FHBA Market Update: 29 May 2017

Has the Turnbull government ‘won’?

Has the Coalition government ‘ended’ the housing affordability debate?

The topic of housing affordability has dominated news headlines throughout 2017, but since the federal budget earlier this month (remember the proposed First Home Super Saver Scheme?) the topic of housing affordability has seen a drop off in media exposure.

Why? Perhaps the wider public believes that first home buyers are now getting help from the government and therefore other areas are more concerning now. Or maybe the media simply got tired reporting it. We are not sure. But what we are sure about is that the Scott Morrison budget failed to offer first home buyers enough help and therefore we will be keeping up our efforts to campaign for more assistance for first home buyers across the country.

Additionally, last Friday we launched our very own financial assistance for first home buyers entering the property market. FHBA co-founder Taj Singh said “we noticed an opportunity in the market to give back to first home buyers purchasing a new home in the form of a cash rebate. It can put thousands back into the pockets of first home buyers and we think first timers will love it. We call it the FHBA 50 Rebate”. You can learn more about the FHBA 50 Rebate here.

First home buyers will love the FHBA 50 Rebate

Enjoy reading the rest of our weekly FHBA Market Update.

First Home Buyer News

- NSW opposition leader put’s pressure on NSW government for more affordable housing supply – Owning your first home in Sydney is as tough as it get’s anywhere in the world. An increased First Home Owners Grant (FHOG) alone would not be enough help for most priced-out buyers. Affordable housing needs to be built, every single year and the NSW opposition leader Luke Foley believes the Labor Party have come up with a viable working solution – see Labor’s proposal on ABC News online

- New financial help for first home buyers – Our governments have not been doing enough to help first home buyers and the property industry always looks after themselves first. So FHBA is doing something themselves to help first-timers across the country – watch FHBA’s launch of a cash rebate for first home buyers in FHBA News

- 1 month until the FHOG falls for Queensland + WA first home buyers – At the end of June the government FHOG will fall by $5,000 in Queensland and Western Australia – learn more about the decreases in FHBA’s weekend edition

Capital City Property Prices Movement – as at 29/May/2017

The CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last quarter and over the last 12 months:

- Adelaide: 485.56 (Qtr + 1.7% / Yr + 2.3%)

- Brisbane: 560.72 (Qtr + 1.9% / Yr + 4.0%)

- Melbourne: 887.69 (Qtr + 0.6% / Yr + 11.4%)

- Perth: 564.72 (Qtr – 0.6% / Yr – 3.5%)

- Sydney: 1093.93 (Qtr + 0.0% / Yr + 11.0%)

(Source: CoreLogic)

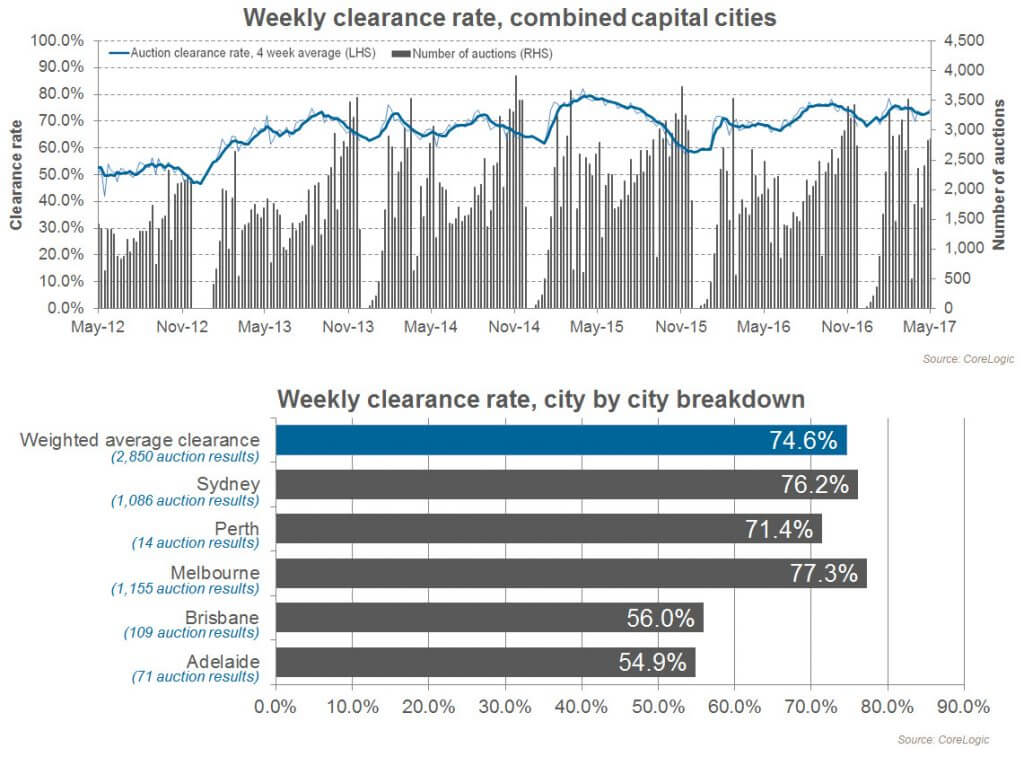

Preliminary Weekend Auction Clearance Rates (27-28 May 2017)

Source: CoreLogic

Interest Rates Update: 29/May/2017

With lending restrictions to investors tightening, banks are increasingly offering hot home loan specials for first home buyers. Talk to a Mortgage Broker today to see these specials!

- Compare a range of high interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

New Homes of the Week (edition 56)

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

“For our WA home of the week, when we say direct beach access, we really mean it“

Tweet of the Week

The brand new 'FHBA 50 Rebate' will put thousands pack into the pockets of first home buyers: https://t.co/98N2jkDrBf #FHBA #ausproperty pic.twitter.com/G3exxZDmsx

— FHBA (@fhba_com_au) May 28, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia