Disclaimer: The information on our website is general in nature and should not be relied upon as financial advice. In particular, this blog has been prepared by a guest, Daniel Kirkovski, who is a charted accountant. If you have any queries regarding your tax affairs, please contact your Accountant or get in touch with Daniel Kirkovski.

Welcome to the wonderful world of income tax!

It’s that time of the year when the average income taxpayer eagerly awaits their PAYG Payment Summary(s) (aka group certificates) from their employers in order to get their ‘tax back’. You hear conversations aplenty at home, in the workplace and in social scenes of people asking others how much they got back in previous years, followed by, what did you claim, can your accountant help me. All these questions, with the ultimate goal of maximising their tax refund.

Though most taxpayers hold a sense of entitlement of getting their tax back, the burning question remains does the taxpayer know why they are getting an income tax refund or their ‘tax back’. Provided below is a snapshot of how the Australian tax system works and the two general contributing factors to people getting their tax back.

How is your income tax calculated?

Broadly, income tax payable by a taxpayer is based on the notion of taxable income. Taxable income is:

Assessable Income – Allowable Deductions

Assessable income is the combination of all income which you have received including salaries and wages, interest income, dividend income, rental income etc. Allowable deductions are those costs which have been incurred/paid by the taxpayer which directly relate to the assessable income included in the return (the term ‘directly related’ will be further explored in our next post).

The tax system

The taxation system in Australia is based on equalisation. In a perfect world, the amount of income tax paid by the taxpayer during the year, will, equal to the amount of income tax they should have paid as prescribed in the legislation. As such, upon lodgement of their return, the result should be a nil position. However, the perfect world does not exist and as such, in almost all cases, the taxpayer at lodgement time will have either tax to pay or be getting some ‘tax back.’

Though a large number of taxpayers have a perception, they are entitled to ‘tax back’ the only income tax they receive is the amount above the amount required as shown in the legislation.

If the system is modelled on equalisation – how do I get a tax refund?

There are 2 major contributors which result in a taxpayer receiving a tax refund upon lodging their income tax return:

- By having paid more income tax than they should have i.e. above their equalisation amount; and/or

- Incurring deductions or losses which relate to their income i.e. costs associated with your employment including home office, uniforms, stationary, books etc, which subsequently reduces their taxable income.

Each one is discussed below.

Pay more income tax

Income tax is refundable if the individual has paid more than what they should have. As this is a taxing system, any amount which is above or below the equalised amount, will result in a like for like change in the individual’s tax position.

For example, a taxpayer received a wage/salary of $35,000, for which they were meant to pay income tax of $3,500 during the year. However, their employer mistakenly withheld $4,000. As a result, upon lodgement of the individual’s tax return, they will be entitled to a $500 refund ($4,000 less $3,500).

If, however, the employer only withheld $3,000 on the salary/wage of $35,000, the taxpayer would have a payable of $500, which is the shortfall.

Therefore, any adjustment, above or below, the equalised amount, will result in a $1 for $1 change.

Incur deductions

Deductions reduce your taxable income. Therefore, the lower your taxable income, the lower the amount of tax that is required to be paid.

In a large amount of cases, taxpayers will have incurred some cost which related to their assessable income, and as such, are entitled to claim this as a deduction in their income tax return. However, the claiming of a deduction in your return does not result in a $1 for $1 change as income tax does. In fact, the income tax saved by incurred/paid deductions is calculated with reference to your income tax bracket.

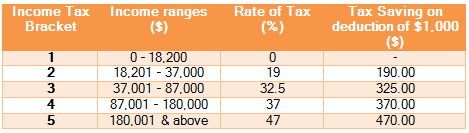

There are 5 tax brackets for individuals in Australia. Put simply, the higher the rate of income tax paid, the greater the tax saving received from incurring deductions. As such, if an individual, in each tax bracket, was to incur a deduction of $1,000, the tax saving will be as follows:

As you can see from the above, the perceived conception of being entitled to tax back is as a result of your paying additional income tax or incurring deductions. If you pay more income tax than what you should have, you will receive a refund of $1 for each $1 overpaid. However, if your taxable income, and subsequently, income tax payable, is reduced by the incurring of a deduction, this will result in marginal decrease in income tax, depending on the rate of income tax payable.

Do you do your own tax return or use an Accountant?

Need help with your tax return?

My name is Daniel Kirkovski; I am a passionate Charted Accountant and founder of DJK Partners. At DJK Partners we always put our clients first when utilising our accounting and tax expertise. Our job is not finished until you are happy. I invite you to visit our website and get in touch with us today.

Written By,

Daniel Kirkovski CA

Principal – DJK Partners

![]()