FHBA Market Update: 28/August/2017

In today’s FHBA Market Update we take a look at where millennials are choosing to live, why first home buyer activity in Melbourne is falling, the launch of a new political party focused on housing affordability, our latest favourite properties for first home buyers, the latest auction clearance rates, the latest property prices around the country, why Liverpool is loved by first home buyers in Sydney and the modern day loan pre-approval for first home buyers.

It is part of a large and ongoing debate, where will our younger generations live? Many from Generation Y (also known as ‘millennials’) want to live close to capital cities for lifestyle, employment and family reasons. However, we all know that generally the closer to a capital city you live, the more expensive the cost of housing (whether you are buying or renting) is. Therefore younger generations often need to consider trade offs and sacrifices, such as living further out, or getting accommodation with less luxurious features.

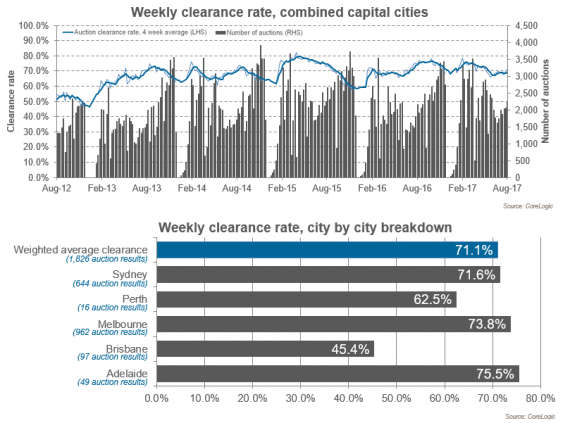

Gen Y also like to live near other young people. So today we thought we would show you, using information from the most recent Cenus, which postcodes have been seeing the largest increases in Gen Y population since 2011. Intriguingly there is a large variety of postcodes in this result, as seen in the infographic below.

(source: realestate.com.au)

This information was compiled by realestate.com.au earlier this month. You can see the full report here.

So where will you buy your first home? And how? As an owner-occupier, as a rentvestor, or perhaps some other alternative way? At FHBA we understand that a first property purchase is different for everyone. There is no one place, size and method that fits all. In fact far from it. To get tailored help with your planning get in touch with us today.

Speak with an FHBA Coach to start your first home planning

More First Home Buyer News

- First home buyer activity in Melbourne falls – with property prices continuing to surge in Melbourne the proportion of first home buyer activity continues to fall – see the report in Domain

- The modern-day loan pre-approval – what does a home loan pre-approval mean to a first home buyer in today’s property market? – learn all about the modern day loan pre-approval in FHBA News

- New political party focused on better housing policies launches – last week a new political party, which wants to see the end of negative gearing and the Capital Gains Tax (CGT) discount, launched – learn about the new Affordable Housing Party on news.com.au

Current hotspot in focus: Liverpool (NSW)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current first home buyer hotspot is Liverpool, NSW.

- Liverpool is located 32km southwest of Sydney CBD (& 12km south of Parramatta)

- Liverpool is of only a handful of regions in Sydney still considered ‘affordable’

- Liverpool has good public transport to employment hubs across Sydney and will only benefit from Badgerys Creek international airport being built not too far away

- The Liverpool town centre is currently going through significant renewal, the magnitude of which you can gather from this NSW government artist impression below

Liverpool (above) is a hotspot for Sydney first home buyers

Capital City Property Price Movements: 28/August/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Over the last three months Melbourne property prices have jumped 7%, resulting in a decrease in first home buyer activity according to Domain. Perth remains the only major capital city to experience annual property price falls, although more recently the Brisbane property market has softened.

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 487.55 | + 0.5% | + 3.8% |

| Brisbane: 557.24 | – 0.7% | + 3.6% |

| Melbourne: 950.01 | + 7.0% | + 15.4% |

| Perth: 563.35 | – 0.2% | – 3.4% |

| Sydney: 1137.65 | + 4.0% | + 11.4% |

(source: CoreLogic)

Interest Rates Update: 28/August/2017

Next week the Reserve Bank of Australia (RBA) will meet to review the official cash rate. So far there have been no changes to the cash rate in 2017. Lenders continue to provide competitive offers to first home buyers.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

New Homes of the Week (edition 69)

These are our top picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! All the homes are affordably priced for aspiring first home buyers:

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

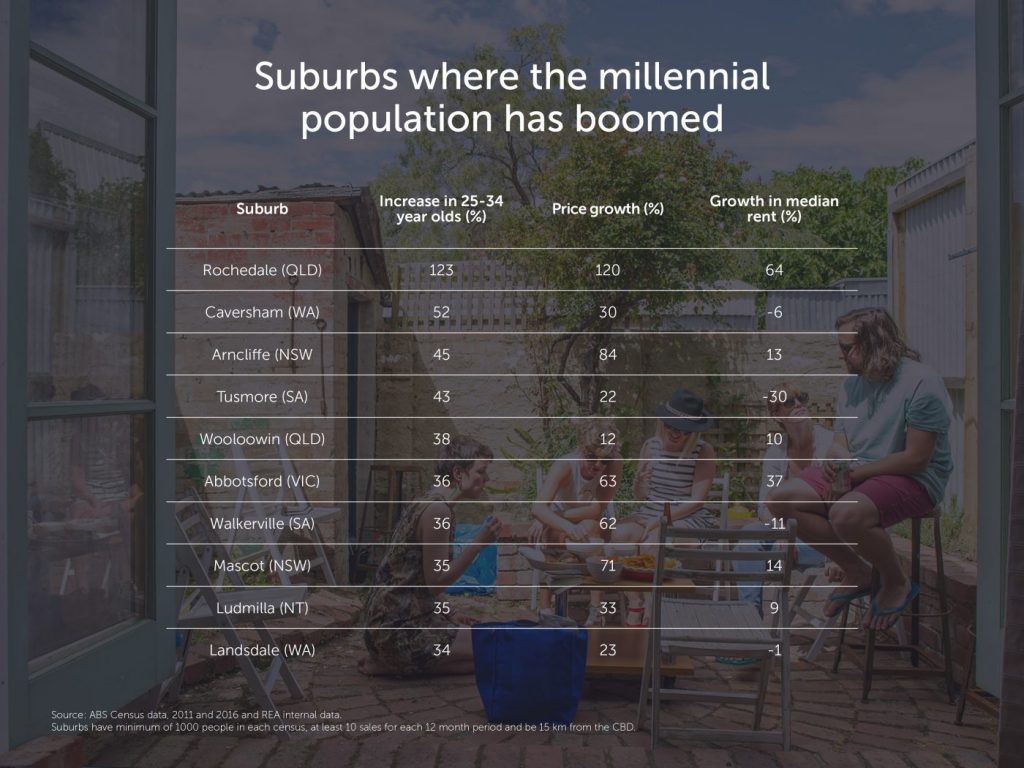

Preliminary Weekend Auction Clearance Rates (26 – 27 August 2017)

(source: CoreLogic)

Tweet of the Week

Concerned about #housingaffordability? There is a new political party in town: @AFHPAustralia https://t.co/sHcxyoQtEc @BenedictBrook #auspol

— FHBA (@fhba_com_au) August 24, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia