FHBA Market Update: 21/03/2017

19%….according to the latest CoreLogic Daily Home Value Index reading, that is how much dwelling prices have increased in Sydney over the last 12 months. Sydney isn’t the only capital city seeing high price growth either….Melbourne, Canberra and even Hobart are seeing strong gains as well.

And….according to Cameron Kusher, the Head of Research Australia at CoreLogic……the surge in investor activity is to blame for the big increases in property prices. Kusher analysed recent finance statistics obtained from the Australian Bureau of Statistics (ABS) to display the recent spike in investor lending.

“Clearly, investor lending is still very strong. We believe more measures are required to reduce investor lending” said FHBA co-founder Taj Singh. “And as for Turnbull, Morrison and the federal government, we are calling on them to admit that negative gearing and the Capital Gains Tax (CGT) Discount is adding fuel to investor demand, thereby adding pressure to property prices. It is time the Coalition admitted that these policies are pricing out first home buyers, they need to be reformed”.

In today’s FHBA Market Update you will learn more about the surge in investor lending, how FHBA is pushing the agenda for negative gearing & CGT discount reductions, as well as some special (rare) opportunities for first home buyers to buy a First Home Owner Grant (FHOG) eligible property that isn’t off-the-plan!

Enjoy your weekly FHBA Market Update.

News affecting first home buyers

In the past week, housing affordability has yet again continued to dominate headlines:

- Investor’s tell first home buyers to get out the way – According to ABS housing finance data for January 2017, investor total lending commitmments jumped 27.5% compared to January 2016. Using 4 graphs, Cameron Kusher from CoreLogic explains why a surge in investor activity is concerning – see the graphs at CoreLogic

- Plan’s for more affordable housing for police, teachers and nurses – The federal government is discussing with a few state governments a plan that could result in more affordable housing being built in some of the more premium locations…..but there’s a catch. It could be reserved for specific occupations, such as the police force, teachers and nurses. FHBA co-founder Taj Singh told news.com.au in an interview that such a measure would be welcomed….but FHBA would like to see more being done for all ocupations, not just select ones – learn about the proposal and the FHBA response on news.com.au

- FHBA pushes housing affordability agenda – On Sunday FHBA co-founder Daniel Cohen joined Mark Latham and Dr Cameron Murray on stage at the Housing Affordability Summit in Sydney. While Latham and Dr Murray were adamant that negative gearing is not the problem causing housing affordability woes, Daniel argued that negative gearing is a policy that needs winding back – watch a replay of Daniel’s full speech on Facebook live

Daniel Cohen [Left] and Mark Latham [Right] at Sunday’s Housing Affordability Debate in Sydney

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 21/March/2017):

- Adelaide – 480.29 (Qtr + 1.4% / Yr + 3.1%)

- Brisbane – 551.37 (Qtr + 0.2% / Yr + 4.6%)

- Melbourne – 900.46 (Qtr + 5.0% / Yr + 15.0%)

- Perth – 573.71 (Qtr – 1.0% / Yr – 3.8%)

- Sydney – 1106.28 (Qtr + 5.2% / Yr + 19.0%)

(Source: CoreLogic)

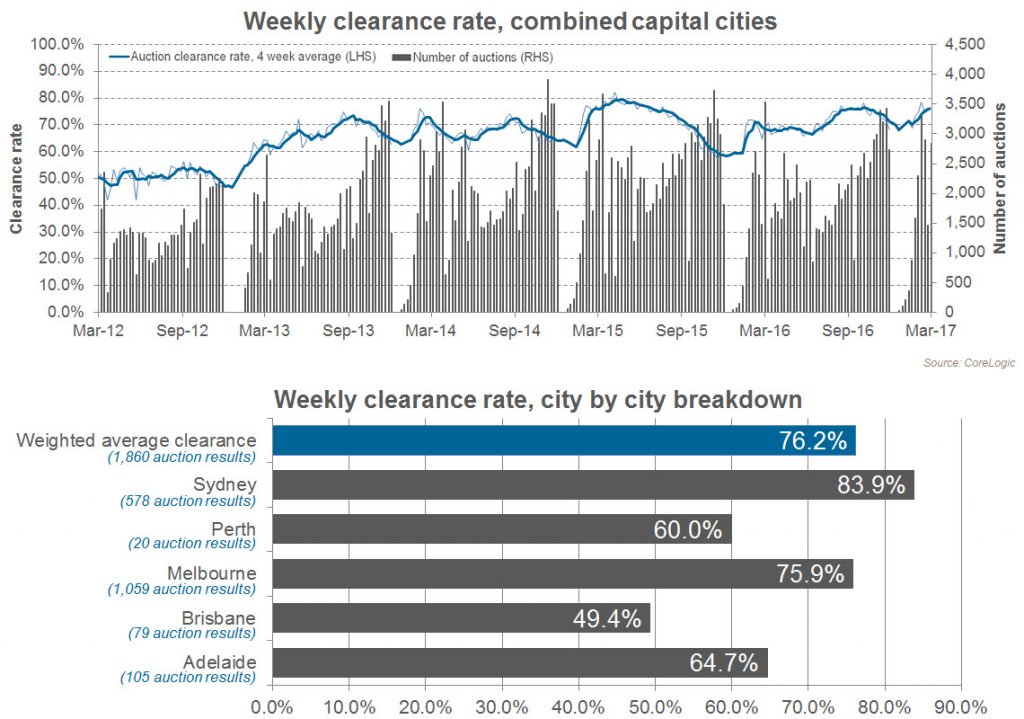

Preliminary Weekend Auction Clearance Rates (18th – 19th of March, 2017)

Source: CoreLogic

Interest Rates Update

In the last week, both NAB and Westpac have announced an increase to home loan interest rates due to the cost of funding rising.

New Homes of the Week (ed. 46)

You see so many first home buyers every week buying properties ‘off-the-plan’ in order to get a FHOG eligible property under the FHOG threshold cap these days. But did you know you can buy properties already constructed and get the FHOG? The key is that the property still needs to meet the ‘new’ definition….that is, that property has never been lived in before you buy it.

In this week’s edition of FHBA New Homes of the Week we selected 4 first home home buyers where construction is completed, they are FHOG eligible, and all that’s left is for you to make the purchase, apply for the FHOG and move in!

See this week’s best first home buyer homes

Tweet of the Week

The @LiberalAus can no longer ignore the affects of negative gearing & the CGT discount. By @David_Scutt https://t.co/beuC2ncHfR #FHBA

— FHBA (@fhba_com_au) March 20, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia