FHBA Market Update: 21/August/2017

In today’s FHBA Market Update we take a look at how there are less and less properties being sold in a typical first home buyers price range, why property developer Tim Gurner is sticking by his comments about younger generations needing to give up avocado and coffee, whose property price predictions you can trust, how more Australians are relying on cash inheritance in order to afford the great Australian dream, whether avoiding Lenders Mortgage Insurance is a good idea (or not), our latest favourite properties for first home buyers, the latest auction clearance rates, the latest property prices around the country and why Liverpool is a hotspot for first home buyers in Sydney.

While it varies from state to state, did you know that the average first home buyer spends around $400,000 on their first home according to government housing data? What is concerning is that the amount of housing being sold under $400,000 is falling at a fast pace according to Australia’s largest property data provider, CoreLogic. This suggests that there are a fewer potential properties in Australia that first home buyers can afford.

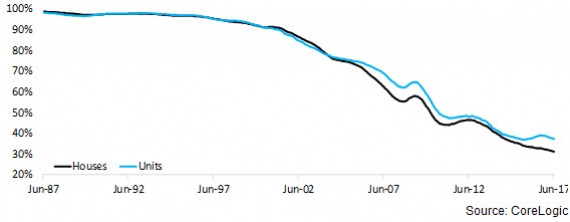

Across the nation, 31.2% of houses and 37.3% of units sold over the last year transacted for less than $400,000. By comparison, a year ago the proportions were recorded at 32.8% for houses and 38.6% for units. A decade ago, 62.4% of all house sales and 68.9% of unit sales were priced below $400,000. This steady decline is shown in the graph below:

Graph: annual % of sales below $400,000 (national) Source: CoreLogic

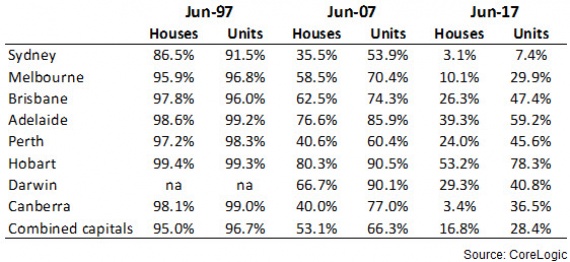

Of course the quantity of properties priced below $400,000 varies from city-to-city. It is of little surprise that Sydney has the least portion of properties priced under $400,000 (versus total properties sold) and Hobart has the most. The breakdown of the capital cities is shown in the table below:

Table: annual % of sales below $400,000 (individual capital cities) Source: CoreLogic

Clearly more needs to be done to boost housing supply in the sub $400,000 bracket. This is something we are campaigning Australia’s governments for. But as an individual first home buyer, you need to carefully plan your first home purchase. This could mean considering alternative areas, or saving a bigger deposit. Remember, an FHBA Coach can assist you with your planning. Enjoy the rest of the FHBA Market Update.

More First Home Buyer News

- To avoid LMI or not avoid LMI? – Lenders Mortgage Insurance (LMI) protects the lender, not the borrower. But should first home buyers save a smaller deposit and accept the LMI cost, or save a bigger deposit and avoid paying LMI? – read the answers in FHBA News

- Whose property forecasts can I trust? – There are a range of ‘experts’ you will see make property price predictions, but which predictions can you trust to make an informed decision based upon? – get the answer in FHBA News

- ‘Avocado man’ sticks by his comments home buyers – Property developer Tim Gurner, famous for his smashed avocado and coffee reference on 60 minutes earlier this year, has told Domain he stands by his comments, although they were taken a little out of context he claims – learn what Mr Gurner had to say in Domain

- 1 in 4 banking on inheritance for first home – According to a new survey one in four Gen Y’s have admitted they will need inheritance cash to help afford a property in certain parts of Australia – see the survey results in Domain or watch FHBA co-founder Daniel Cohen’s thoughts on Ten News below.

https://www.facebook.com/tennews/videos/1606996789370622/

New hotspot in focus: Liverpool (NSW)

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our latest first home buyer hotspot is Liverpool, NSW.

- Liverpool is located 32km south west of Sydney CBD (& 12km south of Parramatta)

- Liverpool is of only a handful of regions in Sydney still considered ‘affordable’

- Liverpool has good public transport to employment hubs across Sydney and will only benefit from Badgerys Creek international airport being built not too far away

- The Liverpool town centre is currently going through significant renewal, the magnitude of which you can gather from this NSW government artist impression below

Liverpool (above) is a hotspot for Sydney first home buyers

Capital City Property Price Movements: 21/August/2017

Updated daily, The CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. Look at the difference between Australia’s second largest city, Melbourne and Australia’s third largest city, Brisbane, over the last 3 months. Very different market conditions in these two cities right now shows the importance of getting advice on local market conditions when purchasing your first home.

| Capital City Index Score | Qtr on Qtr

% Change |

Yr on Yr

% Change |

|---|---|---|

| Adelaide: 491.42 | + 1.7% | + 4.7% |

| Brisbane: 554.51 | – 1.0% | + 3.1% |

| Melbourne: 950.43 | + 6.6% | + 16.4% |

| Perth: 567.65 | + 0.8% | – 0.9% |

| Sydney: 1142.12 | + 4.3% | + 12.1% |

(Source: CoreLogic)

Interest Rates Update: 21/August/2017

In August the Reserve Bank of Australia (RBA) opted to leave the official cash rate on hold at a record low of 1.50%. In the betting markets most money is on no rate changes in 2017, although more money is on a rate increase being the next RBA move (over a rate decrease).

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak with a home loan expert

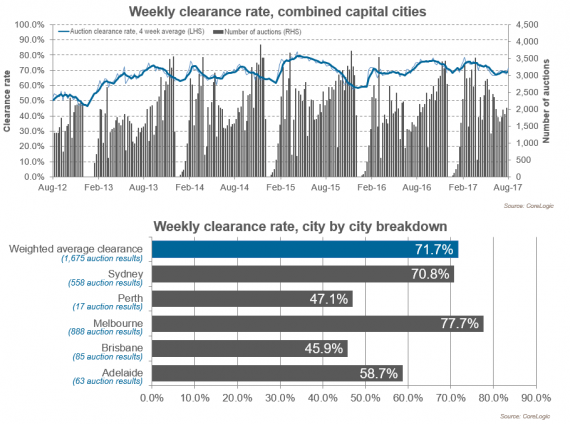

Preliminary Weekend Auction Clearance Rates (19 – 20 August 2017)

(Source: CoreLogic)

Tweet of the Week

The ins & outs of a #homeloan pre-approval – a great place for #firsthomebuyers to start: https://t.co/L2BxS6B4ww #ausproperty #fhba

— FHBA (@fhba_com_au) August 16, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia