FHBA Market Update: 17 July 2017

In today’s FHBA Market Update we take a look at how to know when you are ready to enter the property market for your first time, increasing first home buyer activity in the market, our latest favourite properties for first home buyers, the latest property prices, the weekend auction clearance rates around the country and a whole lot more.

In Australia it takes quite a long time for the typical first home buyer to save a deposit and enter the property market (some research indicates approximately 5 years, but this figure varies from state-to-state). And once that deposit is saved, some enter the market as owner-occupier (i.e. they buy an apartment to live in), while others buy an investment property first (for example, they may rentvest).

So many aspiring first home buyers simply save “as much as they can, whenever they can” without an end goal in my mind and not knowing how long it will take. Many first-timers don’t know what size deposit they require for the type of property they are interested in (or the area they would like to buy their first home in).

There is of course many other emotional factors to consider too, such as what type of property you and your spouse want to buy; where you want to live; the size of the property; do you want to travel, get married first, and/or buy a car first? Just to name a few of the more common factors.

To help first home buyers with the numbers side of things we have a range of tools on our website that aspiring first-timers can use for free. It’s all part of our commitment to help everyday Aussies enter the property market the right way:

- FHBA Eligibility Estimator – see how your current savings is tracking versus the deposit size you need

- FHBA Savers Hub – compare a range of savings accounts and term deposits to make sure your savings is earning a competitive interest rate

Of course you may find you still have a few questions (or even a lot of questions!) so don’t be afraid to get in touch with an FHBA Coach after you have tried these tools out!

An FHBA Coach can help you work out how much you need for your first home

First Home Buyer News

- Do I have a deposit? – Wondering what deposit you need for the type of property and location you are aiming for? We have revamped our FHBA Eligibility Estimator (also know as the Deposit Estimator) so you can self-estimate an approximation yourself in just 60 seconds for free – learn how in FHBA News

- Can I use the First Home Owners Grant to form my deposit? – This is one of our most frequently asked questions – now we take a closer look at the answer so you can consider your options – get the answer in FHBA News

- First home buyer activity up – According to NAB the level of first home buyer activity in the market (in both established and new homes) is on the rise – find out why in FHBA News

Current Hotspot in Focus: Ipswich

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Our current hotspot in focus in Ipswich, Queensland. Stay tuned later this week for our next fist home buyer hotspot. Hint: It is in Victoria!

- Ipswich is located 44km southwest of Brisbane

- The city is renowned for its architectural, natural and cultural heritage with over 6,000 heritage listed sites and 500 parks for residents to enjoy

- With a variety of affordable housing options, transport & good roads to Brisbane, plus infrastructure spending on the rise in the area, it is not hard to see why Ipswich is popular with first home buyers

Learn more about Ipswich including current opportunities to enter the Ipswich property market

Current first home buyer hotspot: Ipswich

Capital City Property Price Movements – as at 17/July/2017

Updated daily, The CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months:

- Adelaide: 480.50 (Qtr – 1.0% / Yr + 1.9%)

- Brisbane: 560.46 (Qtr + 1.1% / Yr + 4.0%)

- Melbourne: 943.23 (Qtr + 3.7% / Yr + 17.0%)

- Perth: 569.83 (Qtr flat / Yr – 2.3%)

- Sydney: 1136.94 (Qtr + 2.1% / Yr + 13.7%)

(Source: CoreLogic)

Interest Rates Update: 17/July/2017

Whether you are thinking of getting a variable home loan or a fixed home loan (or perhaps a mix of both) we have some hot deals for first home buyers right now!

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

- Revealed: July home loan specials!

New Homes of the Week (edition 63)

These are our top picks for First Home Owner Grant (FHOG) eligible properties this week! All the homes are affordably priced for aspiring first home buyers

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

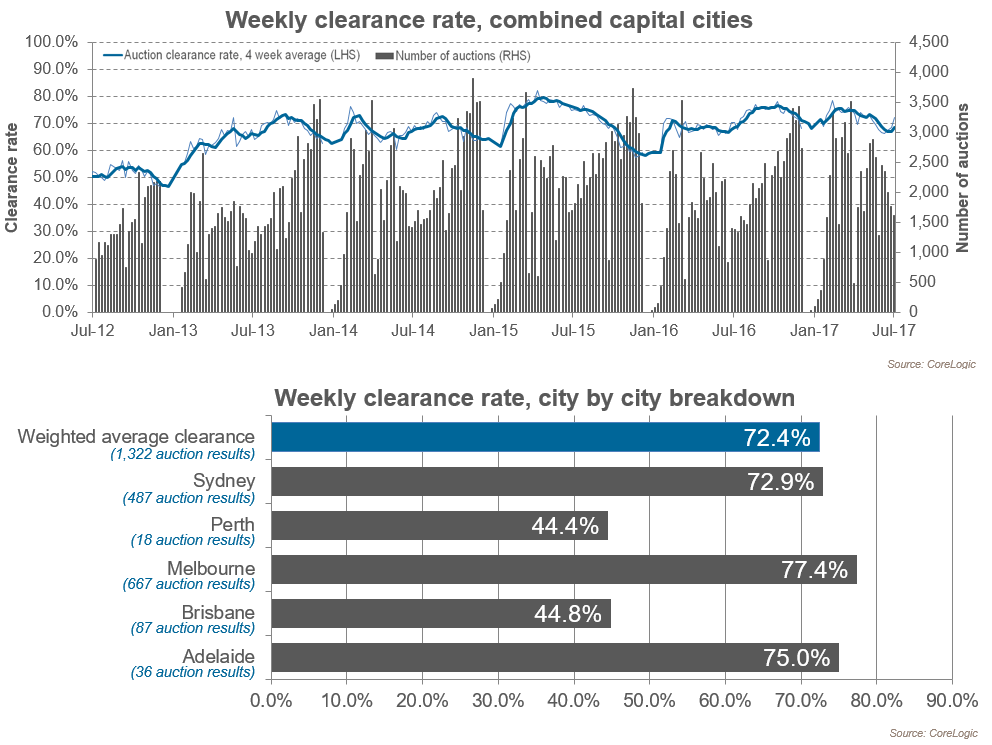

Preliminary Weekend Auction Clearance Rates (15 – 16 July 2017)

(Source: CoreLogic)

Tweet of the Week

Great story by @JaneCowan9 @ABC – highlights the importance of getting appropriate advice #FHBA #ausproperty #auspol https://t.co/a43YkQLdNA

— FHBA (@fhba_com_au) July 16, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia