FHBA Market Update: 26 June 2017

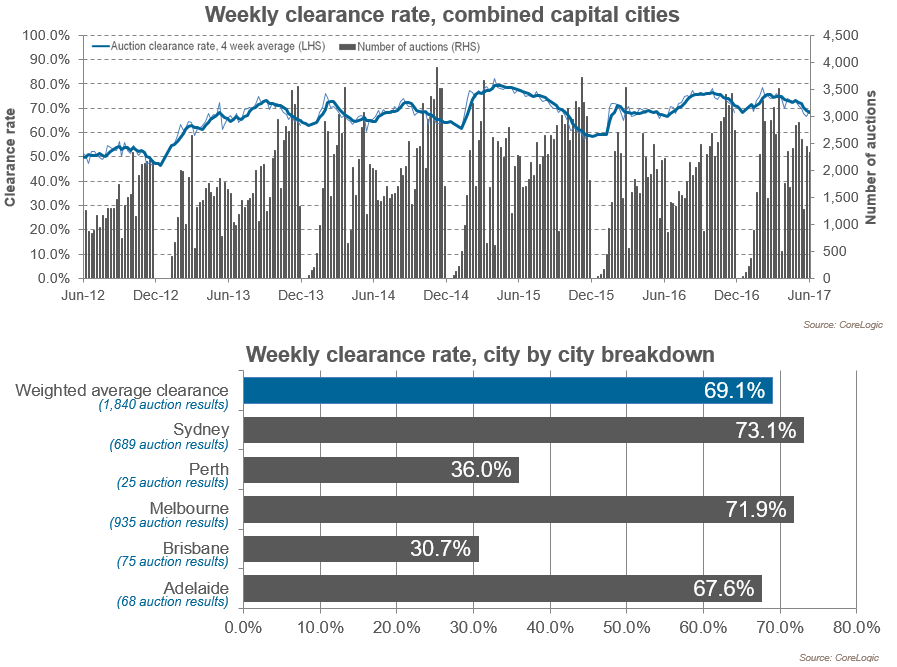

Auction clearance rates are continuing to trend lower according to Australia’s leading residential property research house CoreLogic. This is welcome news to those aspiring first home buyers who have been sitting on the sidelines waiting for new first home buyer incentives set to kick in from 1 July 2017 (in selected states). Later this week we will summarise all the changes in all of the states right here in FHBA News.

One major question many first home buyers have in mind is ‘do I race out and take advantage of the changes or do I wait a little bit longer?’ This is a great question to ask – but the answer is not so easy. Every property market is different and as cliche as it may sound, you should always consider your circumstances and goals.

At FHBA we can assist you in exploring your options so that you can make an informed decision. If you are going to buy soon it would be great to organise a home loan pre-approval now, however, if you haven’t saved a deposit yet, than ultimately you need to work on this before you start thinking about taking advantage of any grants or stamp duty concessions. Don’t worry – you don’t need to be an expert in working all this out – our FHBA Coaches can help you work all this out and more. Want to know what else an FHBA Coach can do for you? Find out here.

In other news this week our co-founder Taj Singh spoke to Domain about the potential impacts stamp duty changes could have on the NSW property market, we take a look at how banks are favouring first home buyer customers over investors, the latest property prices, our latest edition of favourite first home buyer new homes and how the South Australian government is supporting inner-city living with new incentives for home buyers. Enjoy your weekly FHBA Market Update.

Be ready for when the first home buyer concessions kick in – speak with an FHBA Coach

First Home Buyer News

- Will house prices rise as a result of the NSW stamp duty changes for fhb’s? – Our co-founder Taj Singh last week joined a panel of experts to speak with Domain about the potential impact the stamp duty partial and full exemptions will have on the property markets – see what Taj had to say in Domain

- Boost for Adelaide off-the-plan apartment buyers – In a bid to create a more vibrant city last week the South Australian government announced a pre-construction grant of $10,000 for home buyers purchasing an off-the-plan apartment before 30 September 2017 (while stamp duty concessions for first home buyers have been extended by another 12 months) – learn more in FHBA News

- Banks are favouring first home buyer loans over investor loans – With lending conditions for investors tightening and concessions for first home buyers in most states increasing many of Australia’s home loan lenders are turning their focus to offering first home buyers great home loan deals – learn more and see some of the deals in FHBA News

Capital City Property Price Movements – as at 26/June/2017

Updated daily, The CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months:

- Adelaide: 479.28 (Qtr – 0.3% / Yr + 1.9%)

- Brisbane: 555.52 (Qtr + 0.8% / Yr + 3.3%)

- Melbourne: 906.22 (Qtr + 0.6% / Yr + 12.4%)

- Perth: 573.21 (Qtr – 0.3% / Yr – 2.0%)

- Sydney: 1113.95 (Qtr + 0.2% / Yr + 11.8%)

(Source: CoreLogic)

Preliminary Weekend Auction Clearance Rates (24 – 25 June 2017)

Source: CoreLogic

Interest Rates Update: 26/June/2017

As we mentioned earlier in this FHBA Market Update, if you are planning on buying your first home after 1 July you should consider commencing your planning now. Not only is it good to know how much you can borrow prior to attending open homes and inspections but there are also some great first home buyer loans around at the moment!

June home loan specials – be quick!

New Homes of the Week (edition 60)

These are our top picks for First Home Owner Grant (FHOG) eligible properties this week! All the homes are affordably priced for aspiring first home buyers.

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

House & Land packages (like the one above) can be found in Queensland’s newest beachside community!

Tweet of the Week

1 week until the 'July madness' beings? https://t.co/S7iNldCIMN #FHBA #ausproperty #realestate #auspol pic.twitter.com/bdXi8JWdJv

— FHBA (@fhba_com_au) June 26, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia