At FHBA we are passionate about helping aspiring first home buyers buy their slice of the great Australia dream. One of the most common questions we get asked is whether or not an aspiring first home buyer has saved enough to buy their first home?

To assist first home buyers get an answer to this question we have designed an easy-to-use tool that allows you to self-estimate how far away you are from purchasing your first home in your desired suburb. We call it the ‘FHBA Eligibility Estimator’.

What does the FHBA Eligibility Estimator calculate?

What questions does the FHBA Eligibility Estimator answer?

How does the FHBA Eligibility Estimator work?

Why should I try the FHBA Eligibility Estimator?

What does the FHBA Eligibility Estimator calculate?

The Eligibility Estimator estimates the following costs as well as government incentives associated with buying your first home:

- Deposit required at 5%, 10%, 20% levels

- Lenders Mortgage Insurance (indicative only)

- Stamp Duty – Taking into account your State’s first home owner stamp duty concessions/exemptions (indicative only)

- Mortgage Registration & Transfer fees – State based costs associated with the mortgage and transfer of title

- Other Costs – which covers other costs associated with buying a property such as conveyancing, building/pest inspections and moving costs (indicative only)

- First Home Owners Grant (FHOG) – Taking into account your State’s FHOG threshold (please note other eligibility criteria applies)

Are you are ready to buy in your desired suburb?

What questions does the FHBA Eligibility Estimator answer?

Are you looking for an answer to one of the following questions:

- Do I have enough saved?

- Where can I afford to buy with my current savings?

- How much more do I need to save in order to buy my first home?

- What is the minimum I need to save in order to buy in my preferred suburb?

- What are the other material costs I need to consider when saving for my first home deposit?

- Is it better if I buy an established vs new home and/or a house vs unit?

- What is the median price in my dream suburb?

- Do I qualify for the First Home Owners Grant in a particular suburb?

- Where can I find some meaningful data (for my own research) on a particular suburb I am interested in buying at?

- Should I buy with a 5%, 10% or 20% deposit?

If you are looking for an answer to any of the above questions then our Eligibility Estimator is something you can turn to for quick and simple guidance.

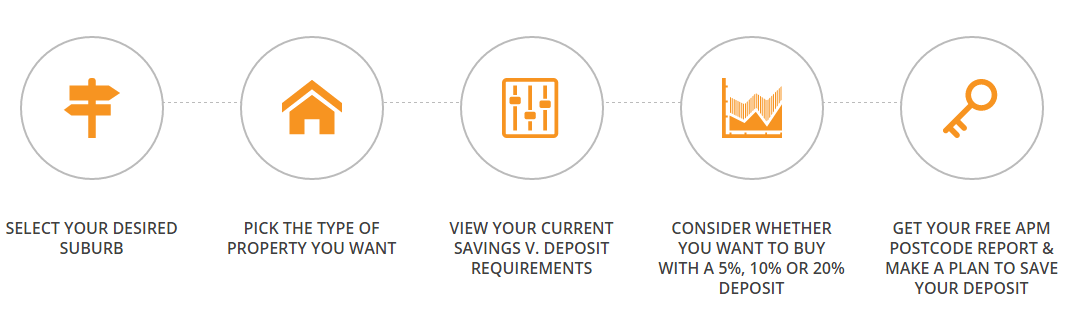

How does the Eligibility Estimator work?

Our Eligibility Estimator allows you to self-estimate how your savings are tracking and whether you have enough saved to qualify for a home loan. The Eligibility Estimator is easy to use and you can complete your self-assessment in under 60 seconds!

Just follow these simple steps:

Why should I try the FHBA Eligibility Estimator?

The main function of the Eligibility Estimator is to allow you to self-compare different deposit options/costs in a particular suburb plus provide you with a deposit guide so you can work towards an achievable savings goal at your own pace.

However, we have taken it a step further by sending you (straight to your inbox) a complimentary Australian Property Monitors (APM) Postcode Report for your selected suburb upon completion of the Eligibility Estimator.

Do you have a deposit saved? Try it now!

Disclaimer: The FHBA Eligibility Estimator is intended as an approximate guide only. It uses a mixture of the data you input, median property prices from APM PriceFinder and estimated purchasing costs. You should not rely solely on the results of the Eligibility Estimator. Please contact an FHBA Coach (who is a licensed credit adviser) for a more comprehensive estimate based on your personal circumstances.

Written By

First Home Buyers Australia