of September, is the first day of Spring 2017.

Spring is typically a busy period for the property market, with plenty of buyers and sellers around. Experts expect this Spring to be no different for most property markets. So if you are a first home buyer, how do you prepare for Spring 2017? Here are our top tips:

- Start looking as early as possible – even before you are ready to start bidding or negotiating, if you are planning on buying soon, go and attend some open homes and auctions in the areas you are considering, to get a feel for the property market. Observe things like the quantity of people at open homes and auctions, the type of people that are around and about (i.e. are they sticky beaks, genuine home buyers, or genuine investors?) and the quality of homes selling (are they top end, mid range, low end, or a variety?)

- Watch what prices properties sell for – people are often quick to check out listings for sale on Domain and realestate.com.au, but these advertised prices can often be frustratingly inaccurate (or no prices quoted at all). Try monitoring the ‘sold’ sections on these websites to get an idea of what the final selling prices are. Again, attending auctions will also give you an idea of current selling prices and what budgets fellow property buyers have.

- Don’t let real estate agents pressure you – agents love Spring time. It is their time to make as much sales commission as they can, as quickly as they can. They use various tactics to help them achieve this. Don’t let them spook you with fear tactics like “it’s Spring, it will sell very quickly” and “property prices will just keep on going up from here”. They want you to be an emotional buyer. Try and stay in control. Make informed decisions. Be the smart buyer.

- Get your loan pre-approval sorted as early as possible – when going on your property hunt you never know when you might come across a property you want to make an offer or bid for. Work with a Mortgage Broker to determine your borrowing capacity and budget early, so you know how much you have to spend when you are attending property inspections. Plus get your Mortgage Broker to help you with a home loan pre-approval for a great home loan so you have an even stronger guide.

If you need assistance with a loan pre-approval or planning your property search you should organise a free Discovery Session with an FHBA Coach today.

For those out and about this weekend, there are plenty of auctions around according to CoreLogic, with more scheduled in the weeks ahead as Fathers Day passes, the footy season wraps up and as the weather gets warmer in the southern states:

- Adelaide – 72

- Brisbane – 116

- Canberra – 57

- Melbourne – 900

- Perth – 21

- Sydney – 725

- Tasmania – 8

Want to know more about this weekend’s auction activity? See the CoreLogic blog.

Good luck to all first home buyers in action this weekend!

Open homes and auction weather

COMING SOON

New hotspot in focus: Wanneroo (WA)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. This week we revealed our latest popular spot with first home buyers, Wannenroo in Western Australia.

- Wanneroo is located 30 km north of Perth CBD (and very close to the beaches on the north Perth coast)

- Wanneroo is part of a fast growing area that is receiving plenty of government investment

- Beautiful parks, shops, restaurants, bicycle paths, the glorious Indian Ocean at the doorsteps, Wanneroo (and surrounding suburbs) has plenty of lifestyle pluses that first timers love

- And despite the great lifestyle and proximity to Perth CBD, the median property price is….click here to reveal more

Wanneroo – location, lifestyle, affordable – great for first timers

House hunt with confidence

Planning on going house hunting soon but don’t know whether a bank will lend you enough funds to buy your first home yet?

You should get a no obligation home loan pre-approval! A loan pre-approval provides you written guidance of how much a particular bank is willing to lend to you. A loan pre-approval comes with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak with an FHBA Broker from FHBA Mortgages today

Search FHOG eligible homes from your couch

Are you in the market for a newly built property? This could be a house & land package, a townhouse or a newly constructed apartment. Search our new look ‘new homes’ portal this weekend to see hundreds of Grant eligible properties suitable for first home buyers!

Search first home buyer homes here

Friday News Review

https://www.facebook.com/fhbah/

Home loan deal of the week

for hot home loan deals for your first home get in touch with us today!

Never miss an FHBA Market Update or FHBA Weekend Preview!

Enjoy reading our free Market Updates and Weekend Previews? You are not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!

Written By,

First Home Buyers Australia

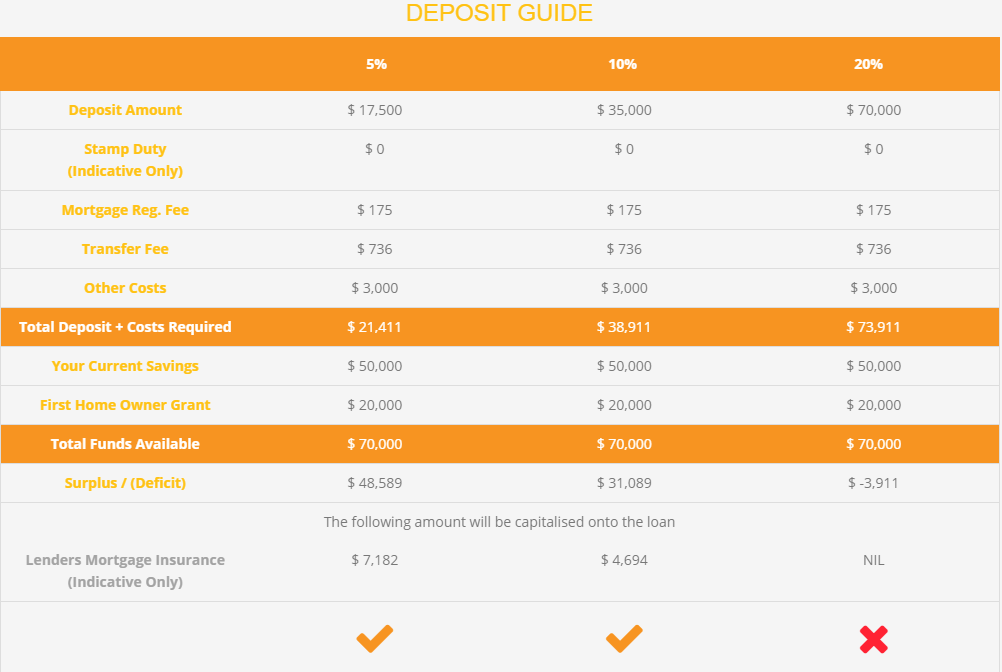

Wondering whether you have saved enough to form a deposit? Try the revamped FHBA Eligibility Estimator for free!

self-estimate if you have saved a deposit using our Eligibility Estimator now