FHBA Weekend Preview: 8 – 9 April 2017

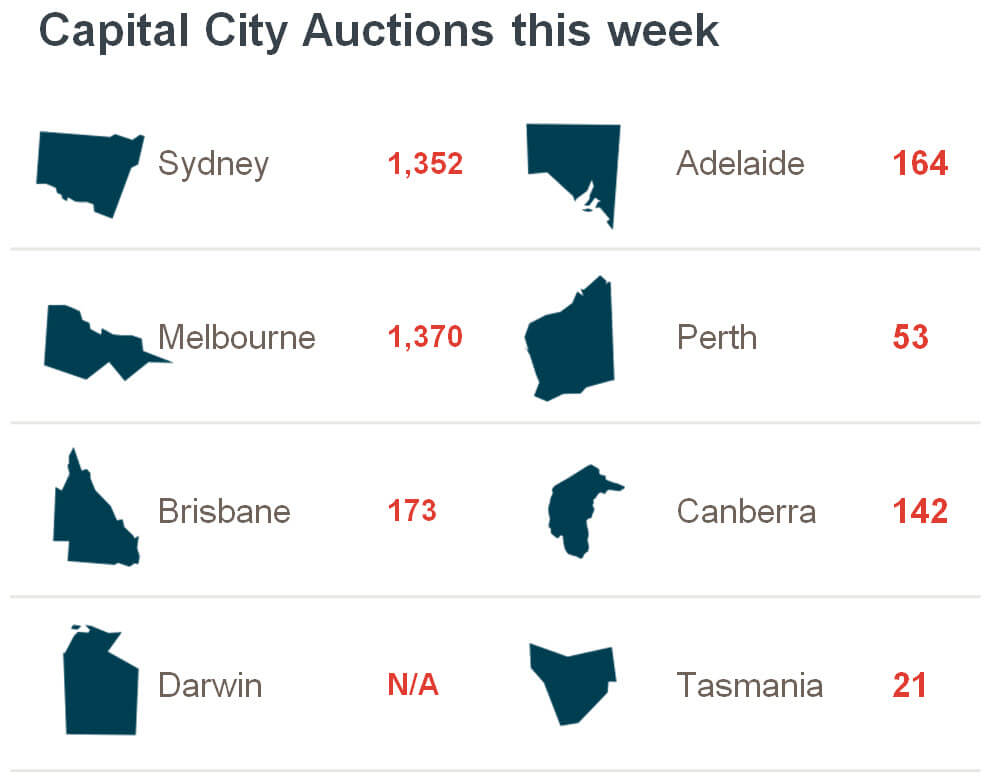

As we reported earlier this week, property prices have commenced 2017 by rising further on 2016 gains, in most capital cities. With the Easter Long Weekend coming up next week and Anzac Day weekend coming up later this month, many sellers have decided to hold auctions this weekend. According to CoreLogic there is 3,275 auctions scheduled around the country this weekend (see a breakdown of those locations below).

For those who are commencing their property search, FHBA co-founder Taj Singh said you will have to be patience. “The auctions being held this weekend would have had open inspections throughout March. But many people thinking of selling now could wait until the Easter & Anzac period is over. Also, the Federal Budget in May, where housing affordability could be on the agenda, could be a reason why sellers hold off for a short period. If you are a first home buyer, you should be patient. There will likely be less property to inspect and choose from over the coming period. It’s important not to rush and pay overs on a property”.

If new property is more of your thing, make sure you check out FHBA New Homes of the Week below. This week we take a look 5 great display home options.

Want to know more about this weekend’s auction activity? Visit the CoreLogic blog.

Good luck to all first home buyers this weekend!

First home buyer homes of the week: ed. 49

We’ve all seen them. Those flashy display homes with nice finishings and high attention to detail. It makes some people think “I wish I could just have that one”. Well guess what? You can. Once a property company is finished using a display home, it could be your very own home!

For FHBA New Homes of the Week edition 49 we have picked out 5 great display homes which you could make your very own!

- Take a closer look at these display homes! FHBA New Homes of the Week – Edition 49

- To search through more first home buyer homes, visit FHBA New Homes

Friday News Review

These are the top stories that affected first home buyers across Australia this week:

https://www.facebook.com/fhbah/posts/1158201440969058

House hunting with confidence

Planning on going house hunting soon but don’t know whether a bank will lend you enough funds to buy your first home yet? You should get a no obligation loan pre-approval.

A loan pre-approval provides you with a written guidance of how much a particular bank is willing to lend to you. Loan pre-approvals come with no obligations to proceed, leaving you in control and importantly, attending open homes knowing what your borrowing capacity and budget is.

To organise a no cost loan pre-approval speak to an FHBA Broker from FHBA Mortgages today

Never miss an FHBA Market Update or FHBA Weekend Preview

Enjoy reading our free Market Updates and Weekend Previews? You’re not the only one! Join our FHBA VIP Club for free today to start receiving your free market reports straight to your inbox. Go on, stay informed!

Join FHBA VIP Club for FREE in under 60 seconds