FHBA Market Update: 06/03/2017

COULD the first weekend of Autumn 2017 prove symbolic for aspiring first home buyers?

Firstly, the most property markets were softer than the previous hot week, in terms of reported numbers at auctions and open houses, as well as preliminary auction clearance results.

Secondly, the Victorian government has announced a range of measures to assist struggling first home buyers in Victoria, including a Grant increase and further Stamp Duty concessions.

Thirdly, the federal government’s tune about housing affordability is beginning to change, with housing affordability originally not on the Turnbull government’s agenda, but now, the media is reporting that the federal government will have policies to address housing affordability as early as the May federal budget.

In today’s weekly FHBA Market Update, we take a closer look to see if life for aspiring first home buyers is about to get any easier.

News affecting first home buyers

In the past week, housing affordability and increasing first home buyer assistance has dominated headlines:

- Victorian Government announces increase to First Home Owners Grant – On Friday Victorian Premier Daniel Andrews announced that from 1 July 2017 the First Home Owners Grant (FHOG) will increase from $10,000 to $20,000 for eligible regional first home buyers – learn more in FHBA News

- Victoria announces Stamp Duty exemptions for first home buyers – On Sunday the Victorian Premier went on to announce further first home buyer assistance measures, including stamp duty exemptions for eligible first home buyers – learn more in FHBA News

- Housing affordability now on Turnbull Governments radar – In 2016 PM Malcolm Turnbull was quoted stating that housing affordability is not the responsibility of the federal government. How times have changed quickly. On Sunday night in an interview with Sky News, Treasurer Scott Morrison confessed that the Government is now working on a housing affordability package to be announced at the May Federal Budget – read more in the Sydney Morning Herald

More help for eligible Victorian first home buyers to start in July

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 06/March/2017):

- Adelaide – 476.54 (Qtr – 0.86% / Yr + 2.74%)

- Brisbane – 550.41 (Qtr + 0.99% / Yr + 3.70%)

- Melbourne – 890.73 (Qtr + 6.04% / Yr + 13.66%)

- Perth – 570.42 (Qtr – 0.83% / Yr – 4.23%)

- Sydney – 1101.10 (Qtr + 5.26% / Yr + 18.64%)

(Source: CoreLogic)

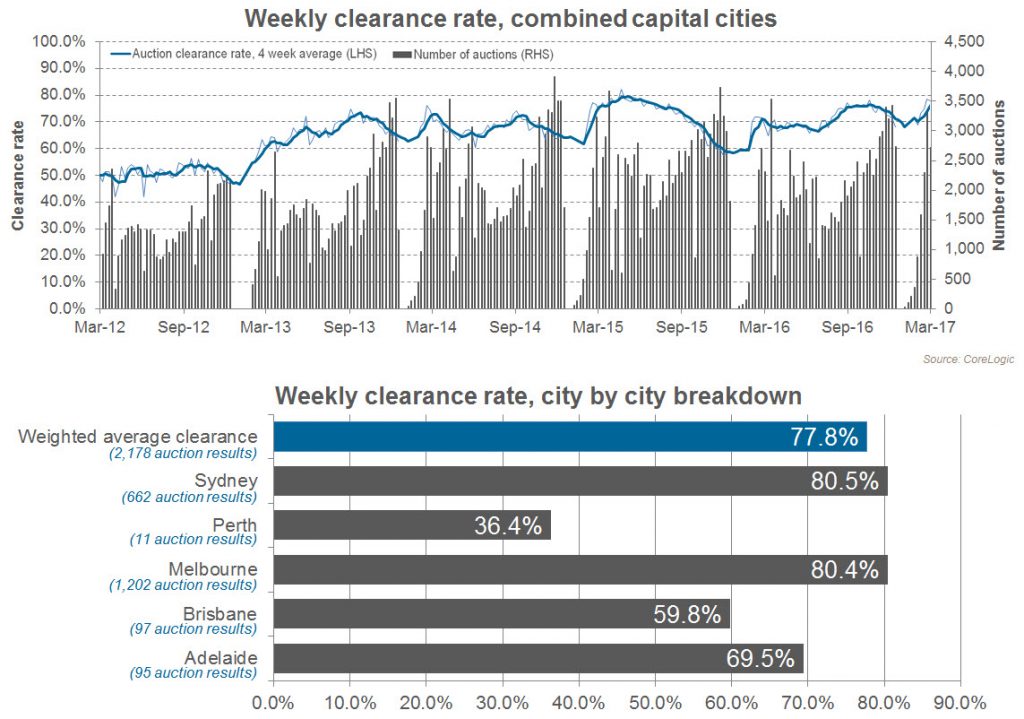

Preliminary Weekend Auction Clearance Rates (4th – 5th of March, 2017)

Source: CoreLogic

Interest Rates Update

Tomorrow the RBA board will meet for the second time in 2017 to review the official cash rate. Since last month’s decision to leave the cash rate on hold the RBA has noted they are unlikely to decrease rates any further at the current time as they do not wish to add any further heat to the Australian property market.

New Homes of the Week (Ed 44)

With summer behind us and Autumn well & truly underway, we dedicated this week’s edition of FHBA New Homes of the Week to First Home Owner Grant (FHOG) eligible homes that are located near stunning landscapes, gardens and bushland. Autumn is a time of the year Australians love to spend outside enjoying the environment. So why not buy your first home where you can spend a lot of time in the great outdoors?

See this week’s best first home buyer homes

Tweet of the Week

Locked out #NSW first home buyers will be hoping @GladysB follows @DanielAndrewsMP blueprint….swiftly. #FHBA #ausproperty https://t.co/KFZzjRaCtz

— Daniel Cohen (@DanielPCohen1) March 5, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia