FHBA Weekend Preview: 12 – 13 August 2017

In today’s edition of FHBA Weekend Preview we take a look at the rise of the first home buyer, why Adelaide Hills is so popular with first home buyers, our five favourite new properties for first home buyers this weekend, a review of the top first home stories this week, the home loan of the week and a preview of this weekends auctions.

First home buyer activity is starting to improve according to several outlets including the Australian Bureau of Statistics (ABS). This week Treasurer Scott Morrison took to Facebook to try and take credit for the first home buyer fight back.

However, it may not really be the government’s policies that have caused the small increase in first home buyer activity. Some of the investor lending restrictions were made by bodies other than the Australian government, while stamp duty exemptions and discounts in key states of NSW and Victoria will also be having an effect. There are other factors too.

But what we want to quickly point out in today’s Weekend Preview is that you will see a lot of noise about first home buyer activity in the market in the weeks, months and even years ahead. After all, it is a hot issue with state and federal politicians, as well as the media. Plus, the Spring market returns in a few weeks. What is important however, is that you be aware of the noise, but you keep to your own path.

First home buyers vary across Australia (we should know, we deal with first home buyers every day!). Some buy as owner occupiers, others as investors, some buy as a couple, some are single, some buy new properties to receive the First Home Owners Grant, while others go for established housing (and so on and so-fourth). Just because you hear first home buyers are returning to the market does not mean you should rush. You still need to travel your course and seek professional advice for circumstances. Be aware of what others are doing and what the media is talking about. But don’t blindly follow.

And that is our big tip in today’s Weekend Preview.

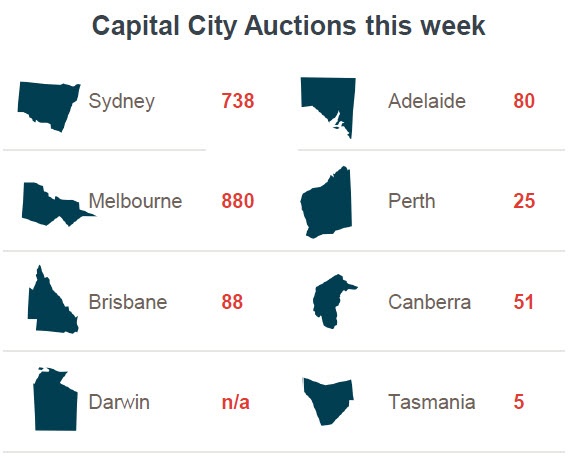

For those who are out and about this weekend, CoreLogic is reporting a busy week in auction activity:

Want to know more about this weekend’s auction activity? See the CoreLogic blog.

Good luck to all first home buyers this weekend – and remember, if you need assistance with planning your property search (or organising your finance), don’t forget to get in touch with an FHBA Coach.

First home buyer homes of the week: edition 66

These are our favourite 5 new properties for first home buyers looking for First Home Owner Grant eligible homes, this week. These properties are also eligible for the exclusive FHBA 50 Rebate! Which one is your favourite?

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

Room for a growing family in this Queensland first home

Open homes and auction weather

See what the weather will be like in your area before you attend open homes and auctions!

COMING SOON

Current hotspot in focus: Adelaide Hills

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot is Adelaide Hills in South Australia.

- Adelaide Hills is located 33km east of Adelaide

- Around a 30-minute drive to Adelaide CBD, it is close enough if you need to travel to the city for work or other reasons, yet far away enough that you can enjoy this lovely and peaceful part of Australia in all its glory

- There are plenty of suburbs across the region for you to consider calling home and with a median house price of $428,000 you will find you have plenty of options to consider

Oh Adelaide Hills – you are so beautiful

House hunt with confidence

Planning on going house hunting soon but don’t know whether a bank will lend you enough funds to buy your first home yet?

You should get a no obligation home loan pre-approval! A loan pre-approval provides you written guidance of how much a particular bank is willing to lend to you. A loan pre-approval comes with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak with an FHBA Broker from FHBA Mortgages today

Search FHOG eligible homes from your couch

Are you in the market for a newly built property? This could be a house & land package, a townhouse or a newly constructed apartment. Search our new look ‘new homes’ portal this weekend to see hundreds of Grant eligible properties suitable for first home buyers!

Search first home buyer homes here

Friday News Review

https://www.facebook.com/fhbah/posts/1281489475306920

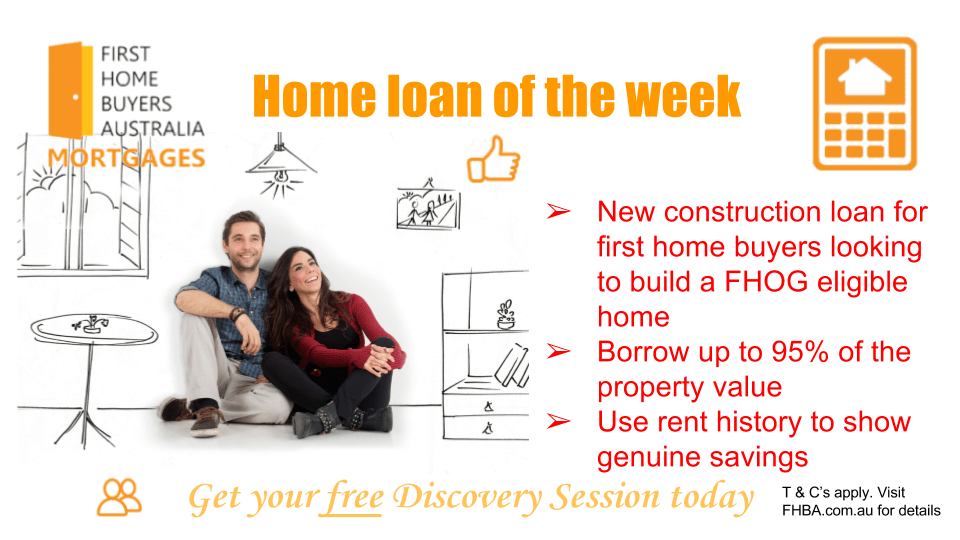

Home loan of the week

For hot home loan deals for your first home get in touch with us today!

Never miss an FHBA Market Update or FHBA Weekend Preview!

Enjoy reading our free Market Updates and Weekend Previews? You’re not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!

Written By,

First Home Buyers Australia

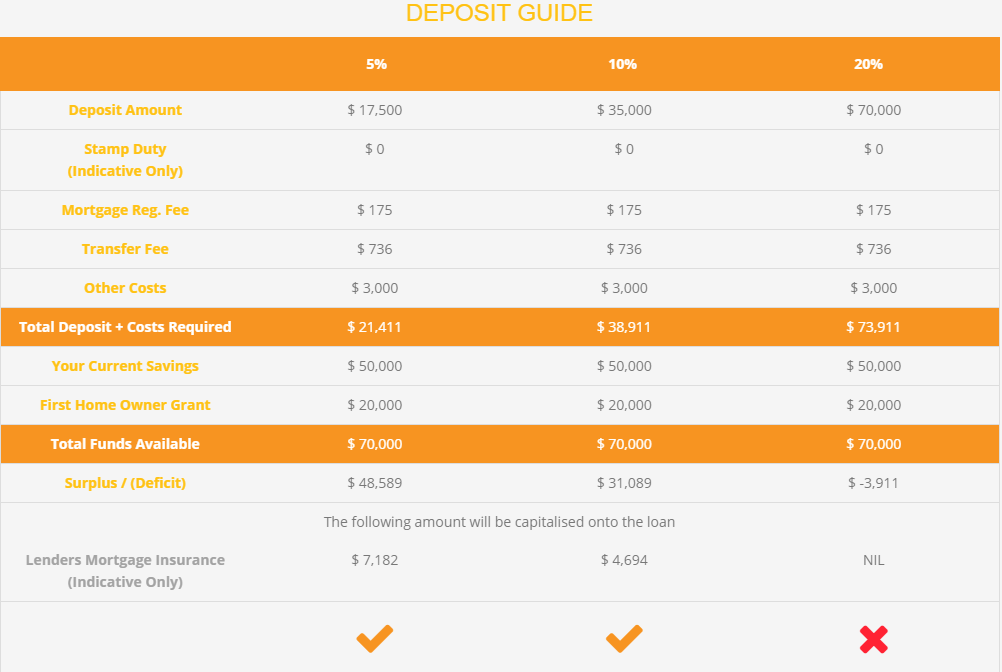

Wondering whether you have saved enough to form a deposit? Try the revamped FHBA Eligibility Estimator for free!

Self-estimate if you have saved a deposit using our revamped Eligibility Estimator