The Reserve Bank of Australia (RBA) has commenced 2018 by leaving the official cash rate on hold at 1.50% during their first rate review meeting for 2018. The cash rate has now been on hold since August 2016. We explore RBA’s reasoning, as well as take a look at what might lie ahead for the remainder of the year.

Disclaimer: Comments made in this article are either general in nature or quoted from the RBA press release. You should not soely rely on the information of this blog. You should consider seeking expert financial and/or credit advice before making any investment or house acquisition decisions.

Despite recent weak data on several fronts, as well as a turmoil stock market over the last few days, RBA Governor Philip Lowe remained relatively positively toned in the press release. The highlights of the media statement are summarised below.

RBA on the Economy

- “There was a broad-based pick up in the global economy in 2017”.

- “The central forecast for the Australian economy is for GDP growth to pick up, to average a bit above 3% over the next couple of years”.

- “Business conditions are positive and the outlook for non-mining business investment has imrpoved. Increased public infrastructure investment is also supporting the economy

- However, “one continuing source of uncertainty is the outlook for household consumption. Household incomes are growing slowly and debt levels are high”.

- “Employment growth has been strong over 2017 and the unemployment rate has declined”.

- “Employment has been rising in all states and has been accompanied by a rise in labour force participation”

- “The various forward-looking indicators continue to point to solid growth in employment over the period ahead”.

- “Wage growth remains low. This is likely to continue for a while yet, although the stronger economy should see some lift in wage growth over time”.

- “There are reports that some employers are finding it more difficult to hire workers with the necessary skills”.

RBA on Inflation

- “Inflation remains low”.

- “Higher commodity prices and tight labour markets are likely to see inflation increase over the next couple of years”.

RBA on the Property Market

- “Nationwide measures of housing prices are little changed over the past six months, with conditions having eased in Sydney. In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years”.

- “Tighter credit standards have been helpful in containing the build-up of risk in household balance sheets”.

Have you spoken to an expert about getting a home loan pre-approval?

What will the RBA likely do with the cash rate for the remainder for 2018?

Currently, markets say no rate changes are on the cards just yet (despite the record run of being on hold). An analysis of FHBA Mortgages panel of lenders show more competitive (i.e. lower) rates are available for shorter term fixed rate home loans, than longer term fixed periods. This suggest that Australia’s banks and lenders currently believe that interest rates are more likely to rise from where they are currently over the longer term (4 years +).

In terms of what the big 4 banks are thinking, 3 of the big 4 believe the RBA will raise the official cash rate at least once during 2018. See the 4 forecasts here.

Do you agree with these interest rate predictions?

I’m about to start looking for my first home. What should I do?

A great place to start is to speak with a qualified Mortgage Broker who specialises in first home buyers. A good Mortgage Broker can determine your borrowing capacity, assist you compare home loan options, help you get a home loan pre-approval, guide you through the whole finance process and of course, answer any jargon you don’t understand.

At First Home Buyers Australia (FHBA) we have linked up with Mortgage Australia Group (MAG) to provide the best mortgage broking service for first home buyers in Australia – FHBA Mortgages, powered by MAG. Why not start with a complimentary consultation with an FHBA Broker? Click here to find out more.

Learn more about FHBA Mortgages

I’m still saving for a home deposit – does the RBA’s announcement impact me?

Unfortunately, the rate of interest on savings accounts are relatively low at the moment. But when saving for a home deposit, as cliche as it may sound, every bit really does count. Here are some hot tips:

- Hot tip 1: Look at your expenses and consider whether you can cut back on any of your lifestyle expenses.

- Hot tip 2: When was the last time you looked at how much interest your savings is earning? When you have a spare moment, take the time to check your rate of interest and compare this to other savings accounts and term deposits around the net. Some of Australia’s leading comparison sites include Mozo, Canstar, Finder and RateCity.

- Hot tip 3: The First Home Super Saver (FHSS) became law in December. Read up on how it works and consider whether this could be something that will help you save your home deposit quicker. How the FHSS works.

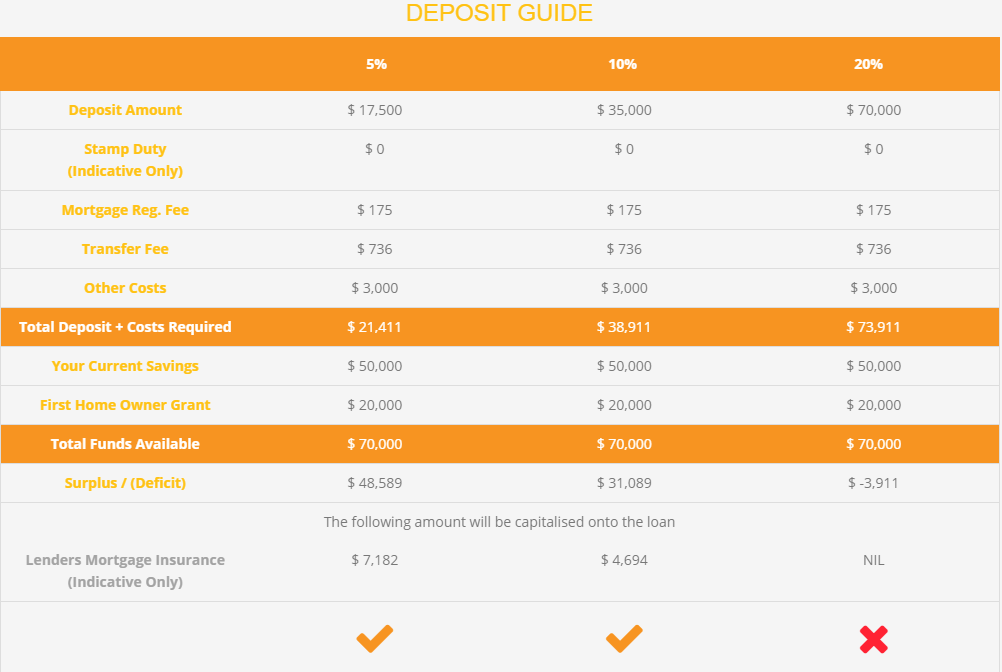

I have some money saved, but I’m not sure if it is enough?

Have you tried our FHBA Deposit Estimator? It gives you a quick snapshot of how your savings are going versus an estimate of how much more you might need to save in order to have the complete deposit. And it’s free! Try it now!

I want to know more about the RBA decision

Interested in reading the full RBA statement from the February board meeting? You can access the RBA media press release here.

When is the next RBA board meeting?

The next RBA board meeting will be held on Tuesday the 6th of March.

If you have any questions, get in touch with your FHBA Coach today – we’d be happy to help!

Written By,

First Home Buyers Australia

Did you know?

Did you know that you can protect yourself from a rate rise as a mortgage borrower? A fixed rate home loan allows you to lock in an interest rate for a period of time, such as 1 year – 7 years. This gives borrowers certainty around home loan repayments. But how do you choose whether to get a fixed rate home loan or go with the more common variable rate home loan option? Click here to learn more about your first home loan options.