Dear Mr Turnbull & Mr Morrison,

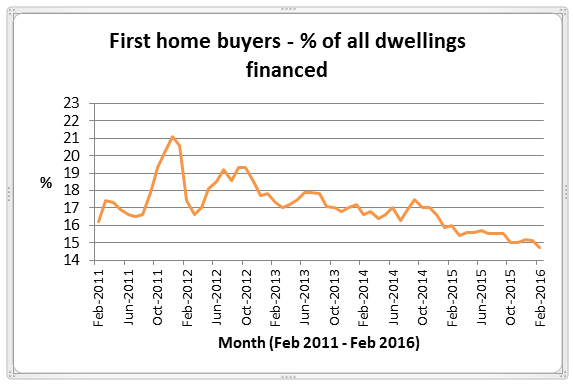

On Sunday the 24th of April, the Liberal party announced that if re-elected you won’t do anything to alter the far too generous tax incentives only investors receive, such as negative gearing and the capital gains tax discount. Further, you had nothing at all to offer struggling first home buyers, whose percentage of the property market place continues to fall according to Government statistics.

The Great Australian Dream has always been home ownership, a safe roof over the head for Australian families. Why won’t you help the younger generations achieve the long desired Great Australian Dream who are statistically finding it harder than any previous generation? Why are you ignoring them?

We could provide you with a report over 100 pages showing the economic struggles of aspiring first home buyers. But we trust you have these statistics on hand being the government (we do hope they aren’t at the bottom of your pile though). What we would like to point out is a more than just an economic issue, it is a major social issue as well. Has it occurred to the Government that young Australian families are getting married later and having babies later (or not all) due to affordability reasons?

This is such an important issue, not something you should be playing political games with. If you disagree with Labor’s proposed policy on CGT & negative gearing, there are other options to reform these policies and there are also other policies you can introduce to address housing affordability, the number one issue for the Australian’s of tomorrow.

Here are 3 suggestions we have that allow you to differentiate yourself from the other political parties, create a fairer tax system, assist the budget bottom line and help young Australians achieve the Great Australian Dream:

- Reduce ‘interest costs’ deductibility on investments from 100% deductible to 50% deductible

- Introduce a tier scaled CGT discount system, with the discount increasing based on the number of years the investment is held

- Reintroduce the First Home Savers Account (FHSA) with enhanced features such as an ability to salary sacrifice pre-tax wages, no tax on investment earnings, a reduced 3 year minimum investment rule and an ability to invest in assets other than cash such as managed funds.

While we don’t entirely agree with the Labor party’s recent policy recommendation on negative gearing, at least they are showing us enough to suggest they are attempting to level the playing field for first home buyers. Leaving negative gearing as it is, because it’s just what we are use to, is just plain lazy and ignorant. It’s time for reform.

Mr Turnbull & Mr Morrison, we want to provide you with the opportunity to show you still care about young Australians working hard to achieve the Great Australian Dream. Perhaps you can answer these questions?

- By leaving negative gearing rules as they are, how are first home buyers going to compete with richer investors who also have greater government incentives to purchase more properties?

- In February, Mr Scott Morrison suggested changes to negative gearing were very possible (in response to Labor’s announcement). What has happened over the last 2 months that made Mr Morrison & your party change your mind?

- On Sunday 24th April 2016, you suggested the key to improving housing affordability is to provide more apartments & houses. What policy reform do you plan to implement to encourage & facilitate increased affordable housing?

- On Sunday 24th April 2016, you suggested the key to improving housing affordability is to provide more apartments & houses. ALP’s policy recommendation, which is biased in favour of new housing, is more likely to boost housing supply is it not?

- Are you aware how much the generous investor tax incentives are costing the Government?

- Why is it that a few of your Liberal MP’s recently stated that negative gearing is actually driving up property prices and worsening the housing affordability crisis?

- Why are you convincing the 90% of taxpayers who don’t negatively gear to keep paying more tax to support the 10% of taxpayers that negatively gear?

- The top 10 electorates for claiming negative gearing losses are run by Liberal members. Was your announcement on the 24th of April aimed at making sure these members are re-elected so investors can continue negatively gear multiple properties?

- How do you feel about tax dollars advantaging those who are already advantaged, while locking out those who just want a house to live in for themselves for their first time?

- Are there any policies you will implement to help the struggling first home buyer?