FHBA Property Market Update – Top story

On Sunday night it was the 2017 grand final of the channel 9 TV series, The Block. The Block grand final is always known for their entertaining and rather dramatic auctions. For the contestants of the show, their prize money all comes down to the results of auction day. It can be quite stressful to say the least. So are everyday auctions.

While The Block is a commercial TV program (and a very successful one at that), the auctions are very much real. Yes, celebrity Dave Hughes really did buy Josh & Elyse’s winning house. Each auction even had a representative from the Consumer Affairs Victoria to ensure that the auctions were being held within the real estate laws of Victoria.

Perhaps what might be less common about the auctions of The Block is that they are not too many everyday punters in the room. All the action seems to be amongst the ‘pros’ in the room. Representing the interests of the selling parties, the sales agents along with the auctioneer and representing the interests of buyers, Buyers Advocates who are trying to get their clients a successful purchase of the property at the lowest price possible. Sounds simple enough.

Well not really. It gets quite tricky watching the pros utilise different strategies to try and get the auctions to run the way they want it to. Take constants Georgia & Ronnie for example. They passed their property in at the auction, only to sell the property to a different Buyers Advocate to the one that made the highest bid during the auction moments earlier. This resulted in the selling party maximising the sale price, giving Georgia & Ronnie 3rd spot rather than 5th. And a different buyer ultimately sneaked in to buy the property over the one that was originally the highest bidder.

Was it all legal? Yes, says Consumer Affairs Victoria. Was it tricky? Absolutely.

Transparency in real estate is a big problem in general in Australia – whether property is being sold via auction or private treaty. Some, like us, are pushing for more transparency in real estate transactions, but in the meantime first home buyers need to research the rules of their state and learn different strategies so that when they find the property they want to buy, they give themselves the best chance possible to outbid other property seekers & investors.

Looking for tips on buying your first home? Check out our hot tips section!

For the record, Georgia & Ronnie’s place was one of hundreds of auctions that passed in on the weekend in Melbourne, according to CoreLogic data.

Last tip first home buyers – don’t be afraid to ask for help!

The concept of auctions seem easy enough, but they can get quite tricky

Enjoy the rest of your weekly FHBA Property Market Update.

More First Home Buyer News

- A place close to Sydney that is still affordable? – These days it is very rare to hear ‘Sydney’ and ‘affordable’ in the one sentence. But that is true for this location – FHBA co-founder Taj Singh spoke with Domain about increased first home buyer interest in the Central Coast

- Split home loans are increasingly popular with first-timers – When it comes to the outlook of interest rates, no one has a crystal ball on what will happen in the future and that is one key reason why split loans are becoming increasingly popular with first home buyers – learn more about split home loans in FHBA News

- A new provider of home loans – Australia’s most popular real estate website, realestate.com.au, has partnered up with ‘big 4’ bank, NAB, to provide a new home loan service to property buyers – learn about the pros & cons of realestate.com.au Home Loans in FHBA News

Capital City Property Price Movements: 30/October/2017

Updated daily, the CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Would have you guessed that over the last 3 months the Sydney property market has seen property values decline as much as the struggling Perth property market?

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 113.28 | + 0.2% | + 4.7% |

| Brisbane: 109.36 | +0.6% | + 3.2% |

| Melbourne: 156.41 | + 1.9% | + 11.0% |

| Perth: 95.24 | – 0.7% | – 2.6% |

| Sydney: 175.75 | – 0.7% | + 7.8% |

(Source: CoreLogic)

New Homes of the Week (edition 78)

Introducing our top five picks for First Home Owner Grant (FHOG) (& FHBA 50 Rebate) eligible properties this week! We apologise, but for this week’s properties you must enquire in order for us to develop an FHBA 50 Rebate quote but be rest assured that we will try and maximise the size of the cash rebate for you. If you are interested in any of these properties or want assistance in searching for other opportunities get in touch with our team for a complimentary consultation.

| New home of the week | State FHOG* | FHBA 50 Rebate* | View Property |

|---|---|---|---|

| New South Wales | $10,000 | ‘on enquiry’ | See property |

| Queensland | $20,000 | ‘on enquiry’ | See property |

| South Australia | $15,000 | ‘on enquiry’ | See property |

| Victoria | $10,000 | ‘on enquiry’ | See property |

| Western Australia | $10,000 | ‘on enquiry’ | See property |

Nice entry level living in South East Queensland – from $315,000

Did you know??

Our FHBA New Homes service can help you compare hundreds of new property options from a large variety of property developers and agencies (including house & land packages, apartments, townhouses, duplexes, terraces and more)? Plus, we are the only ones to offer the FHBA 50 Rebate on top of the First Home Owners Grant*. Get in contact with us so we can help you with your search to find your unique slice of the great Australian dream today! Sounds great!

*FHOG & FHBA 50 Rebate amounts are estimates only. Eligibility rules apply. Speak to an FHBA Coach for details.

Interest Rates Update: 30/October/2017

Wondering what will happen to interest rates before an announcement by the Reserve Bank of Australia (RBA)? The ASX (Australian Stock Exchange) Rate Indicator shows market expectations of a change in the official cash rate set by the RBA. The indicator calculates a % probability of an RBA interest rate change. To learn more about the ASX Rate Indicator and see current market expectations visit the ASX website.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

https://www.facebook.com/fhbah/posts/1341284822660718

New hotspot in focus: Central Coast (NSW)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Introducing our new hotspot in focus, Wyong (and the broader Central Coast region) of NSW:

- Wyong is an affordable housing area located approximately 90km’s drive North of Sydney CBD and 70km’s drive from Newcastle.

- Wyong is one area that is within a reasonable commute to Sydney CBD (via the freeway or train) that is still considered affordable, with a median dwelling price of around $536,000 according to APM data

- Much of the Central Coast property is still priced under thresholds to receive the NSW Governments’ first home buyer incentives such as the First Home Owners Grant and Stamp Duty exemption (or concession)

- Learn more about Wyong and surrounding areas in our hotspot in focus article

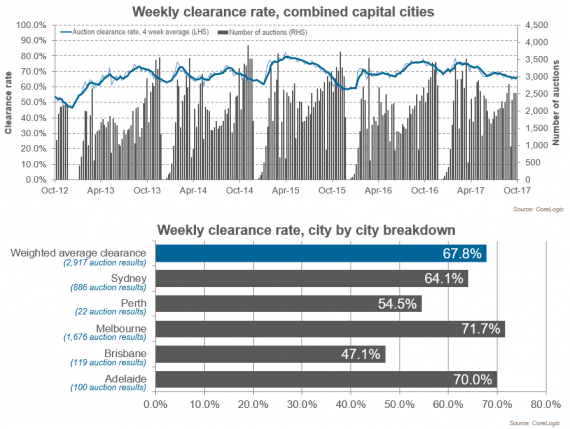

Preliminary Weekend Auction Clearance Rates (28th – 29th of October)

(Source: CoreLogic)

FHBA Social

A quick snap of what’s trending on our social media accounts – are you participating in the conversations?

https://www.facebook.com/fhbah/posts/1344381225684411

Thus far, stamp duty concessions have NOT resulted in increased #ausproperty prices. #FHBA #aushousing #auspol https://t.co/Zt2Lq4YPmQ

— FHBA (@fhba_com_au) October 25, 2017

https://www.instagram.com/p/BacYBoCn3HL/?hl=en&taken-by=fhba_firsthomebuyersaustralia

https://www.linkedin.com/feed/update/urn:li:activity:6329138367183355904

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia

Jessica Irvine’s Diary of a First Home Buyer: Week 6

https://www.facebook.com/fhbah/posts/1345753968880470

Are you planning on entering the property market soon?

Regardless of who you are or what you are looking for, before you commence house hunting you should get a no obligation home loan pre-approval!

A loan pre-approval provides you with written guidance of how much a particular bank is willing to lend to you, so you can determine your approximate borrowing capacity. A loan pre-approval comes with no obligations to proceed with a home loan application, leaving you in control and importantly, attending open homes knowing what your budget is.

Get a no cost loan pre-approval by speaking with an FHBA Lending Adviser today