The housing finance data for August 2016 was released today by the Australian Bureau of Statistics (ABS). The report showed that the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 13.4% from 13.2% in July 2016*. However, on a like-for-like basis (adjusting for seasonal factors) there was no improvement, with a significant drop from 14.1% in August 2015 to 13.4% in August 2016.

* The number of first home buyers in Australia is actually much lower than previously reported, despite already being close to record lows, after the Australian Bureau of Statistics revised key figures over a four year period. The number of first home buyers, already around record lows, saw numbers drop even lower. In the original ABS numbers, 14.1% were home buyers in July 2016, but that has been revised lower to 13.2%.

“The revision by the ABS reinforces that first home buyers are really struggling at the moment” said FHBA Co-Founder Daniel Cohen. “It is no surprise that the ABS has revised the figures to new record lows as it has never been harder for first home buyers, especially with rising property prices and low interest rates pricing many first home buyers out of the market.” Daniel said.

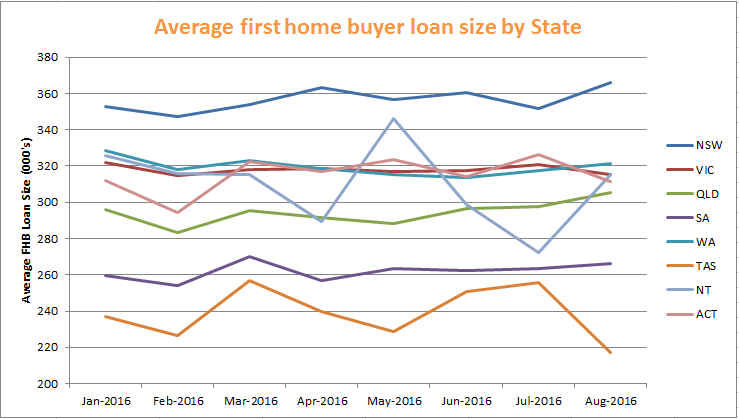

Average first home buyer loan size jumps in NSW, NT & QLD, plummets in TAS

NSW – Up 4% from $351,900 to $365,900

VIC – Down -1.7% from $320,600 to $315,100

QLD – Up 2.6% from $297,700 to $305,500

SA – Up 1.1% from $263,200 to $266,100

WA – Up 1.1% from $317,700 to $321,100

TAS – Down -15.2% from $255,800 to $216,900

NT – Up 15.8% from $272,200 to $315,300

ACT – Down -4.5% from $326,100 to $311,300

NATIONAL – Up 0.6% from $316,300 to $318,300

“With auction clearance rates and the property market heating up in NSW, some first home buyers are choosing to buy now as they fear missing out” said FHBA Co-Founder Taj Singh. “In a welcome sign for Tasmanian’s the average first home buyer loan size has decreased significantly after steadily rising in the first 7 months of the year.”

NT recorded a large increase in the average first home buyer loan size, which could be attributed to the signs of recovery in the Darwin property market. Interestingly, despite concerns about the Melbourne property market, the average first home buyer loan size in Victoria is still lower than the average in WA, despite the significant downturn in the Perth property market over the last few years.

How has the average home loan size in your state fared this year

Written By,

First Home Buyers Australia