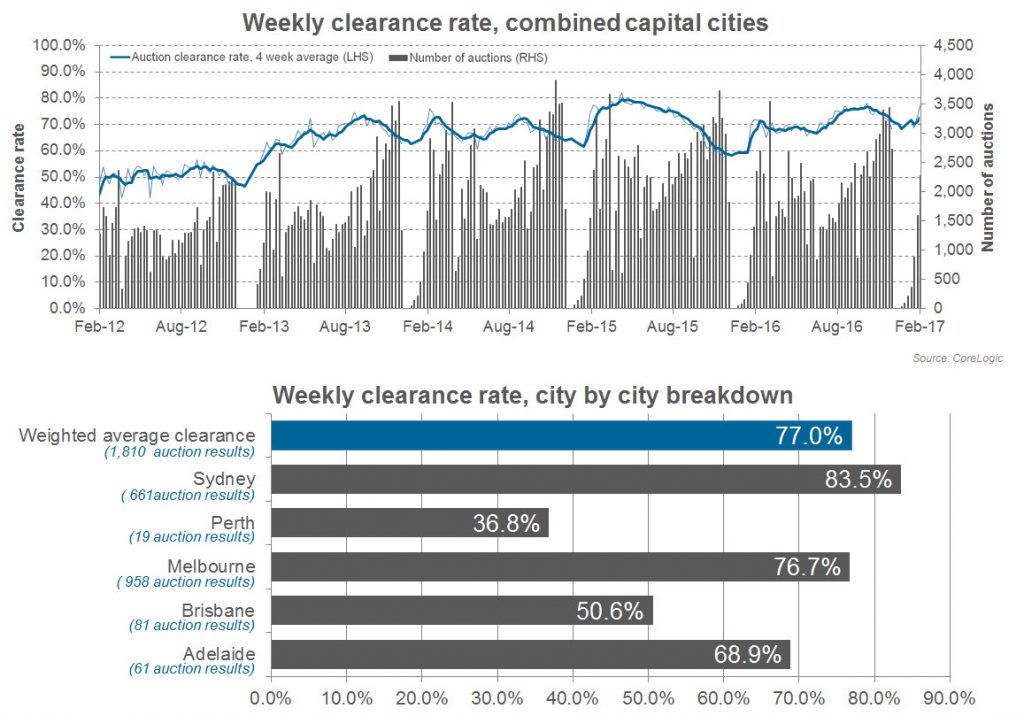

IF Auction clearance rates are anything to go by it was another strong summer weekend for most capital city property markets. With CoreLogic data showing 2017 auction clearance rates at strong levels, with high prices also being achieved according to the CoreLogic Data Home Value Index, aspiring buyers are scratching their heads and wondering where they will be able to afford to buy.

We would like to take this opportunity to re-share with you our suburb of the month, Newcastle (and surrounding areas) in NSW. This month FHBA co-founder Taj Singh took a closer look at Newcastle and what opportunities exist for first home buyers in this more affordable housing market. You can read more about Newcastle here.

If you are an aspiring first home buyer in other States why not revisit our FHBA New Homes of the Week segment? This weekly segment looks specifically at properties suitable for first home buyers, which means the properties displayed have first home buyer affordability requirements in mind. You can browse through previous FHBA New Homes of the Week editions right here. There are a massive 42 editions to explore, so you are very likely to find something you like.

The other talking point over the last week has been housing affordability policies once more. While there has been no new policies announced (unfortunately) there has been plenty of attention on this issue again. Our co-founders Daniel Cohen and Taj Singh have been very busy talking to the media about this issue and in today’s FHBA Market Update you will see some of the highlights.

Enjoy your weekly FHBA Market Update.

Newcastle (NSW) is an area with better housing affordability

News affecting first home buyers

Here are the top stories affecting first home buyers this week:

- Survey reveals more people giving up – A new survey shows that many young Australians are ‘giving up’ on the great Australian dream of home ownership. FHBA co-founder Taj Singh spoke to Domain about this concerning trend read more in Domain

- Liberal MP calls for housing affordability measures – Federal Liberal MP John Alexander has said in an interview with The New Daily that he would like to see Capital Gains Tax (CGT) discounts wound back. Mr Alexander said that investors are dominating the housing market and are eliminating first home buyers. FHBA co-founder Daniel told The New Daily that FHBA believes that both the CGT discount and negative gearing incentives are to generous and need to be wound back, regardless of who is in power read more in The New Daily

- New NSW Premier Gladys Berejiklian to take housing affordability more seriously? – The NSW Premier last week announced that the NSW Government has employed former RBA boss Glenn Stevens to look into housing affordability and recommend solutions to her directly. Can the new Premier be trusted when it comes to housing? read more on our Facebook page

Capital City Price Movements

The CoreLogic Daily Home Value Index (as at 20/February/2017):

- Adelaide – 476.04 (Qtr – 0.58% / Yr + 4.33%)

- Brisbane – 551.24 (Qtr + 0.87% / Yr + 4.11%)

- Melbourne – 868.92 (Qtr + 2.67% / Yr + 11.84%)

- Perth – 569.69 (Qtr – 0.31% / Yr – 3.55%)

- Sydney – 1086.46 (Qtr + 3.63% / Yr + 17.54%)

(Source: CoreLogic)

Weekend Auction Clearance Rates (18-19th of February, 2017)

Source: CoreLogic

Interest Rates Update

At the February RBA board opted to leave the cash rate on hold at 1.50%.

- Read more on the RBA’s decision

- Compare a range of savings account rates

- Compare a range of home loan rates

New Homes of the Week

Many first home buyers like to buy for their future. And for many, that means a young growing family. This week’s edition of FHBA New Homes of the Week (edition 42) focused on First Home Owner Grant (FHOG) eligible homes that are suitable for growing families. All 5 homes around Australia are for you to build and make your very own.

See this week’s best first home buyer homes

Tweet of the Week

Well done @GladysB. We are also happy to assist you and/or Mr Stevens explore options. #FHBA #Ausproperty https://t.co/C0bAel2thu

— FHBA (@fhba_com_au) February 15, 2017

Missed a previous FHBA Market Update? Click here to catchup now

Written By,

First Home Buyers Australia